FOR FAMILY OFFICES AND SUCCESSFUL INDIVIDUALS

Research, Whitepapers, Polls, Surveys, and Studies

Latest Polling Data. In-depth Reports, Analysis, and Data Insights. Estate Tax, Income Taxes, Legislative Impact, and more.

Topics and Whitepapers:

2026

- Changing Public Markets and the Impact for Average Investors, by Bank OZK, February, 2026

- The Special Purpose Supporting Organization, by Brown & Streza LLP, January, 2026

2025

- Developing Next Generation Members in the Family Business and Family Enterprise, by CFAR, December, 2025

- Preserving Legacy Beyond the Operating Business: Evolving from Operator to Investor, by Buchanan Street Partners, November, 2025

- From Vision to Venture: An Entrepreneur’s Guide to Launching a Lasting Business, by Rockefeller Global Family Office, November, 2025

- Hidden Risks in Family Enterprise: Transforming Vulnerability into Strength, by Bank OZK, October, 2025

- Who Pays The Most Taxes?, by Policy and Taxation Group, October, 2025

- Charitable Giving: DAFs vs. Private Foundations, by Whittier Trust, October, 2025

- Purpose-Driven Wealth: Redefining Prosperity to Build a Lasting Legacy, by Rockefeller Global Family Office, September, 2025

- How Family Governance Protects Generational Wealth, by Whittier Trust, August, 2025

- How Family Businesses Can Cultivate Resilient Growth, by EY, August, 2025

- Wealth, Complexity & The One Big Beautiful Bill: Time for a Family Office?, by Whittier Trust, July, 2025

- 2024-25 Family Business Rising Gen Survey: Communication is Still Key, by Cornell University, Family Enterprise USA, and The Roberts Group, June, 2025

- Why Every Family Office Needs an ‘Expert Generalist’, by Mack International, June, 2025

- Wealth & Values: Defining Family and Individual Values, by Rockefeller Global Family Office, June, 2025

- Controlling Risk and Maximizing Protection Through Consultation and State of The Art Technology, by USI, June, 2025

- Engaging Next Generation Members in the Family Business and Family Enterprise, by CFAR, April, 2025

- Flash Market Update: The “Liberation Day” Jolt, by Rockefeller Global Family Office, April, 2025

- Family First: Navigating Success and Succession in Business, by Brown & Streza LLP, March, 2025

- How Parallel Governance Can Guide Generational Transition, by EY, February, 2025

- Parenting Amidst Wealth: Navigating the Shift as Kids Enter Adulthood, by Pathstone, February, 2025

2024

- An Under Appreciated Risk to Family Legacies, by Robert F. Mancuso, October, 2024

- A Sustainably Successful Process for an Executive Search, by Mack International, October, 2024

- How Your Shareholder Liquidity Strategy Can Be Made Future-Proof, by EY, September, 2024

- Private Business Transition: An Approach to Optimize Success, by Michalzuk Group at Morgan Stanley Private Wealth Management, July, 2024

- Evaluating Business Structures: The Pros And Cons, by Homrich Berg, July, 2024

- Handing Over the Keys—The Challenges of Reaching Gen Z, by Mack International, June, 2024

- Family Vision and Values: The Starting Point of Estate Planning, by Pathstone, June, 2024

- DAC Insights – The Case for Dividend Growth Investing, by Dividend Assets Capital, May, 2024

- Six Best Practices to Keep Your Business Sale-Ready, by Whittier Trust, May, 2024

- Business Succession – The Essentials, by Brown & Streza LLP, April, 2024

- Uncover the Power of Active Management with Fenimore Asset Management, by Fenimore Asset Management, April, 2024

- Frequently Asked Questions Posed to this C-Suite Executive Search and Family Office Consulting Firm, by Mack International, February, 2024

- Would You Like More Income Every Year?, by Dividend Assets Capital, February, 2024

- Give it away now? Today’s favorable estate tax is set to expire after 2025, by Fiduciary Trust, February, 2024

- Tax Implications for Family Business Succession Planning in 2024 and Beyond, by Whittier Trust, February, 2024

- 7 Capital Planning Questions For Family Businesses, by EY, January, 2024

Infographics on Family Office, Taxes, and More

2023

- The Importance of Pre-Sale Planning for Your Family Business, by Pathstone, November, 2023

- What a 2023 Survey Found Re: Family Office Compensation and Talent, by Mack International, November, 2023

