Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Podcast – Hear Pat Soldano: The Importance of Family Businesses in the US

Listen or watch an interview with Pat Soldano conducted by Jonathan Goldhill, Business Strategist. What is important to family businesses and what they can expect from Congress in 2021. She also discusses the recent family business economic research done by FEUSA and...

WATCH; Casey Roscoe 3rd Generation, Seneca, Eugene, OR; The Impact Of The Estate Tax (Death Tax)

Casey Roscoe is 3rd generation family member of Seneca, a women-owned business in Eugene, Oregon. Listen to her tell the story of the history of the business and the family’s commitment to their employees and their community. Learn how the current tax proposals under...

Death Should Not Be a Taxable Event

Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families to fully enjoy the economic liberties and benefits of a robust free market unique to our nation. For over 25 years, we have been the...

WATCH; David Plimpton; Inolex CEO; impact of Bidens tax proposal

Watch and hear the “real story” of how the Biden tax proposals could affect a real family business as David Plimpton, CEO of Inolex, which employs 170 team members, tells us the impact the Biden tax proposals could have on his family business. Policy and Taxation...

How Much Tax Will You Pay With Biden’s Tax Plan?

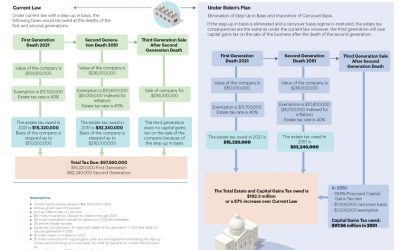

President Biden has proposed an elimination of step up in basis and an increase in the capital gains tax; how much will this impact family businesses? See the example below. A $50 million family business could be subject to a $82 million estate tax after the death of...

Pat Soldano Speaking at Family Firm Institute July 12

Family Business Matters; Research, Data and Issues Facing Family Businesses in 2021 Family Businesses employ 59% of all workers in the US and generate 54% of GDP, (“2021 Contribution of Family Businesses to the US Economy”; Piper and Astrachan by FEUSA), yet they face...

PLEASE! Watch short video; Destruction Of Family Businesses; Elimination Of Step Up In Basis!

President Biden has proposed the elimination of the “step up in basis,” while keeping the 40% (or higher) estate tax on the full value of a family business owner’s assets. That means that each person who inherits a business will pay taxes on the same appreciation...

ALERT: Elimination of Step Up in Basis Could Destroy Your Business!

While the devil is in the details, it is possible that if President Biden's elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%. The graphic below shows an example of a business...

Job Loss Example Due to Repeal of Step-Up Of Basis

A significant portion of the burden of repeal of step-up of basis would fall on workers through reduced labor productivity, wages, and employment. Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American...

Economic Impact from Repeal of Step-up in Basis

President Biden has proposed the elimination of the “step up in basis,” while keeping the 40% (or higher) estate tax on the full value of a family business owner’s assets. That means that each person who inherits a business will pay taxes on the same appreciation over...

Champion Women Profiles: Pat Soldano

IWF is pleased to announce that Pat Soldano, perhaps the most important leader in the country fighting to kill the "death tax,” is the latest entry in our popular series of Champion Women profiles. It’s a good time to be talking to Pat. President Biden has plans to...

Reach Out To Congress: Ask Them To Sponsor The Estate Tax Rate Reduction Act of 2021

There are efforts in DC to make the estate tax (death tax) worse; higher than a 40% tax on your business and all your assets! But there is hope; a bill to reduce the rate of tax from 40% to 20% has been introduced in the House HR 3178 and in the Senate S1627. We need...

Update on Biden Administration FY22 Budget Request & Treasury “Green Book”

Thank you to Brandon Roman and the team at Squire Patton Boggs (US) LLP for this report. The Biden Administration this afternoon released its FY22 Budget Request. The proposal, which is estimated to cost more than $6 trillion, would dramatically expand the size and...

Warning; Elimination of Step Up in Basis could destroy your business!

While the devil is in the details, it is possible that if President Biden's elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%. The graphic below shows an example of a business...

Estate Tax Overview

The estate tax (also known as the death tax) is one of three taxes on assets and businesses passed from one person to another, whether through wills, trusts, or gifts. The other two are the gift tax and the generation-skipping transfer tax. They all have similar rules...

Contact Congress Asking Them To Sponsor The Estate Tax Rate Reduction Act of 2021

There are efforts in DC to make the estate tax (death tax) worse; higher than a 40% tax on your business and all your assets! But there is hope; a bill to reduce the rate of tax from 40% to 20% has been introduced in the House HR 3178 and in the Senate S1627. We need...

