Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Taxation & Representation, October 5, 2021

Tax Tidbit Where In the Tax World Are Manchin and Sinema? The contents and scope of the Build Back Better Act—the budget reconciliation measure through which congressional Democrats are attempting to enact most of President Joe Biden’s “human infrastructure”...

Family Business Under Attack; What Budget Reconciliation Includes

Please read below and tell your member of the House and Senate what you think!!! You must do it now as a vote could happen soon. Protect your generationally owned family business and a lifetime of savings! Proposals included in the House Reconciliation Package that...

Webinar Replay: Introduction to Family Governance

Family Business owners plan their business as a legacy to their family, their employees, and the community. To sustain and grow that legacy, estate planning is critical. Please review the white paper below from BNY Mellon Wealth Management to learn some of those...

PATG Zoom on 9/22 Addressing Latest Tax Legislation – PATG Supporters Only

Policy and Taxation Group Supporters Zoom Meeting - September 22 at 9:30am EST To receive the Zoom information and to be invited, your membership with PATG needs to be paid and current. There is a link below to securely donate now. Please ignore this notice if you...

IMPORTANT NEWS: Ways and Means Propose tax increases on Family Business and High Income Individuals

Below is a summary of the relevant provisions in a proposal released Monday from Ways & Means; imposing tax increases for “high-income individuals.” The proposal does include increases in the individual and capital gains tax rates; a “sur charge” for individuals...

Estate Tax Projects Within the Treasury’s 2021-2022 Priority Guidance Plan

GIFTS AND ESTATES AND TRUSTS Final regulations establishing a user fee for estate tax closing letters. Proposed regulations were published on December 31, 2020. Final regulations under §§1014(f) and 6035 regarding basis consistency between estate and person acquiring...

Senator Wyden Released Legislation: “Significant Changes To The Taxation Of Partnership Distributions, Allocations, And Gain Recognition Rules”

We wanted to call your attention to draft legislation that Senators Ron Wyden and Sherrod Brown released today that would make significant changes to the taxation of partnership distributions, allocations, and gain recognition rules. The bill text is available via the...

Plan to Attend – Introduction to Family Governance Webinar

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.Family Business owners plan their business as a legacy to their family, their employees, and the community. To sustain and grow that legacy, estate planning is critical....

Family Businesses Face Pandemic Challenges and Legislative Concerns

By Patricia M. Soldano & Dawn S. Markowitz, published at wealthmanagement.com.Between January and March 2021, Family Enterprise USA (FEUSA) conducted its annual survey of family businesses in the United States (the FEUSA survey). FEUSA was also part of a...

Poll: How Long is Your Longest-Term Employee?

Participate in our latest poll question and see what others are saying: Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families...

National Poll Results: Do Legislators Listen to You?

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.We asked the question "Do Legislators Listen to You?". See the results of this National poll via the infographic below. Policy and Taxation Group is your voice in...

Register Now to Attend “Introduction to Family Governance” Webinar

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.Family Business owners plan their business as a legacy to their family, their employees, and the community. To sustain and grow that legacy, estate planning is critical....

WATCH: Is Life Insurance A Solution For The Estate Tax?

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.While life insurance is important and useful for many purposes, does it provide a resource to pay the estate tax for most families? Hear one family’s story in which the...

Join Us For Introduction to Family Governance

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.Family Business owners plan their business as a legacy to their family, their employees, and the community. To sustain and grow that legacy, estate planning is critical....

How Biden’s Tax Proposals Will Affect 3rd Generation Women Owned Business

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.Casey Roscoe with Seneca Jones Timber Company Talks about Managing Today’s Resources for Tomorrow Casey Roscoe is a 3rd generation family member of Seneca, a women owned...

Poll: How Long is Your Longest-Term Employee?

Participate in our latest poll question and see what others are saying: Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families...

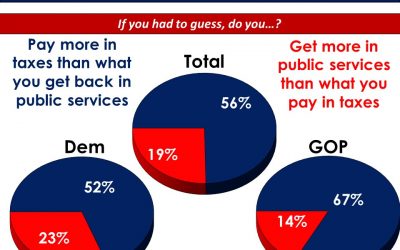

National Survey Results: Biden’s New Tax Policies – Help or Hindrance?

