Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

From the President – 9-30 – Weekly Update

WEEKLY UPDATE This might sound strange, but I’ve always been fascinated by tax policy. Besides the need for general operating money, the tax code serves as a mechanism to encourage or discourage individual and corporate behavior. So it’s no surprise that two of the...

From the President – 10-7 – Weekly Update

[vc_row][vc_column][vc_column_text] I want to thank all of the Family Enterprise USA and Policy and Taxation Group members that flew into Washington, DC to participate in our combined Board Meetings and Capitol Hill visits. Having family business leaders join us on...

Pat Soldano Speaking at IvyFON – 9/17/19

Pat Soldano will be speaking at IvyFON on September 17, 2019 in Newport Beach, CA; see link for location and agenda; http://ivyfon.com/sep17forum/agenda.htmlTopic: Family Businesses; Voters Concerns; Legislative SolutionsPolicy and Taxation Group/ Family Enterprise...

From the President – 9-9 – Weekly Update

[vc_row][vc_column][vc_column_text] I want to thank all of the Family Enterprise USA andPolicy and Taxation Group members that flew into Washington, DC to participate in our combined Board Meetings and Capitol Hill visits. Having family business...

From the President – 7-26 – Weekly Update

[vc_row][vc_column][vc_column_text] The big legislative news this week is the sweeping budget deal President Donald Trump, and congressional leaders reached to increase the debt limit through 2021, thus averting a default on U.S. payments, and lifting stiff budget...

From the President – 7-12 – Weekly Update

[vc_row][vc_column][vc_column_text] It took a while, but the dueling letters" by the wealthy to either tax them more or figure out better ways to create wealth opportunities for others has just gotten another response. While it will come as no surprise as...

From the President – 6-28 – Weekly Update

[vc_row][vc_column][vc_column_text]Call it the dueling letters. On the eve of the first set of debates by the Democrat candidates for president, a group calling themselves the “Patriotic Millionaires” penned an open letter calling on the candidates to “tax them...

From the President – 7-18 – War on the Successful

[vc_row][vc_column][vc_column_text] As reported earlier in the week, Representative MikeThompson (D-CA) introduced the Taxpayer Certainty and Disaster Tax Relief Act of 5 2019', legislation that would extend a variety of expired or expiring tax provisions thru...

From the President 6/17

[vc_row][vc_column][vc_column_text] It has become abundantly clear that general public sentiment about the wealthy has been degrading over the last few years. A day hardly passes without headlines about wealth inequality, income disparities, and calls from...

The War on Capitalism – The Whole Story.

[vc_row][vc_column][vc_column_text] While I can’t say I’m pleased with what we learned, I am encouraged that there is a roadmap forward. Capitalism isn’t dead, but it is certainly damaged thanks to decades of political attack and corporate abuse. But...

The War on Capitalism – Part 1 of 3

Whether we call it the war on success, or the successful or the war on Capitalism what we're seeing is a change of perception - all due to the media machine, effective political attacks and corporate abuse. What follows is a 3 part series where we will be giving you...

Pat Soldano – Speaking at FON – Family Office Network

Pat Soldano is speaking at the FON - Family Office Network on 5/14 on; Tax Policy - What Now? Everyone who has a stake in the game, (paying taxes) should come, listen and learn from an expert on taxation, taxation legislation and specifically the estate tax.

Review of Reviews: Afterlife of the Death Tax

Throughout the years, there have been many proposed solutions to the estate tax; from increasing it to eliminating it. In this article, Professor Samuel D. Brunson advocates for the elimination of the estate tax and proposes to replace it with an inheritance tax. He...

Oprah Winfrey Attacking Taxes on the Rich

Unlike most outspoken Hollywood stars, business moguls and the incredibly wealthy Oprah Winfey has a different take on taxes, especially that of the Death Tax. Interestingly enough here, is Oprah Winfrey talking about tax reform, her specific issues with how the...