Steve Wells, Founding Partner Of American Food And Vending Corporation Joined The Board Of Family Enterprise USA

John Gugliada Joins Family Enterprise USA As Director Strategic Partnerships And Business Development John Marino Joins Policy And Taxation Group As Director Of Strategic Partnerships And Business Development “Our Board of Directors, a team of experienced...

House Ways & Means Select Revenue Measures Subcommittee Hearing on Taxing the Wealthy

On Wednesday, May 12, the House Ways & Means Select Revenue Measures Subcommittee held a hearing titled "Funding Our Nation's Priorities: Reforming the Tax Code's Advantageous Treatment of the Wealthy." The following witnesses testified at the hearing: Adam...

BREAKING NEWS!! Bipartisan Estate Tax Rate Reduction Bill introduced in both House and Senate today!

Earlier today, Congressman Jodey Arrington (R-TX) and Congressman Henry Cuellar (D-TX) and Senator Tom Cotton (R-AR), on a bipartisan, bicameral basis, introduced the Estate Tax Rate Reduction Act of 2021 (H.R. 3178 and S 1627). This legislation would reduce the...

Pat Soldano Speaking at LIDO LIVE Webinar May 19

Pat Soldano will be apeaking on "Family Business Economic Impact, Family Business Issues and Voter Attitudes". Family Businesses employ 59% of all workers in the US and generate 54% of GDP, (“2021 Contribution of Family Businesses to the US Economy”; Piper and...

Importance of Family Businesses’ Contribution to the U.S. Economy

By Torsten M. Pieper, Franz W. Kellermanns, Joseph H. Astrachan & Nina Anique Hadeler The Importance of Family Businesses’ Contribution to the U.S. Economy A survey provides some updated figures Everyone involved with family businesses knows that those businesses...

Family Business Survey Highlights Estate Tax As The #1 Economic Public Policy Priority Issue

2021 FEUSA Family Business Survey Highlights Estate Tax As The #1 Economic Public Policy Priority Issue For Family Businesses Washington DC, May 9, 2021: Family Enterprise USA, releases results of FEUSA 2021 Family Business Survey revealing that while Income Tax is...

Last Chance To Register to Hear About Current Legislative Agendas

We hope you will join us for a PATG update call on May 6, 2021 at 12pm PT or 3pm ET. Below is the Zoom Webinar agenda for the noteworthy speakers who will be talking on current legislative and political agendas and platforms: Welcome by Pat Soldano and intro Frank...

An Inside Look at Seven Family-Owned Businesses

How each one handled the challenges posed by the pandemic By Patricia N. Soldano & Dawn S. Markowitz Mention the word “COVID-19” to a family business owner, and it’s a sure way to elicit a variety of responses. For some, the pandemic brought new and innovative...

Biden Administration Tax Proposals Included in the American Jobs Plan and American Families Plan

Thank you to Brandon Roman and the team at Squire Patton Boggs (US) LLP for this report. The American Jobs Plan and American Families Plan together include a wide variety of changes to the Tax Code, building on the tax proposals included in the already-passed...

What is the House and Senate Step Up In Basis Elimination Legislation?

Thank you to Brandon Roman and the team at Squire Patton Boggs (US) LLP for this report. Next week, President Biden is expected to reveal details about his American Families Plan proposal, which will focus on paid family leave, free community college, and other...

Biden to Propose Capital Gains Tax as High as 43.4% for Wealthy

By Laura Davison and Allyson Versprille / Bloomberg GovernmentPresident Joe Biden will propose almost doubling the capital gains tax rate for wealthy individuals to 39.6%, which, coupled with an existing surtax on investment income, means that federal tax rates for...

Save The Date: May 6 PATG Supporters Call

We hope you will join us for a PATG update call on May 6, 2021 at 12pm PT or 3pm ET. Hear the following noteworthy speakers talk on current legislative and political agenda and platforms: Patrick O'Connor, Legislative Assistant to Congressman Henry Cuellar of Texas...

Results Are In: 2021 Family Business Survey Report Highlights

This year’s survey, conducted between January 6, 2021 and March 31st, 2021 by Family Enterprise USA, delivers many insights with regard to family businesses. Almost 82% of the respondents are CEO/President/Chairman or Senior Management in the family businesses; 58%...

White House Releases Topline Spending Proposal

Thank you to Russ Sullivan and the team at Brownstein Hyatt Farber Schreck LLP for this report.The Biden administration released its fiscal year (FY2022) discretionary budget request, also known as the “skinny budget.” The request proposes $769 billion in non-defense...