- Appraising A Company That Is Subject To A Potential Sale/Merger Event: Chief Counsel Advice Memorandum 202152018, by MPI, October, 2023

- Cybersecurity is No Longer Optional, It’s a Necessity, by USI Insurance Services, September, 2023

- Decoding Philanthropic Designs: DAFs, Foundations, Support Orgs, by Brown & Streza LLP. August, 2023

- Contingency Planning For Business Owners, by Homrich Berg. July, 2023

- AI’s Transformative Potential: Rational Interest vs Irrational Exuberance, by Pathstone, June, 2023

- Selecting Modern Trust Structures Based on a Family’s Assets, by South Dakota Trust Company, June, 2023

- Protecting What You’Ve Spent a Lifetime Building, by Chubb, June, 2023

- Setting Up Your Family Philanthropy for Long-Term Success, by Fiduciary Trust International, June, 2023

- IRS Releases Inflation Reduction Act Strategic Operating Plan: Is an Audit Storm Brewing for High Net-Worth Individuals?, by MPI, June, 2023

- Profile of the Family Office Leader of the Future, by Mack International, April, 2023

- SECURE 2.0 Act Changes Affecting Family Business Owners, by Homrich Berg. April, 2023

- Inheritance VS. Private Capital, by The Madison Group, February, 2023

- Impact of Supply Chain Disruptions in 2023, by USI Insurance Services, January, 2023

2022

- It’s All Relative; Family Matters in Business Succession, by Homrich Berg, December, 2022

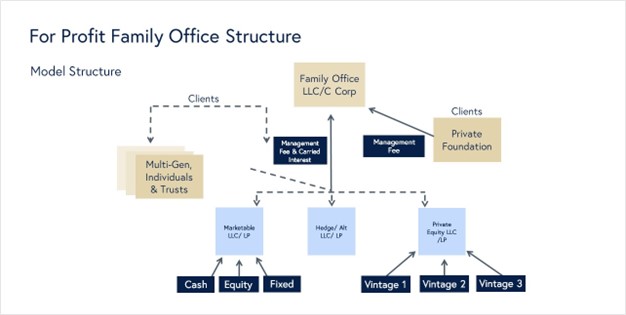

- Is a For-Profit Family Office Right for You?, by Pathstone, November, 2022

- Reducing the Tax Impact on the Sale of Your Business, BNY Mellon Wealth Management, October, 2022

- Successful Succession Planning, by Whittier Trust, October, 2022

- Considerations on Establishing Family Governance, by Pathstone, September, 2022

- Envisioning Life After Your Family Business Succession, by Aspiriant, September, 2022

- Above the Line Planning, by The Madison Group, August, 2022

- How to Get the Most from Your Board, BNY Mellon Wealth Management, June, 2022

- A Proven Process for Recruiting and Retaining Top Family Enterprise Leadership Talent, by Mack International, June, 2022

- Private Placement Insurance Products, by The Madison Group, May, 2022

- 2022 Family Office Trends, by Pathstone, April, 2022

- Navigating “Company Value” in Times of Choppy Market Activity, MPI, April, 2022

- Considerations in Making a Gift of a Business Interest to a Public Charity, BNY Mellon Wealth Management, April, 2022

- An Opportunity to Save on Income Taxes, BNY Mellon Wealth Management, April, 2022

