Jun 27, 2016 | Blog

According to a recent study published by the Tax Foundation, presumptive Republican presidential nominee Donald Trump’s estate tax proposal would encourage economic growth, but also reduce tax revenue by billions of dollars. The group said that even though his...

Jun 23, 2016 | Blog

We thought this story about the launch of a potential rival lobbying organization featured in Politico would be of interest to you. The Patriotic Millionaires, a group of wealthy Americans who argue they should pay higher taxes, registered to lobby for the first time....

Jun 9, 2016 | Blog

The results of the 2016 presidential and congressional races could hold significant sway over the future use of grantor-retained annuity trusts (GRATs) while simultaneously impacting estate and gift taxes. If presumed Democratic nominee Hillary Clinton wins the...

May 10, 2016 | Blog

During an address to the American Bar Association Taxation Section over the weekend, Melissa C. Liquerman, Branch Chief within the IRS Office of the Chief Counsel, acknowledged that long awaited regulatory guidance under Section 2704 addressing family-owned business...

May 5, 2016 | Blog

The Estate Tax Turns 100 years old this year! It is time to kill it once and for all! Please help us to do that by referring families to us that can help our efforts and support our work. Forward this email on to any family that you think would be interested in...

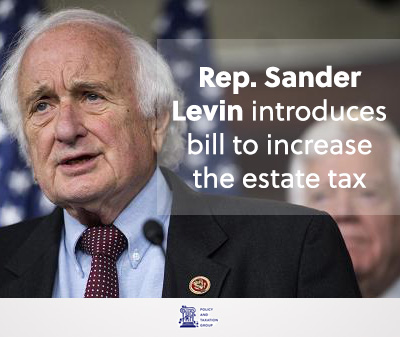

Apr 28, 2016 | Blog

Rep. Sander Levin, the top Democrat on the House Ways and Means Committee, recently released a new bill that brings back the estate tax parameters from early in the Obama administration – a $3.5 million exemption, and a 45 percent top rate. That’s moving...