Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Soldano Speaks at ATA’s Recent Global Management Conference in San Diego

‘Trucking Central to Economy’s Success,’ Says Family Enterprise USA’s Pat Soldano at ATA’s Recent Global Management Conference in San Diego Attendees at the American Trucking Association’s Management Conference, held in San Diego last month, heard from Family...

PODCAST: Across the Aisle: Upcoming Midterms

With the 2022 midterms fast approaching, the heads of our Washington, D.C. Technology and Telecommunications group, Al Mottur and Greta Joynes, provide perspective, and banter, from both sides of the aisle on the upcoming elections, Senate and House leadership...

Midterms State of Play. Less Than Two Weeks To Go Until Election Day.

With less than two weeks to go until Election Day, and early voting already taking place in several battleground states, recent polling results and spending trends continue to indicate that the electoral environment is shifting toward Republicans. At present, some...

WEBINAR REPLAY: Linda C. Mack of Mack International Talks About Recruiting and Retention Strategies

Thank you to the Orange County Business Journal for publishing this article.Leadership Compensation, Hybrid Work Accelerate in Family Businesses, Family Business Offices Says Expert Linda MackRecruiting the best leadership and keeping them is no longer “a winging it”...

Mid-Term Election Fallout Critical to Tax Policies for Family Businesses

Thank you to the Orange County Business Journal for publishing this article.Mid-Term Election Fallout Critical to Tax Policies for Family Businesses, New Family Enterprise USA Podcast Details Russ Sullivan, Capitol Hill tax policy veteran, and Podcast Host Pat...

Tax and Economic Legislative Concerns for Families and Family Business

Thank you to the Orange County Business Journal for publishing this article.Friday Oct 28, 2022 11:00 AM - 12:00 PM ET / 10:00 AM - 11:00 AM CDT / 8:00 AM - 9:00 AM PT Families and their businesses are under attack by Congress. The proposed Congressional tax and...

Saying It Out Loud, By Pat Soldano. October 2022.

Congress and Our New Voice We are getting very close. As you know we have been working very hard behind the scenes with Congress to finally embrace the importance of family businesses. Our goal is to give family businesses a louder, more prominent voice on Capitol...

Last Chance to Register. 2022 Family Business Survey Review Webinar (10/25)

Thank you to the Orange County Business Journal for publishing this article.Business Owners 2022 Family Enterprise USA Survey Review 1:00 PM - 2:00 PM ET / 10:00 AM - 11:00 AM PT Family Enterprise USA invites you to join us for a webinar with special guest speakers...

Only 5 Days Left to Register For The 2022 Family Business Survey Review Webinar

Thank you to the Orange County Business Journal for publishing this article.Business Owners 2022 Family Enterprise USA Survey Review 1:00 PM - 2:00 PM ET / 10:00 AM - 11:00 AM PT Family Enterprise USA invites you to join us for a webinar with special guest speakers...

Reducing the Tax Impact on the Sale of Your Business

Thank you to BNY Mellon Wealth Management for this report. Thoughtful estate planning and business succession strategies provide the greatest opportunity to maximize wealth for business owners. When it comes time for a business owner to transition or sell their...

Last Chance to Register. Recruiting and Retention Strategies Webinar (10/19)

Thank you to the Orange County Business Journal for publishing this article.Join Family Enterprise USA's Pat Soldano when she interviews Linda C. Mack about recruiting and retention strategies, best practices in recruiting and retaining top talent, a proven process...

Save 15% When You Register Now: Transitions Fall 2022

Family Business Transitions Fall 2022 November 2-4Marriott Marina del Rey, CA Connect with other multigenerational family businesses and experts in a "safe harbor" environment to openly share real-life issues and challenges with other families. The past 40 years have...

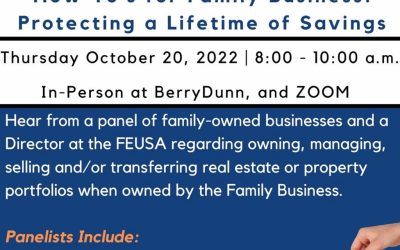

How To’s – Protecting a Lifetime of Savings

What Washington Needs to Know and Benefits of Businesses Owning Their Own Real Estate Thursday, October 20, 2022 | 8:00 - 10:00 a.m. Join John Gugliada, Family Enterprise USA’s (FEUSA) Director of Strategic Partnerships & Business Development, who will set the...

[WEBINAR] Business Owners 2022 Family Enterprise USA Survey Review (10/25)

Thank you to the Orange County Business Journal for publishing this article.Business Owners 2022 Family Enterprise USA Survey Review 1:00 PM - 2:00 PM ET / 10:00 AM - 11:00 AM PT Family Enterprise USA invites you to join us for a webinar with special guest speakers...

You Are Invited to Register. Recruiting and Retention Strategies Webinar (10/19)

Thank you to the Orange County Business Journal for publishing this article.Join Family Enterprise USA's Pat Soldano when she interviews Linda C. Mack about recruiting and retention strategies, best practices in recruiting and retaining top talent, a proven process...

