By Matt Brown, Partner, Brown & Streza LLP

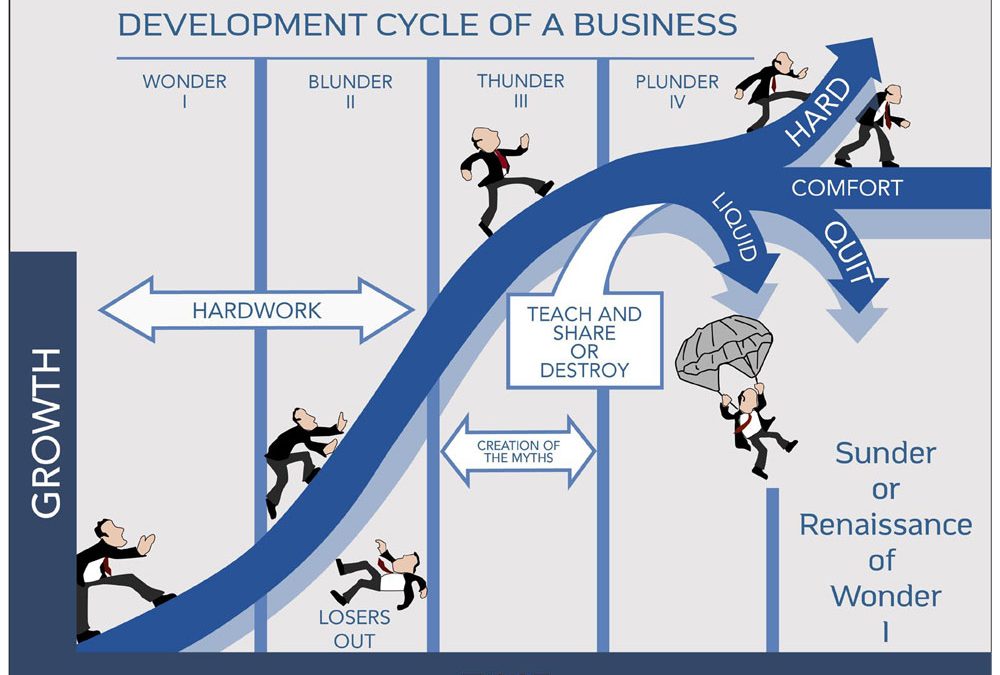

There are four stages of entrepreneurial business growth: wonder, blunder, thunder, and plunder. Each stage has its own opportunities and challenges. And each stage brings with it the need for one or more attorneys as a member of the entrepreneur’s advisory team.

Attorney as Entrepreneur

Entrepreneurship is exciting. I am an attorney, but I am also an entrepreneur. Brown & Streza fosters innovation and other entrepreneurial behaviors. We speak entrepreneur because we are entrepreneurs.

Entrepreneurship is not just an opportunity to innovate. It is an opportunity to serve. I enjoy the occasional stroll around the office, considering the lives touched directly and indirectly by the decisions I make every day. It is a lofty responsibility. But it is also a tremendous privilege. I have created, and continue to create, rewarding employment opportunities for staff – serving and impacting both the staff and their broader families. I also serve clients in areas that are deeply personal to them. I am a part of something bigger than myself – something truly special.

There are four phases of entrepreneurial development: the Wonder Stage, in which the entrepreneur postulates what could be or should be; the Blunder Stage, in which the entrepreneur, having taken the plunge, gets a “real-world” business education; the Thunder Stage, during which the entrepreneur strikes a rhythm and begins a growth pattern; and the Plunder Stage, the time during which the entrepreneur needs to innovate once again, taking the business to the next level, starting an entirely new business, cashing in by selling to a third party or the employees, or transitioning the business to the children.

Wonder – “What if” . . . or . . . “There Must Be a Better Way”

The entrepreneur, driven by creative energy, wonders whether their craft could be done better. Better customer care. Better processes. More innovation. The Wonder Phase is filled with excitement about the opportunities that lie ahead.