- From Generation to Generation, by Pathstone, February, 2022

2021

- 87% of the Businesses in the US – Policy and Taxation Group, May 2021

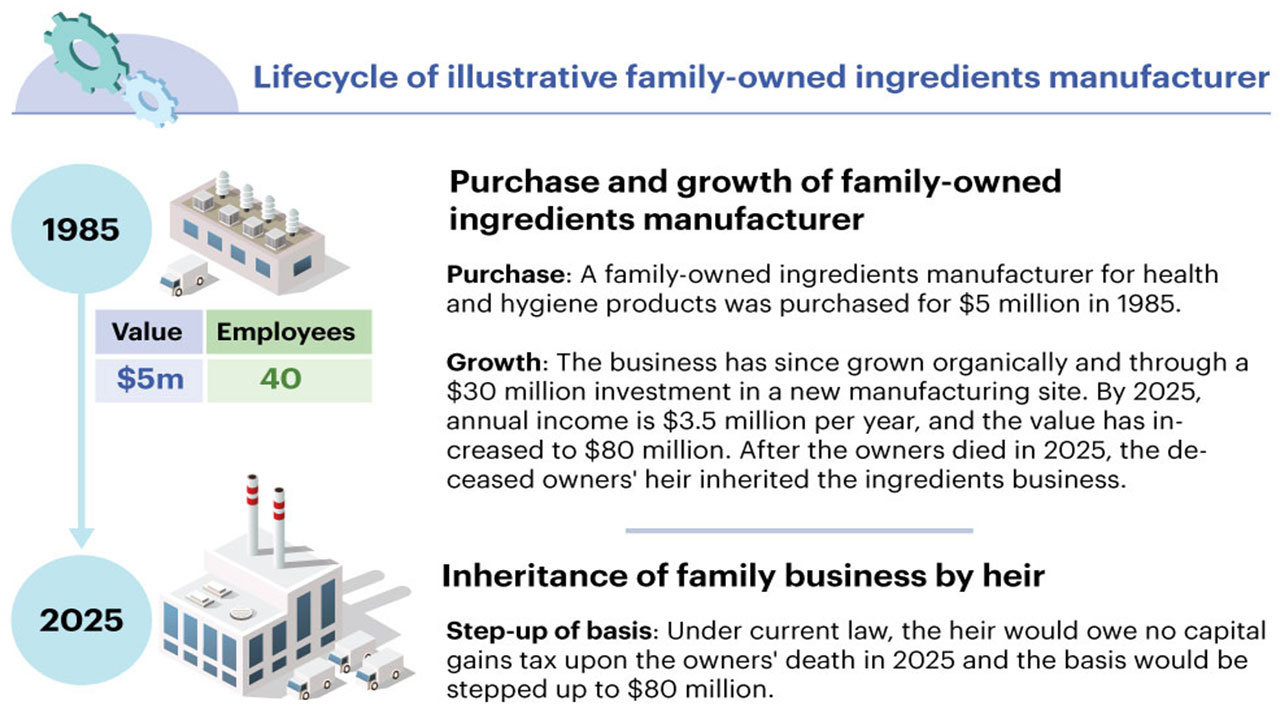

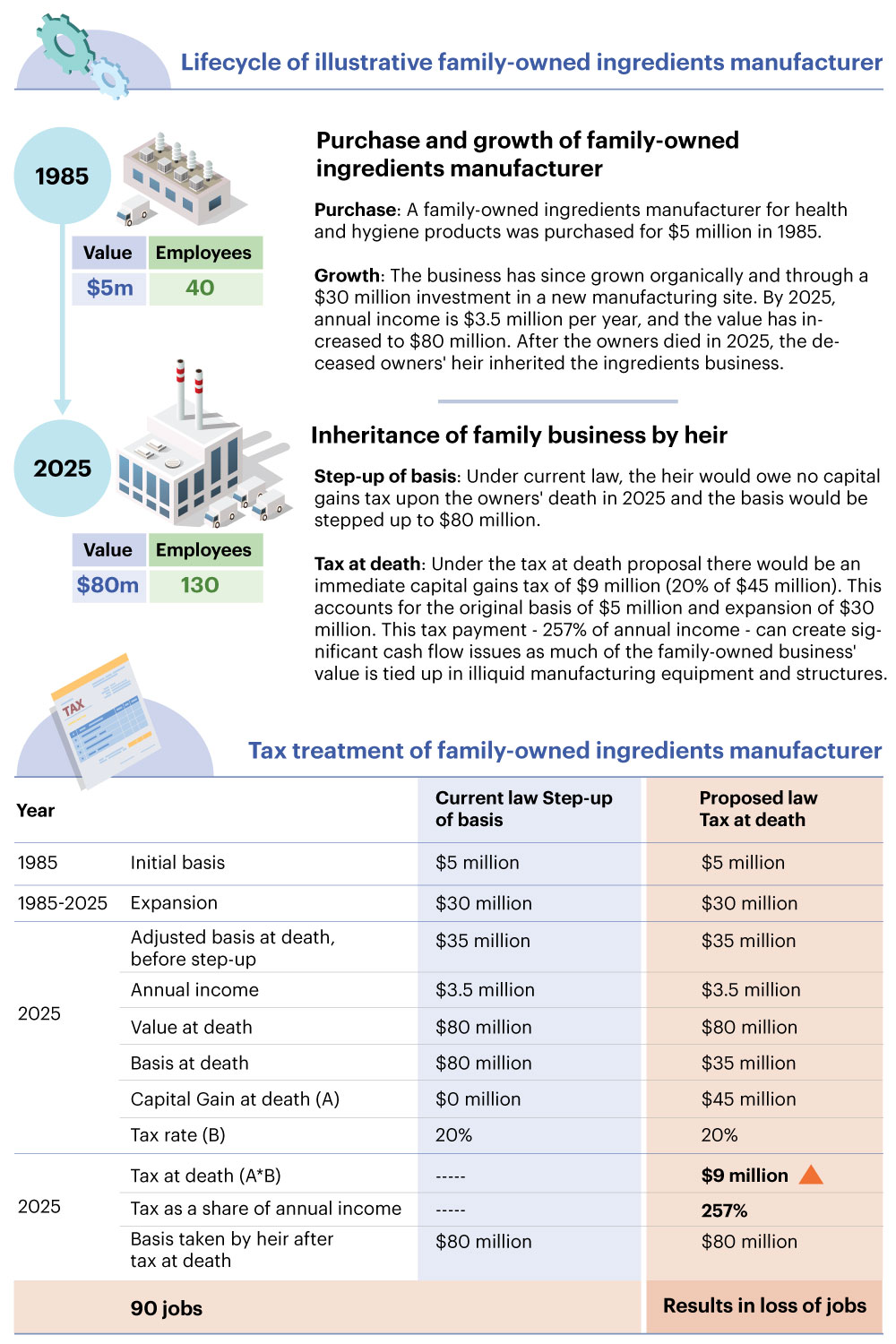

- Job Loss Example Due to Repeal of Step up on Basis – Policy and Taxation Group, May 2021