Chubb Insurance & USI Insurance Join FEUSA as New Sponsors

Chubb, USI Insurance Join Family Enterprise USA as New Sponsors Supporting Family Businesses Two major insurance companies focused on wealth management and family businesses, Chubb Insurance and USI Insurance, have joined Family Enterprise USA as new sponsors. Chubb...

Whittier Trust & Homrich Berg Join Family Enterprise USA as New Sponsors

Wealth Management Firms Whittier Trust, Homrich Berg Join Family Enterprise USA as New Sponsors Supporting Family Businesses Two large family business wealth management firms, Whittier Trust and Homrich Berg, have joined Family Enterprise USA as sponsors. Whittier...

Meet Our Keynote Speakers: 2022 Family Business Survey Review Webinar

Thank you to the Orange County Business Journal for publishing this article.Business Owners 2022 Family Enterprise USA Survey Review 1:00 PM - 2:00 PM ET / 10:00 AM - 11:00 AM PT Family Enterprise USA invites you to join us for a webinar with special guest speakers...

Join Other Family Companies at Transitions Fall 2022

Family Business Transitions Fall 2022 November 2-4Marriott Marina del Rey, CA Connect with other multigenerational family businesses and experts in a "safe harbor" environment to openly share real-life issues and challenges with other families. The past 40 years have...

Annual Awards Presented to Best Family-Owned Businesses

22nd Annual Maine Family Business Awards Presented to State’s Best Family-Owned Businesses Awards Livestreamed by Family Enterprise USA, Wednesday, October 12, 6:15 – 8PM EST Maine’s Institute for Family-Owned Business will host its annual Maine Family Business Awards...

Successful Succession Planning

By Whittier Trust, Private Wealth ManagementWe've all heard horror stories of bad things that happened to a business that didn't plan for succession. An owner suddenly falls ill, and the company has trouble meeting its obligations to clients, who are forced to go...

You’re Invited to Business Owners 2022 Family Enterprise USA Survey Review Webinar (10/25)

Thank you to the Orange County Business Journal for publishing this article.Business Owners 2022 Family Enterprise USA Survey Review 1:00 PM - 2:00 PM ET / 10:00 AM - 11:00 AM PT Family Enterprise USA invites you to join us for a webinar with special guest speakers...

Learn About Recruiting and Retention Challenges & Successes

Thank you to the Orange County Business Journal for publishing this article.Join Family Enterprise USA's Pat Soldano when she interviews Linda C. Mack about recruiting and retention strategies, best practices in recruiting and retaining top talent, a proven process...

Legislative Lowdown. Congress Advances Towards CR as Deadline Approaches.

Yesterday, Senate Democrats proposed legislation to fund the federal government through Dec. 16 with the use of a continuing resolution (CR). The proposal would fund each agency at current FY 2022 levels until the December deadline, by which point lawmakers would need...

[Webinar] Get Ahead of the Curve: How Recruitment and Retention Strategies Are Changing Everything

Thank you to the Orange County Business Journal for publishing this article.Join Family Enterprise USA's Pat Soldano when she interviews Linda C. Mack about recruiting and retention strategies, best practices in recruiting and retaining top talent, a proven process...

Join Us For The ‘Voice of Family Business on Capitol Hill’ Podcast Series

Thank you to the Orange County Business Journal for publishing this article.Host Pat Soldano, President, Family Enterprise USA/Policy Taxation Group, Focuses Attention on Key Issues Facing Families, Their Businesses, and Legislation Dr. Frank Luntz Talks About...

Summary of PATG Supporters Meeting Conducted in Washington DC On 9/21/22

Pat Soldano opened the meeting by providing an update on the work that Policy and Taxation Group (PATG) and Family Enterprise USA (FEUSA), is doing in Washington. Specifically, she provided an update on the Congressional Family Business Caucus, highlighting that...

Podcast: A Family Business Boosts its Health by Making a MD its CEO

Why did Dr. Varish Goyal turn in his white lab coat and join his family’s business? Find out on a recent episode of BNY Mellon Wealth Mangement’s Your Active Wealth business owner podcast series. As the president and CEO of a collection of family-operated businesses,...

[Webinar] Recruiting and Retention Strategies That Actually Work

Thank you to the Orange County Business Journal for publishing this article.Join Family Enterprise USA's Pat Soldano when she interviews Linda C. Mack about recruiting and retention strategies, best practices in recruiting and retaining top talent, a proven process...

Legislative Lowdown. Democrats Prepare Another for Expanded CTC.

Democrats Prepare Another for Expanded CTC. With the year-long effort to legislate a comprehensive energy, healthcare and tax bill finally completed, many Democratic lawmakers and members of the administration have fully transitioned to campaigning for the upcoming...

![Content [WEBINAR] Business Owners 2022 Family Enterprise USA Survey Review (10/25)](https://policyandtaxationgroup.com/wp-content/uploads/2022/10/Instagram-register3-400x250.jpg)

![Content [Webinar] Get Ahead of the Curve: How Recruitment and Retention Strategies Are Changing Everything](https://policyandtaxationgroup.com/wp-content/uploads/2022/09/Instagram-recruitment-400x250.jpg)

![Content [Webinar] Recruiting and Retention Strategies That Actually Work](https://policyandtaxationgroup.com/wp-content/uploads/2022/09/Instagram-register2-400x250.jpg)