How Does The Estate Tax In the United States Compare to Other Countries?

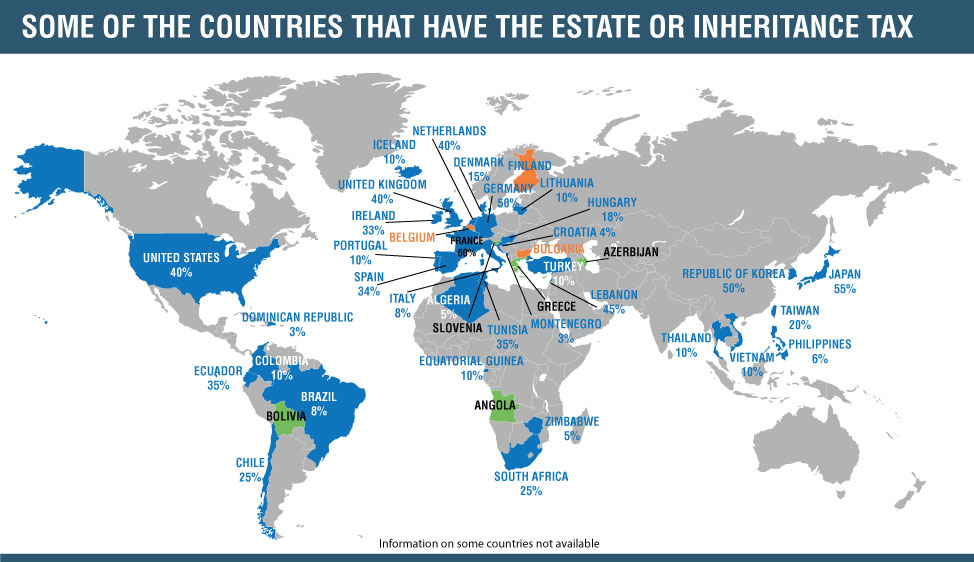

The U.S. has the fourth highest estate or inheritance tax rate of all the OECD countries at 40 percent and 6th highest of any country in the world.

To learn how the United States compares with other countries, download Estate and Inheritance Taxes Around the World. This report was produced by Alan Cole at the Tax Foundation.

The United States has one of the highest rates of estate tax in the world. While other countries may call a tax on assets at death, an estate or inheritance tax it is still an additional tax on assets.

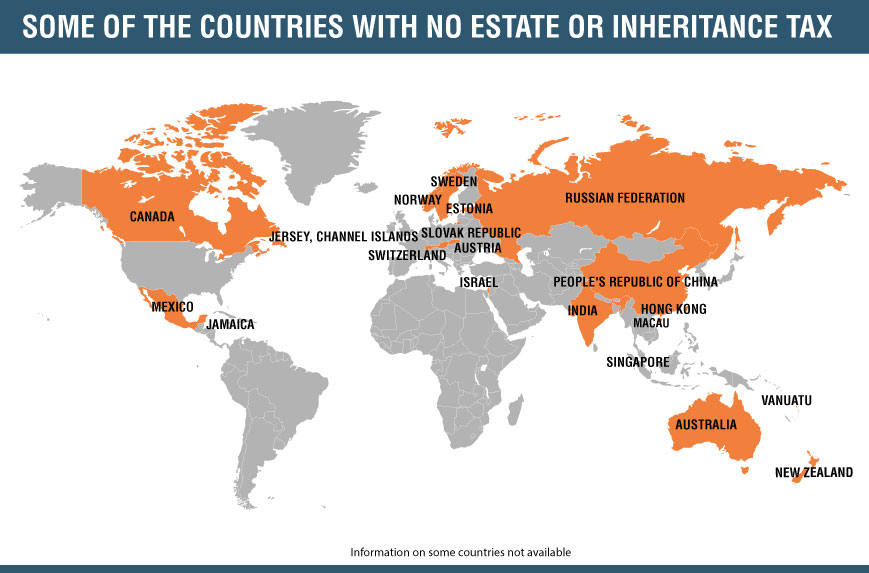

Many other developed countries have eliminated their estate or inheritance tax like Russia, India, China, Australia, Norway, Mexico, and more.

The United States continues to impose an estate tax on assets at death for over 100 years. This tax imposes additional costs to family businesses making competing with countries who do not impose an estate or inheritance tax very difficult. For those countries including the US who currently have an estate or inheritance see the image below.