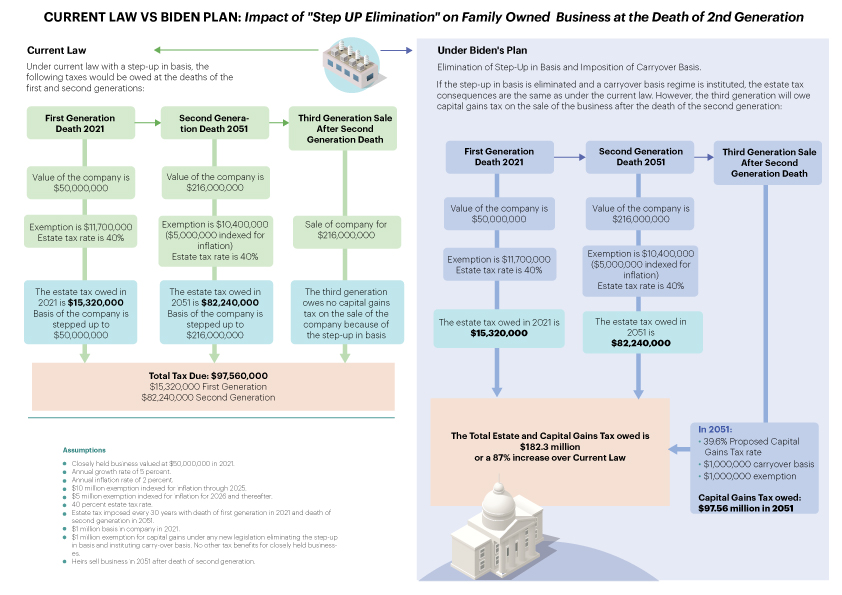

- Elimination of Step up of Basis – Policy and Taxation Group, May 2021

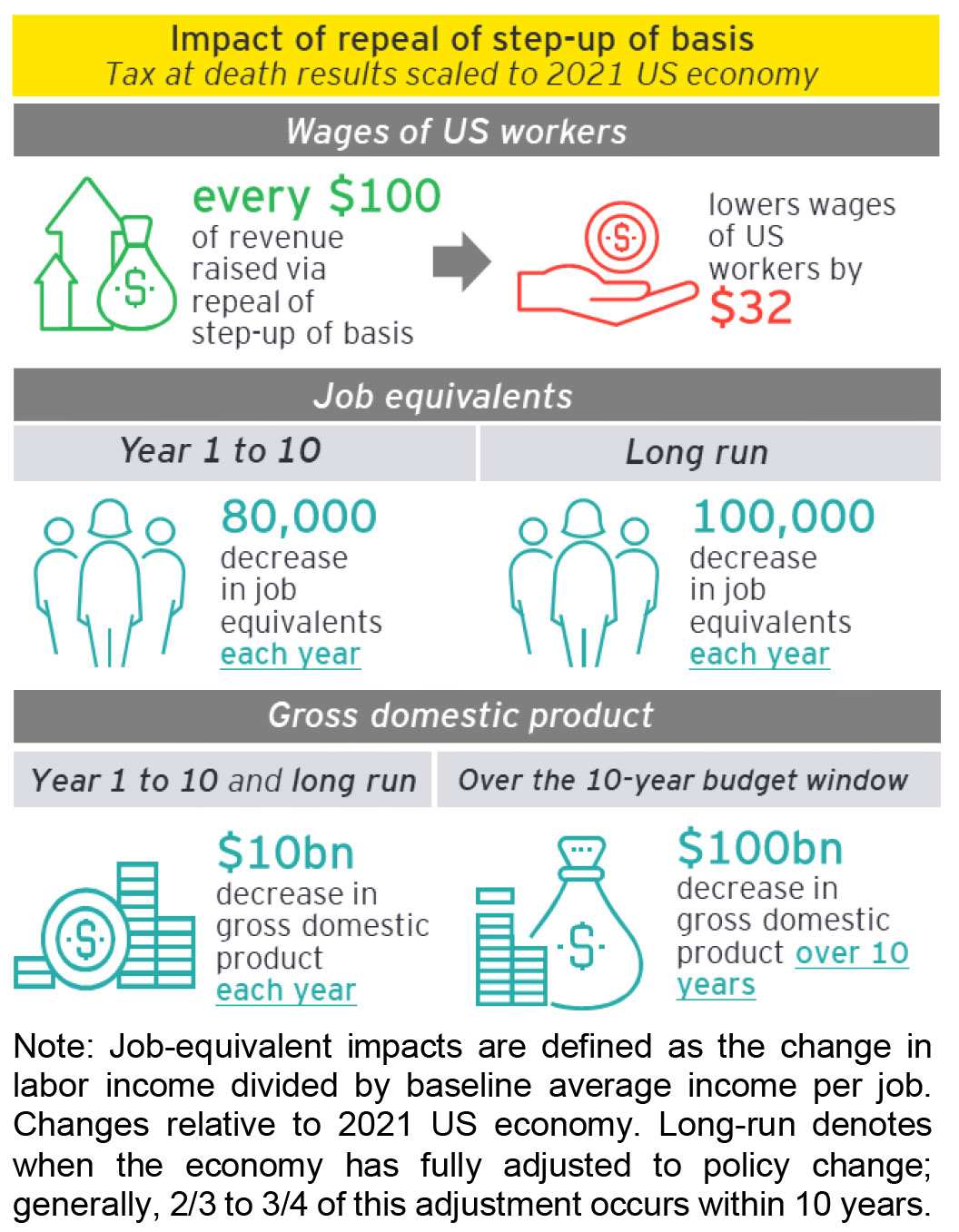

- Impact of Repeal of Step-up of Basis – Policy and Taxation Group, May 2021

- House Ways & Means Select Revenue Measures Subcommittee: “Funding Our Nation’s Priorities: Reforming the Tax Code’s Advantageous Treatment of the Wealthy” – by Squire Patton Boggs (U.S.) LLP, May 14, 2021

- Submission for May 12 House Ways and Means Hearing on Reforming the Tax Codes Advantageous Treatment of the Wealthy – by Policy and Taxation Group, May 12, 2021