The attorney can play a key role in setting expectations. Attorneys are trained to be forward-thinking – to identify key issues early enough to avoid challenges, capitalize on opportunities, and prevent costly mistakes.

And entrepreneurs tend to be creative thinkers. Sometimes creative thinkers need a small dose of reality and a large dose of help attending to details. Experienced attorneys can bring that dose of reality to the table, aiding the entrepreneur by adding focus and meticulous planning before forging ahead.

But good attorneys also know that some business decisions are best made on gut instinct. A skilled, entrepreneur-focused attorney knows when to back off and leave the business decisions to the entrepreneur’s instincts. Legal decisions are not necessarily business decisions.

While an attorney may serve a broader counseling role at the beginning of a business venture, proper entity selection is often the key focus. Relevant considerations include maximizing liability protection and minimizing both current and future taxation. Choosing the right entity is both a science and an art. There is no universal checklist. A bad choice-of-entity decision is often the bad decision the entrepreneur most regrets once the business later succeeds – particularly if selling the business to a third party.

Blunder – Baptism by Fire: If Running a Business Were Easy, Everyone Would Do It

What did I get myself into? Payroll. Employees. Accounts receivable. Insurance. Quarterly tax estimates. When do I finally get to build my dream?

The second phase of entrepreneurial development is the Blunder Phase. It seems a common assumption that most wealthy business owners just got lucky. Maybe they were in the right place at the right time. Maybe they inherited their seed capital. Maybe they just knew the right people. Few entrepreneurs would suggest luck had nothing to do with their success. In fact, entrepreneurs tend to be a rather humble bunch, often attributing much of their success to luck.

But chance favors the prepared, and virtually all entrepreneurs succeed based on hard work, deep expertise, and identifying, or better-serving, a new or underserved niche.

These abilities do not, however, mean the entrepreneur will achieve overnight success. Every entrepreneur makes many, many blunders throughout their career: hiring too soon (or too late!); hiring the wrong people; keeping the wrong people too long; setting customer expectations too high (or accepting the wrong customers!).

The attorney’s role during the Blunder Phase is to assist the entrepreneur in staying on track and out of trouble. An entrepreneur-focused attorney is familiar with entrepreneurial business cycles. The attorney knows how to counsel the entrepreneur on what to expect next and what to avoid. Building a working relationship with an attorney at this phase is invaluable, inevitably saving the entrepreneur significant multiples of the cost.

For example, many entrepreneurs borrow liberally during the Blunder Phase. But they fail to appreciate the impact of borrowing on their cash flow. Repayment of loan principal is not deductible, so the entrepreneur must repay the loan out of after-tax dollars. This can have a devastating impact on cash flow, and it can be a very unwelcome surprise to the unsuspecting entrepreneur.

Newer entrepreneurs may also underestimate the importance of adequate capital to smoothing economic downturns. Additionally, they are generally ignorant of many of the compliance requirements of running a business. Labor law, tax law, and corporate law (all of which challenges, for California businesses, are part of, and further compounded by, California’s exceptionally anti-business climate) contain compliance elements that can thwart the best laid plans.

Toward the end of the Blunder Phase, the entrepreneur begins to transition from working “in the business” to working “on the business”. The entrepreneur is gearing up for the Thunder Stage.

Thunder – “This business just might work”

The third phase is the Thunder Phase. This is often the most exciting part of the ride for the entrepreneur. The Thunder Phase begins with a sense that the business is improving. Revenues and profits are up. Systems are working more smoothly. The entrepreneur has widespread credibility in their industry. Maybe this business is going to make it after all!

Entrepreneurs tend to have a massive growth in confidence as they progress through the Thunder Phase. They have proven to themselves and to others that their ideas do indeed have merit.

The “arrived” entrepreneur may begin to create myths in their own mind. There is a tendency to forget the sleepless nights, the long hours of toil, and the sheer terror of near brushes with failure. The entrepreneur may trick themselves into believing that success came easily.

The attorney’s role during the Thunder Phase is to aid the entrepreneur in building more sophisticated systems. Perhaps taxes have become an increasing burden and it is time to reconsider the ideal ownership structure or to consider how to set aside retirement funds tax-efficiently.