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.With proposals emerging from the Biden White House that would raise the estate and capital gains taxes on America's family-owned businesses, we were commissioned to ask...

Poll: What Biden Tax Policy is Important to You?

President Biden has proposed two plans which would change tax policy, The American Jobs Plan and the American Families Plan. Included in these plans are some of the policies described below; please give us your opinion of what is most important to you, see the list...

UPDATE: Thune Proposed Amendment to Budget Resolution. Don’t Eliminate Step Up!

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.Early Wednesday morning, Sen. John Thune (R-SD) offered Amendment #3106 to the Senate budget resolution, protecting owners of generationally-owned businesses, farms, and...

NEWS: Thune Proposed Amendment to Budget Resolution; DON’T ELIMINATE STEP UP!

Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report.Early Wednesday morning, the Senate reached an agreement on S.Con.Res.14, FY2022 Budget Resolution. Over 40 amendments were considered and voted on. The following...

NEW Section 199A Bill Update; Taxing Pass Through Entities

Download and read "Wyden Small Business Tax Fairness Act:Implications for Pass-through Business Owners"Candidate Biden proposed to phase out the 20% deduction on pass-through net income for taxpayers with incomes of over $400K President Biden did not include the...

2021 State by State Tax Chart Updated

Download and read "Estate Tax (Death Tax) by US State Chart"States Which Have a State Estate Tax (Death Tax) that is Accessed in Addition to the Federal Estate Tax As hard-working taxpayers and generationally owned family businesses, built on hard work, plan for the...

Infrastructure Update – Week of August 2-6

Thank you to Brandon Roman and the team at Squire Patton Boggs (US) LLP for this report.Senate Majority Leader Chuck Schumer (D-NY) has scheduled a vote for Saturday, August 7, to end debate on the Infrastructure Investment and Jobs Act (IIJA), a comprehensive $1...

WATCH; Steve Wells, Founding Partner of American Food and Vending Corp: How Will Bidens Tax Proposals Impact His Family Business

American Food and Vending was co-founded with Steve Wells and his brother, and until the pandemic employed 1700 people. Steve and his family, as well as his employees and the community, will be substantially impacted by the Bidens tax proposals. Watch this video in...

State by State Death Tax Chart Update July 26, 2021

This chart is maintained for the Policy and Taxation Group Website and is updated regularly. Any comments on the chart or new developments that should be reflected on the chart may be sent to [email protected] the Estate Tax (Death Tax) by US State Chart...

Poll Question: What Biden Tax Policy is important to you?

President Biden has proposed two plans which would change tax policy, The American Jobs Plan and the American Families Plan. Included in these plans are some of the policies described below; please give us your opinion of what is most important to you, see the list...

All Republican Senators Urge President to Keep Step UP

Individuals pay a 40% tax on the FULL MARKET VALUE of their assets, when they die, not just on the appreciation of those assets. That is why they receive a “step up in basis” to this value. On July 21, 2021, Senators Thune, Daines, McConnell, Crapo and ALL Senate...

Frank Luntz to be on Supporters Update Call – Plan To Attend – Register Now!

We hope you will join us for a PATG update call on July 29, 2021 at 12pm PT or 3pm ET. Hear the following noteworthy speakers talk on possible tax and legislative polices that could affect families and their business: Frank Luntz, FIL, Inc. “The War on the Wealthy in...

Tax and Legislative Polices & The Impact on You – PATG Supporters Call

We hope you will join us for a PATG update call on July 29, 2021 at 12pm PT or 3pm ET. Hear the following noteworthy speakers talk on possible tax and legislative polices that could affect families and their business: Frank Luntz, FIL, Inc. “The War on the Wealthy in...

Hearings Review: Tax and Financial Services Committees

Thank you to Russ Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report..Last week, the tax and financial services committees held multiple hearings related to the state of the economy and general monetary concerns and potential policies that...