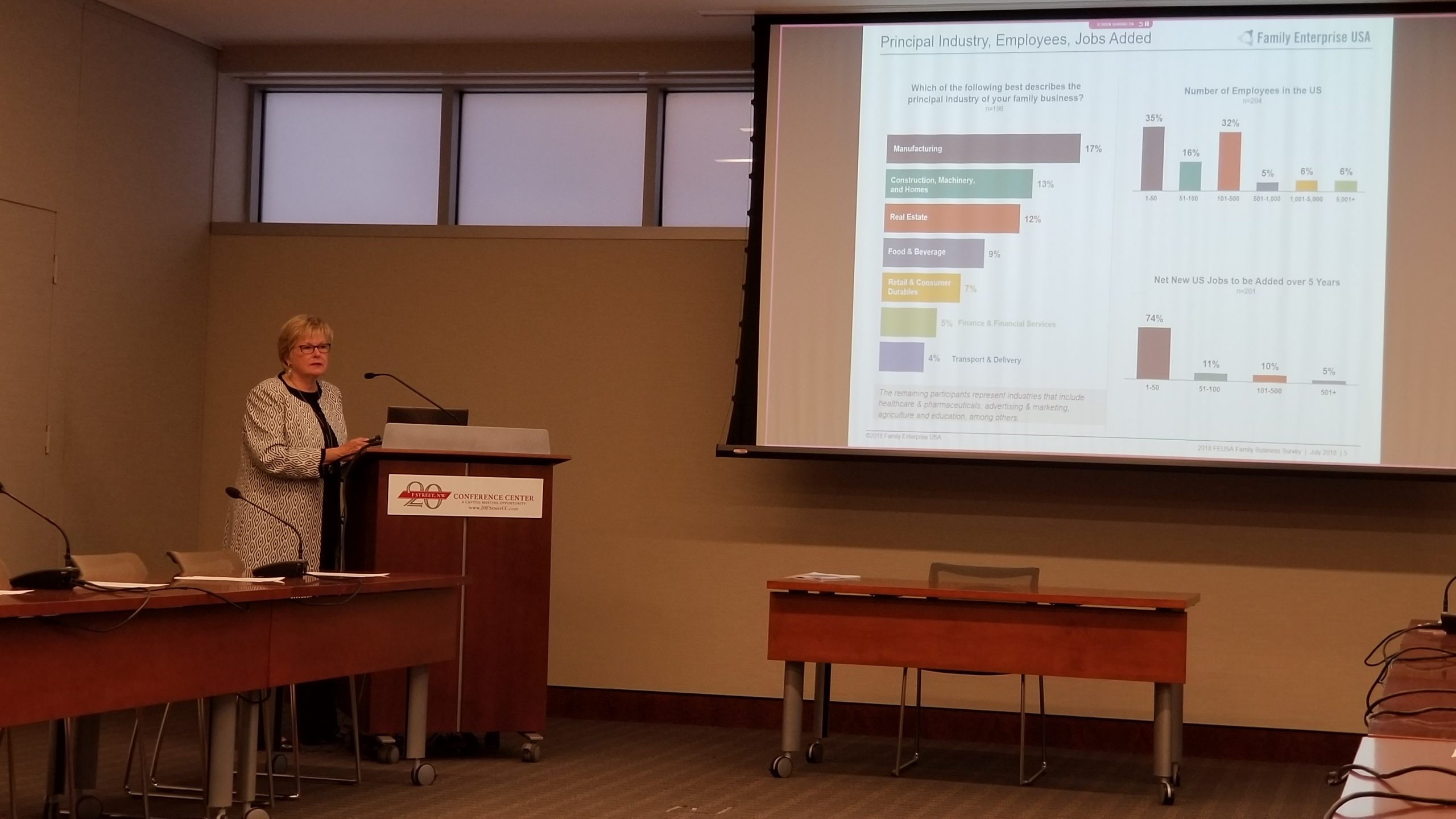

2019 – Family Business USA Survey

A MESSAGE FROM OUR FOUNDER - Pat Soldano I am contacting you to request your help in reaching business-owning families and asking them to complete the 2019 Family Enterprise USA survey. To access the short, online survey, the link...

Our Work is NOT Complete – The Estate Tax has NOT been repealed.

I'll say it again, our Work is NOT Complete – The Estate Tax has NOT been repealed. What we saw and heard in President Trump’s State of the Union, in reference to the Death Tax is the core of the challenge we face in solving this problem. Members in Congress and the...