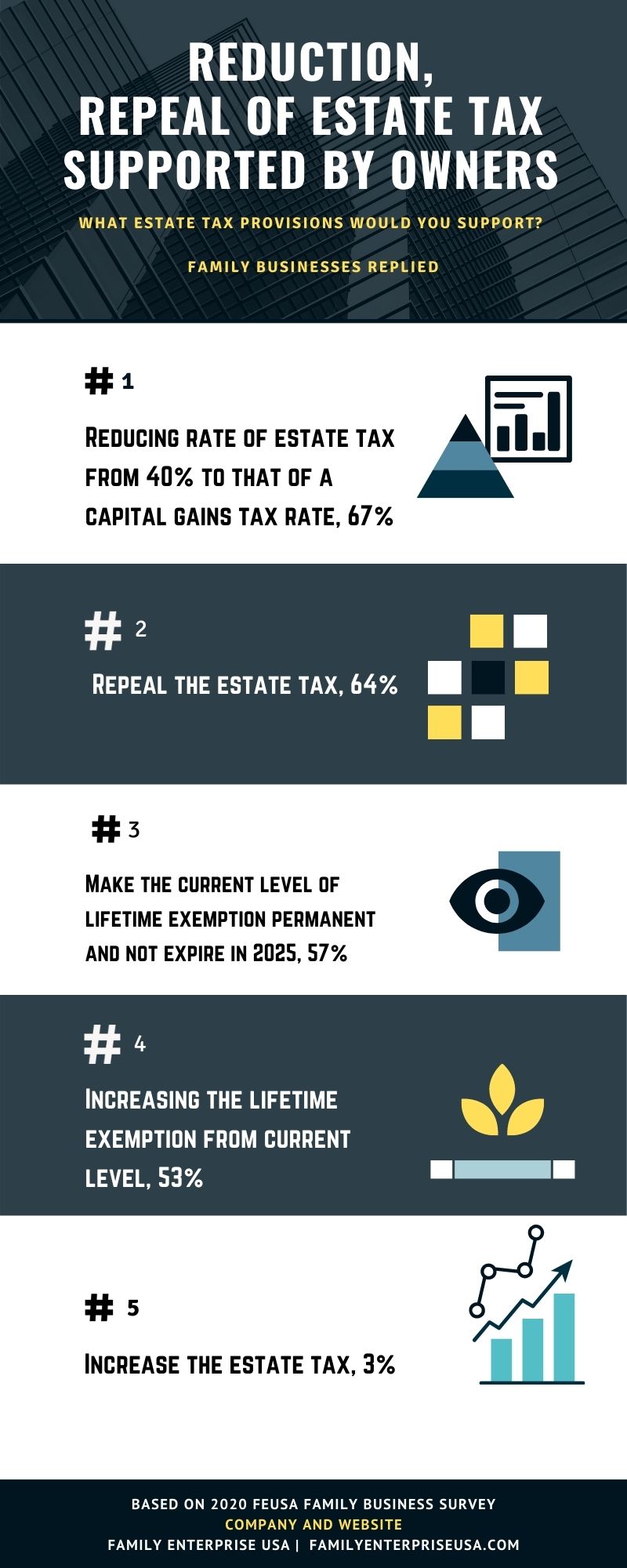

- Estate Tax Rate Reduction Act One Pager – Policy and Taxation Group, May 2021

- Repealing step-up ofbasison inherited assets: Macroeconomic impacts and effects on illustrative family businesses – by Family Business Estate Tax Coalition(FBETC), April 2021

- An Inside Look at SevenFamily-Owned Businesses – by Patricia N. Soldano & Dawn S. Markowitz, March 2021

