May 19, 2022 | Blog, California, In The News

Andy JohnstonHis grandfather’s property was handed down to his grandmother when my grandfather passed, and more recently to him and his sister when his mom passed. Each time a member of the family passed, they had to sell a portion of the ranch to pay the inheritance...

May 12, 2022 | Blog, California, In The News

Jeff PageHis family was hit twice by the estate tax. The first tax forced his grandmother to lease out her land for cash flow and sell all our pasturelands except the home ranch in preparation for her own passing. Location: Youtville, CABusiness: Truboy Ranch...

May 11, 2022 | Blog, California, In The News

Wayne VineyardIf a single partner in their rice and beef cattle operation were to perish, they would have to sell a significant part of their assets in order to stay in business. The 55% tax would basically halve the operation and the ability to continue to have a...

Apr 27, 2022 | Blog, California, In The News

Marjie BartelsWhen both her parents died, not only were she and her sister dealing with the sudden loss of our parents, they were now faced with a huge estate and income tax burden we weren’t sure we could pay. Eliminating or reducing the estate tax will help...

Apr 7, 2022 | Blog, California, In The News

Richard RuddickHe was an heir as a result of death and had to sell half of the farmland to come up with enough money to pay the estate tax. There was no feasible way that our farming children could pay the estate taxes that would be due and have the ability to...

Jul 4, 2018 | Blog, California, Estate Tax Horror Stories, Family Businesses

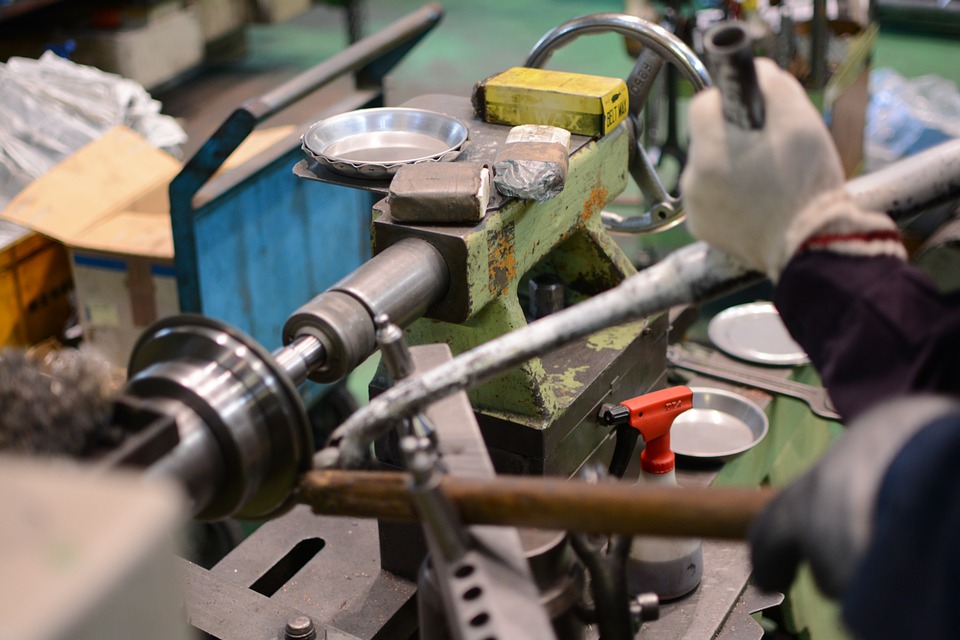

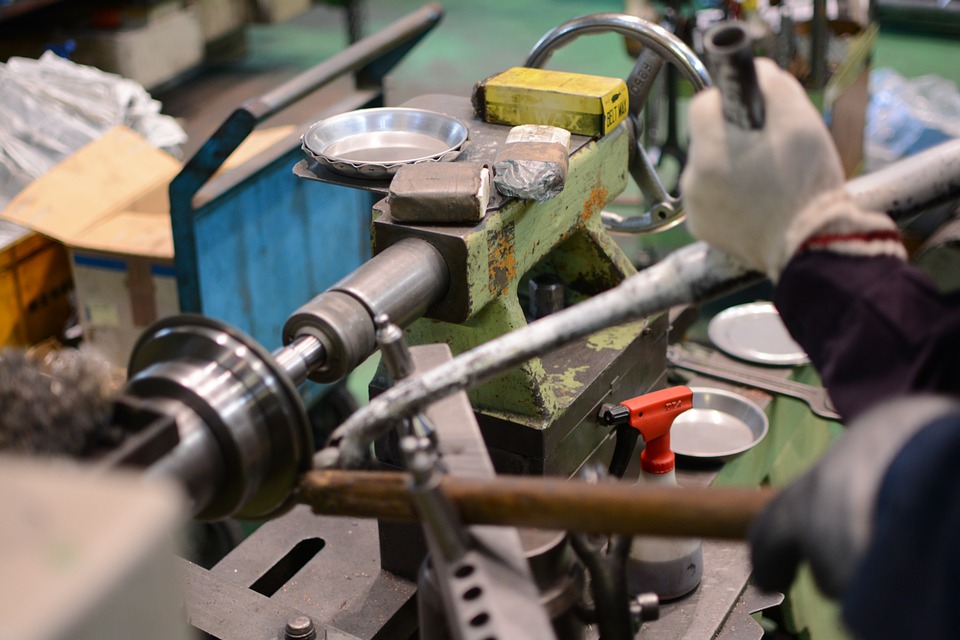

June 13, 2018 My father started an aerospace component manufacturing business March 31, 1961 in Maywood, California. He started it by himself investing $7,500 dollars in the business. He hired one person. He struggled for 10 years before he finally made a profit. His...