Congressman Jason Smith (R, MO) Introduces Estate Tax Repeal Bill HR218

Supporters, On 1/8/19 Representative Jason Smith of Missouri introduced HR 218; Death Tax Repeal Act of the 116th Congress with 37 original co-sponsors including Representative Sanford Bishop (D) (GA). Please note that it does NOT repeal the gift tax, and it...

Elizabeth Warren Proposes New Wealth Tax

Emmanuel Saez and Gabriel Zucman, two left-leaning economists at the University of California, Berkeley, have been advising Elizabeth Warren on a proposal to levy a 2 percent wealth tax on Americans with assets above $50 million, as well as a 3 percent wealth tax...

Senator Thune Introduces S215; Bill to Repeal Estate and GST Taxes

Senator John Thune introduced S.215 with 28 Cosponsors; a bill that will repeal the estate and GST tax but NOT the Gift tax and will maintain step up in basis; so, the same bill language he has introduced before. While we continue to remind legislators that the gift...

Cotton, Boozman, Blunt, and Ernst Introduce Estate Tax Rate Reduction

Washington, D.C.-Senator Tom Cotton (R-Arkansas) along with Senators John Boozman (R-Arkansas), and Roy Blunt (R-Missouri) today introduced the Estate Tax Rate Reduction Act. This would reduce the estate tax to 20 percent, the same as the current capital gains tax...

Jason Smith (R-MO) Introduces Estate Tax Repeal Bill HR218

Yesterday, Representative Jason Smith of Missouri introduced HR 218; Death Tax Repeal bill of the 116th Congress with 37 original co-sponsors including Representative Sanford Bishop (D) (GA); We are pleased to have this bill introduced in order to repeal the...

Update on S. 3638 from Pat Soldano

An update on S. 3638, Senator Kyl’s (R-AZ) estate tax rate reduction bill introduced on our behalf last month As we near the end of the 115th Congress, I wanted to provide you with an update on where we are with S. 3638, Senator Kyl’s (R-AZ) estate tax rate...

Frank Luntz: Death Tax Election Night Polling

“It's just wrong. The death/estate tax is wrong for one simple reason: death shouldn't be a taxable offense or action. The very idea of making people struggle to file a tax form at the time of death is immoral and unethical.” This is the best anti-death tax...

Senator Kyl Again Seeks to Cut the Death Tax

Seeking to "start the conversation”, Senator Kyl proposed cutting the estate tax rate in half, from 40 percent to that of capital gains. It's a return to a favorite subject for Kyl, who tried repeatedly in his initial 18 years in the Senate to reduce the tax,...

Urgent: Support Bill S-3638

Dear Supporters and Friends, We urge you to reach out to your Senator and ask that they sign onto Bill S-3638. If you do not have the direct number, you can reach US senators by calling 202-224-3121. Ask the operator to connect you to the individual office. We...

Supporters Meeting Recap from 9.27.18

Below is a summary of the PATG-FEUSA Supporters and Members Meeting held on September 27, 2018. I opened the meeting by pointing out that after enactment of tax reform last year – which included a temporary doubling of the estate tax exemption – we had anticipated a...

Pat Soldano Interview on Exit Coach Radio

GOP Releases Phase 2 Retirement Details

Below is the link to a summary of details on Tax Reform 2.0 legislation issued by the Ways and Means Committee. Please note this includes making permanent the doubling of the lifetime exemption. Chairman Brady hopes to have a vote in the House at the end of September....

Senator Kyl Returns to Senate to Succeed Sen. John McCain

Excellent news as our good friend and supporter, Senator Kyl will be back in the Senate. From AZ Central Jon Kyl, once one of the most powerful Republicans in the U.S. Senate, will return to Capitol Hill to succeed the late Sen. John McCain, The Arizona Republic has...

Ways and Means to Consider Phase 2 Tax Bill Next Week

House tax writers will meet to consider legislation. This makes permanent, expiring individual and business tax provisions in the 2017 tax law during the week of September 10. House Ways and Means Committee Chair Kevin Brady, R-Texas, said he wants the legislation...