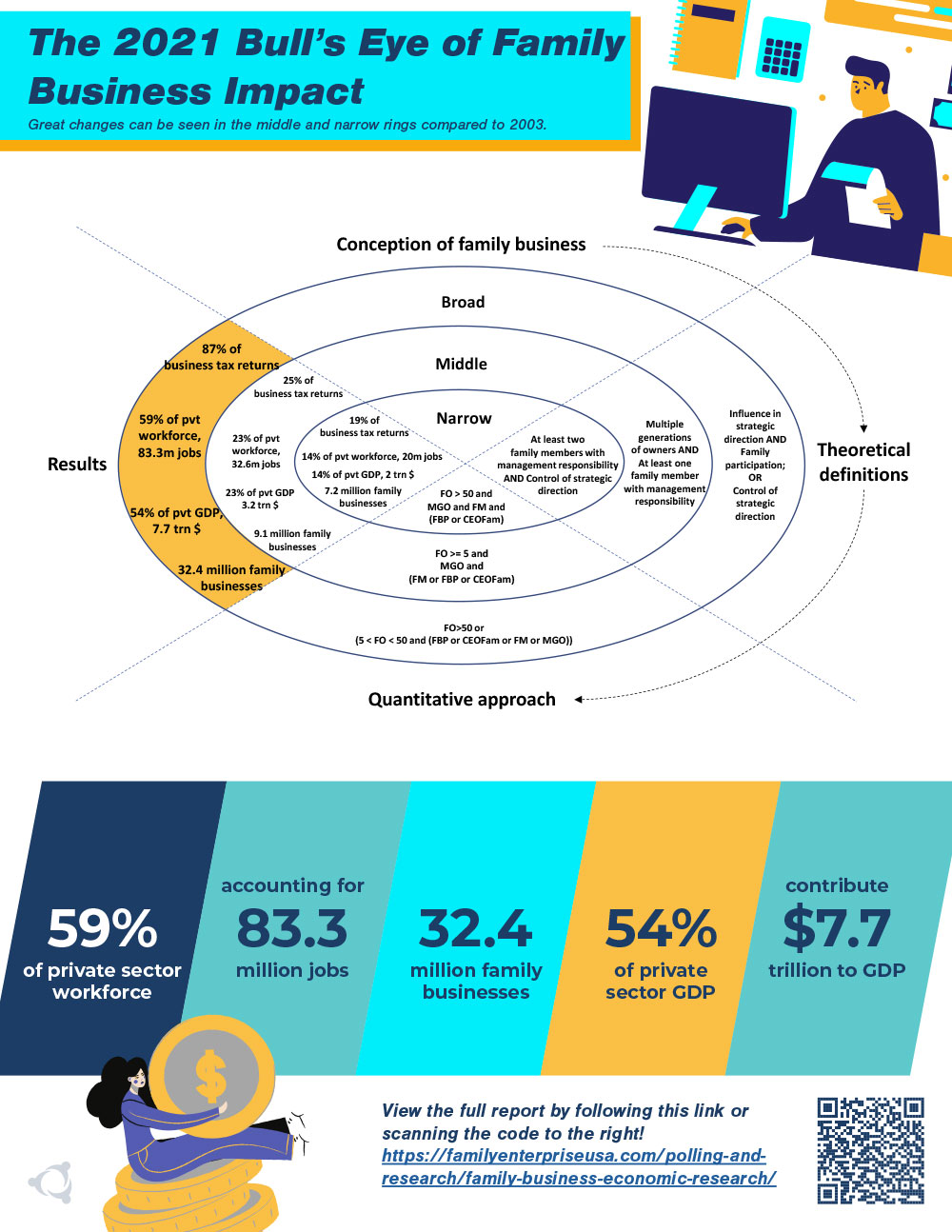

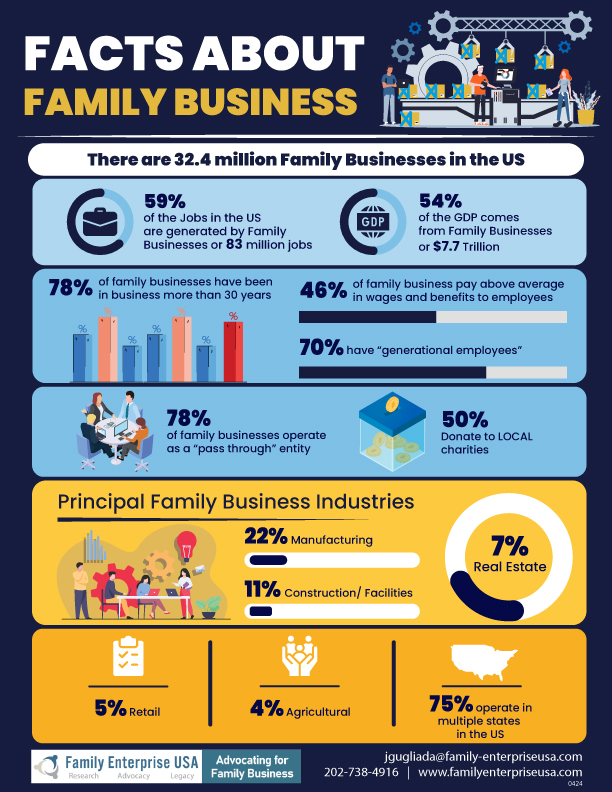

- The Importance of Family Businesses’ Contribution to the U.S. Economy – By Torsten M. Pieper, Franz W. Kellermanns, Joseph H. Astrachan & Nina Anique Hadeler, March 2021

- Update 2021: Family Businesses’ Contribution to the U.S. Economy – by Torsten M. Pieper, Ph.D. February 2021

2019

- Socialism Survey by Frank Luntz — June, 2019

- Cotton, Boozman, Blunt, and Ernst Introduce the Estate Tax Rate Reduction Act for 2019; S176 by FEUSA — January, 2019

- Senator Thune Introduces S215; Bill to Repeal Estate and GST Taxes by FEUSA — January, 2019

- Elizabeth Warren Proposes New Wealth Tax by FEUSA — January, 2019

- Congressman Jason Smith Introduces Estate Tax Repeal Bill HR218 by FEUSA — January, 2019