The entrepreneur may also increase their interest in charitable pursuits, but the bulk of the entrepreneur’s assets are in an illiquid business. The attorney can counsel the entrepreneur on how best the entrepreneur might use illiquid business interests to benefit charity and realize tax savings.

If the entrepreneur engages in advanced legal planning during the Thunder Phase, they should be well-prepared to reap maximum rewards during the Plunder Phase.

Plunder – “I’ve made it. What’s next?”

For the extremely successful entrepreneur, this stage can be a major turning point. Is it time to take the company to the next level? What is the next level? How do we get there?

Most entrepreneurs will begin the Plunder Phase by changing personal spending habits. They may buy a bigger home. Or perhaps they buy more luxury items, travel more, or purchase bigger, faster, or more sophisticated toys.

But most entrepreneurs tire quickly of simply spending their hard-earned money on material pursuits. The plundering entrepreneur is confident and often wants new and bigger challenges. But there is a reality check to be had at this level. Does the entrepreneur have the skill and the staff to move to the next level? Can the entrepreneur sell the business? What is the right price? Who can help the entrepreneur prepare for sale? Do the children want to work in the business? Are they qualified? What will the employees think? Should I leave the business to my children?

If the entrepreneur decides to sell to a third party or even to the employees, there is a considerable amount of work to be done. The entrepreneur needs to ensure a well-trained management team is in place to attract the highest price. The entrepreneur also needs to improve earnings by increasing revenue and cutting expenses – including, perhaps, those quasipersonal expenses that the entrepreneur was paying out of the business that may or may not have been truly necessary business expenses.

One very critical point for the entrepreneur to remember: You will probably make more money operating your business than you will selling your business.

And of course there are taxes due upon sale. Entrepreneurs are well-advised to assemble an experienced team of advisors years before selling to ensure they can get the highest price and pay the least tax. CPAs are a great resource for certain year-to-year tax savings ideas. But entrepreneurs really need an experienced tax attorney to help them get the most after-tax dollars upon selling. And a good M&A attorney is a must to ensure the entrepreneur keeps the sale proceeds instead of losing them to future lawsuits over inaccurate representations and warranties made to the buyer. To get the right results, a selling entrepreneur should expect to spend substantial sums on professional fees. This may be the single largest financial transaction of the entrepreneur’s life, and this is not the time to cut corners.

Of course, if the entrepreneur has brought the children into the business, there is an entirely different dynamic. Are the children prepared to take the business to the next level? What are the income, gift, and estate tax consequences of gifting or selling the business to the children? Most successful entrepreneurs have a 40% silent partner – Uncle Sam. It is not uncommon to lose 40% of a valuable business – including the value added by children working in the business – to estate taxes if the entrepreneur fails to plan well in advance of death. The estate tax can be mitigated via thoughtful, proactive planning. And it is, in fact, optional for those who plan well in advance and integrate significant philanthropic gifts.

So there you have it. The lifecycle of the entrepreneurial business. It is a wild and crazy ride, filled with both excitement and heartbreak. At Brown & Streza, we are entrepreneurial attorneys. We love this wild and crazy ride. Let us partner with you as you go through the peaks and valleys, the triumphs and the challenges. We have been there before, and we would love to help you through your own adventure.

About Brown & Streza LLP

Brown & Streza LLP is a law firm providing exceptional, integrated legal services in the areas of tax, estate, business, and charitable planning, mergers and acquisitions, business succession planning, trust and estate administration, and real estate. We serve families, businesses, entrepreneurs, investors, philanthropists, and charitable organizations. We provide caring service, deep expertise, innovative solutions, and a stable, professional, and well-respected staff while embracing and communicating that life is more than wealth.

Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families to fully enjoy the economic liberties and benefits of a robust free market unique to our nation. For over 25 years, we have been the loudest voice in the nation’s capital on eliminating the death tax. This ill-conceived tax has a destructive impact on families, family businesses, job creation, and the national economy.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness