Anthony Timberlands

My personal view, for what is might be worth, is that lowering the corporate tax rate from the current 35% to 20% is too big a cut and unnecessary to serve the purpose intended. Certainly, a cut is needed, but just as certainly a reduction to 25% would provide the stimulant desired. Such a change […]

Estate Tax Causes In-ability To Contribute Clean Water, Clean Air, And Wildlife Habitat

Tom Crowder’s grandfather had a passion for the outdoors and sustainability. This was reflected in the 6,000 acres of pines, bottomland hardwoods, and wildlife occupying his forest in south central Arkansas. However, counter-intuitively, his grandfather took such good care of his forest land that the Crowder family was penalized for it. Upon Mr. Crowder’s grandmother’s […]

The Estate Tax Kills Jobs

The Estate Tax kills jobs. It kills the companies that provide jobs. In the process, it kills towns and communities, particularly those in rural areas dependent upon the land and local industry. Almost all small business is privately owned and most locally owned. When the Estate Tax strikes (or is imminent), these are the businesses […]

My Estate Tax Experience

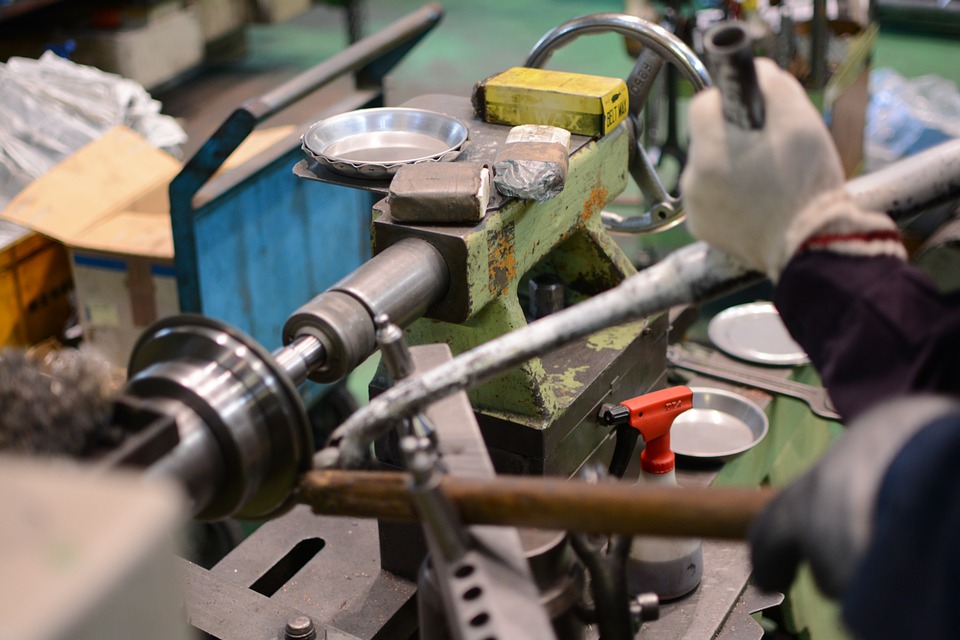

June 13, 2018 My father started an aerospace component manufacturing business March 31, 1961 in Maywood, California. He started it by himself investing $7,500 dollars in the business. He hired one person. He struggled for 10 years before he finally made a profit. His gross sales that 10th year were $1m. Forty-two years later both […]

Estate Tax Will Be Impossible To Pay Off Forcing Sale

In 2005, Elizabeth Marshall Maybee inherited a 3000-acre Northern California ranch from her grandmother that had been in the family since the 1880s. However, “the Marshall Ranch, which survived the Great Depression and survived a case of eminent domain for the building of a water treatment plant, according to Maybee, faces its biggest hurdle yet. The […]

Selling Everything To Pay Estate Tax

The Page Family began farming in the 1880s, when Jeff Page’s great-grandfather purchased 50 acres of land in Napa Valley to grow orchard fruit and raise cattle, sheep, and turkeys. As a firm believer in land investment, Mr. Page’s great-grandfather expanded to other areas in Napa Valley. While this mindset worked for the first two […]

Our Story – California Family Farm At High Risk

Our beloved 101 “acre California farm-my small family’s one asset- has been in my family since 1942, when it was purchased by my great uncle. It has been planted In crops of many kinds, worked first by my uncle and then by my father, who earned a very modest salary as a mechanical engineer in […]

Land Owner Impacted In Major Way Upon The Death Of The Patriach

My family has almond land, rice land and cattle land in California. Our forefathers settled on the cattle land in the mid 1800’s. The problem I see is that land in California has increased in value so tremendously that he average land owner is going to be impacted in a major way upon the death […]

Unfair Tax On The Dead And The Living

I have not had to sell assets yet but as it stands upon the death of my father, because of the value of the farm land now, my sisters and I will have to either sell some of the land or clear cut timber to pay for the estate taxes. It is just a small […]

Why White Castle Supports Repealing the Death Tax

As a family owned business for 97 years now, White Castle has learned a lot about what it takes to create an enterprise that’s sustainable and capable of nourishing our team members, and the communities where we live, work and raise our families. Along the way, not only do we get to serve up the […]

Shutting Down Branches, Laying Off Workers, Or Liquidating Inventory

In 1973, Karen Madonia’s father purchased Illco, a Chicago-based distributor of parts and supplies for heating, ventilation, air conditioning, and refrigeration equipment. Although the company now has 97 employees in 3 different states and generates $42 million in revenue, Illco was very small when acquired. Consequently, it was Mr. Madonia’s hard work, time, and investment […]

Death Tax End Needed For Business

The American free market typically rewards success and encourages growth, unless you happen to be a family-business owner. My family has distributed food-service products and paper and plastic disposable products in Maine for more than 1 00 years. If President Obama’ s death tax – aka federal estate tax -plan becomes law, we may not […]

Congress Should Reduce Or Repeal Death Tax

Dear Ms. Soldano: I want Congress to do something about reducing the death tax if they won’t repeal it. It looks like the Democrats are dead-set against a repeal, but might support a compromise (even though they killed the latest attempt to come up with a bill package that had something for everybody.) What can […]

Selling Nearly Half Of The Estate To “Pay For” The Other Half

My Mother in law recently passed away. She lived in Minden, Ne. all her life. She and her late husband worked their entire lives in Kearney County. They owned farms, feed lots, gas stations, implement dealerships, and rental properties. They have payed income taxes on these business their entire life as well as capital gains […]

Spending A Lifetime Building To Pay Estate Tax

Mr. Syman is worth multi-millions – interests include real estate holdings, shopping center/strip mall developments, restaurants, etc. He is 66 years old and has just recently started consulting with attorney’s about death tax issues. He has spent $15,000 already on attorney’s fees- with what he says is “a long way to go” to sort out […]

United States Thrives Because Of The Entrepreneurial Spirit

Our great United States thrives because of the concept of capitalism and the promotion of an entrepreneurial spirit With those thoughts in mind, 1 strongly urge you to support permanent elimination of estate and generation-skipping taxes, now commonly referred to as the “Death Tax”. Family businesses are a v1tal part of the American fabric and […]

The Additional Costs Of Estate Tax

Mr. Goebel, the owner of the bus line and a hockey rink, currently has a “buy/sell” arrangement with his brothers regarding the business. They pay about $75,000 a year in insurance just to protect themselves should there be a death. Tom’s teenage children are not involved in the business yet, but will be and that […]

Had To Sell Business Due To Estate Tax

My father owned a small business which provided health products to his long time customers. Upon his death, we had to sell the business because of the estate tax on the sole proprietorship business left us too little to continue it. Now my brother and I who used to work for the business, have to […]

Sacrificing Land To Pay The Death Tax

Just outside Nashville, Brandon Whitt operates Batey Farms with his wife, Katherine, and father-in-law, who owns the property. Established in 1807 from a Revolutionary War land grant for military service, this seventh-generation family business provides over 65,000 customers each year with fresh fruits, vegetables, and pork. Simultaneously, the Whitts farm 1,800 acres of row crops […]

Estate Tax Must Be Repealed

My mother is 86 years old. My father died in ’94. They grew up during the depression. My mother’s father was a share cropper in Nebraska. He earned a dollar a week. Mom never learned to read or write, but she was brilliant at figuring out how things worked mechanically. As she aged she developed […]

Estate Tax Must Be Repealed

My mother is 86 years old. My father died in ’94. They grew up during the depression. My mother’s father was a share cropper in Nebraska. He earned a dollar a week. Mom never learned to read or write, but she was brilliant at figuring out how things worked mechanically. As she aged she developed […]

Investments At Risk If The Tax Exemption Is Reduced

When Tom and Leslyn Jacobs first got married, buying land was simply a dream. Indeed, they were both young foresters saddled with college loans and old vehicles. However, in 1984, their dream became a reality when they received a $40,000 loan to buy 80 acres of land. Since this first purchase, they have lived frugally, […]