2018

- Death Tax Election Night Polling by Frank Luntz — December, 2018

- Senator Kyl Again Seeks to Cut the Death Tax by FEUSA — November, 2018

- New IRS Data Reiterates Shortcomings of the Estate Tax by Scott Eastman – October, 2018

- Family Businesses; Jobs and Revenue Generated in the US by FEUSA— September, 2018

- Family Businesses; Charitable Giving; 2018 – May, 2018

- Update and Extend Earlier Estimates of Proposals to Modify The Estate, Gift and Generation-Skipping Transfer Taxes – March 28, 2018

2017

- Estate Tax Is Hurdle For Minority American Business Owners by Harry Alford – December, 2017

- Support for Death Tax Repeal by Frank Luntz – November, 2017

- Revenue Analysis Of Options to Reform The Federal Estate, Gift and Generation-Skipping Transfer Taxes by Quantria Strategies – September 2017

- As Congress debates repeal of estate tax, why not consider ending the gift tax? by Pat Soldano – June, 2017

- American Voter Attitudes On Estate, Gift, And Generation-Skipping Taxes – January 30, 2017

2016

- Killing the Death Tax Would Resurrect Growth by Stephen Entin – October, 2016

2014 and Earlier

- Frank Luntz Presentation on Women Voters – June 18, 2014

- Frank Luntz Presentation on Income Inequality & Taxes – January 28, 2014

- Impacts on Small Businesses and Families – September 2010

- How the Death Tax Kills Small Businesses, Communities—and Civil Society by Patrick Fagan – June, 2010

- Statement of Terry Neese: Distinguished fellow, National Center Of Policy Analysis Family Policy Center – November 4, 2009

- Let The Death Tax Rest In Peace – August 5, 2009

- Afro American Newspapers: Families need a permanent, certain fix of Estate Tax – April 26, 2006

- Death Tax Squeezes Smaller Companies – May 17, 2005

- Death Tax Chronicle – 2005

- Hispanic Family-Owned Business Interviews – June 1, 2004

- Family Businesses Contribution to the U.S. Economy_ A Closer Look by Joseph H. Astrachan and Melissa Carey Shanker — September, 2003

- Family Businesses Contribution to the U.S. Economy_ A Closer Look by Joseph H. Astrachan and Melissa Carey Shanker — September, 2003

- The Effects on Government Revenues from Repealing the Federal Estate Tax and Limiting the Step-Up in Basis for Taxing Capital Gains – June 30, 2003

- Women & The Death Tax – April 2002

- The Death Tax & Gay and Lesbian Americans – April 24, 2002

- Post-Election Survey Results, Groundbreaking Data On The Efforts Of The Death Tax – November 27, 2000

- A Declaration Of Independence From Death Taxation: A Bipartisan View – July 2000

- Survey Of The Impact Of The Federal Estate Tax on NAWBO Member Businesses – February 23, 2000

- Policy Analysis: Grave Robbers, The Moral Case Against The Death Tax – October 4, 1999

- Family Businesses In The US Economy – 1998

- An Analysis Of The Descent Distance Into The Defects Of The Estate Tax On Entrepreneurship – June 1, 1994

- Federal Transfer Taxation: A Study In Social Cost – 1993

Latest Insights on Taxes and Policies Effecting Family Offices and Successful Individuals

Changing Public Markets and the Impact for Average Investors

By Jordan WaldrepChief Investment OfficerBank OZKThe landscape of public markets in the US has undergone a profound change over the past 30 years with a significant reduction in the number of publicly traded equities. This has been driven by many factors...

Congress Is Listening – Will You Speak Up?

Small action. Serious influence. See why this matters more than ever. Your voice matters - and it directly strengthens our mission. Why your input is essential: When you share a few quick, anonymous facts about your family-owned business, you help us...

Ernie Pomerleau Retires From the Board After 20 Years

Dear Partners and Friends, I wanted to let you know that Ernie Pomerleau, a distinguished Board Member of Policy and Taxation Group for over 20 years, will be retiring from the Board. Ernie was one of our earliest supporters and one our first Board...

Saying It Out Loud February 2026, By Pat Soldano

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupReconciliation 2.0, State Wealth Taxes ‘In Play’ for 2026 Legislative Sessions; Monitoring is Key to Winning The main sport in Washington, D.C., is predicting what new tax and economic...