Topics and Whitepapers:

2024

- Six Best Practices to Keep Your Business Sale-Ready, by Whittier Trust, May, 2024

- Business Succession – The Essentials, by Brown & Streza LLP, April, 2024

- Uncover the Power of Active Management with Fenimore Asset Management, by Fenimore Asset Management, April, 2024

- Frequently Asked Questions Posed to this C-Suite Executive Search and Family Office Consulting Firm, by Mack International, February, 2024

- Would You Like More Income Every Year?, by Dividend Assets Capital, February, 2024

- Give it away now? Today’s favorable estate tax is set to expire after 2025, by Fiduciary Trust, February, 2024

- Tax Implications for Family Business Succession Planning in 2024 and Beyond, by Whittier Trust, February, 2024

- 7 Capital Planning Questions For Family Businesses, by EY, January, 2024

2023

- The Importance of Pre-Sale Planning for Your Family Business, by Pathstone, November, 2023

- What a 2023 Survey Found Re: Family Office Compensation and Talent, by Mack International, November, 2023

- Appraising A Company That Is Subject To A Potential Sale/Merger Event: Chief Counsel Advice Memorandum 202152018, by MPI, October, 2023

- Cybersecurity is No Longer Optional, It’s a Necessity, by USI Insurance Services, September, 2023

- Decoding Philanthropic Designs: DAFs, Foundations, Support Orgs, by Brown & Streza LLP. August, 2023

- Contingency Planning For Business Owners, by Homrich Berg. July, 2023

- AI’s Transformative Potential: Rational Interest vs Irrational Exuberance, by Pathstone, June, 2023

- Selecting Modern Trust Structures Based on a Family’s Assets, by South Dakota Trust Company, June, 2023

- Protecting What You’Ve Spent a Lifetime Building, by Chubb, June, 2023

- Setting Up Your Family Philanthropy for Long-Term Success, by Fiduciary Trust International, June, 2023

- IRS Releases Inflation Reduction Act Strategic Operating Plan: Is an Audit Storm Brewing for High Net-Worth Individuals?, by MPI, June, 2023

- Profile of the Family Office Leader of the Future, by Mack International, April, 2023

- SECURE 2.0 Act Changes Affecting Family Business Owners, by Homrich Berg. April, 2023

- Inheritance VS. Private Capital, by The Madison Group, February, 2023

- Impact of Supply Chain Disruptions in 2023, by USI Insurance Services, January, 2023

2022

- It’s All Relative; Family Matters in Business Succession, by Homrich Berg, December, 2022

- Is a For-Profit Family Office Right for You?, by Pathstone, November, 2022

- Reducing the Tax Impact on the Sale of Your Business, BNY Mellon Wealth Management, October, 2022

- Successful Succession Planning, by Whittier Trust, October, 2022

- Considerations on Establishing Family Governance, by Pathstone, September, 2022

- Envisioning Life After Your Family Business Succession, by Aspiriant, September, 2022

- Above the Line Planning, by The Madison Group, August, 2022

- How to Get the Most from Your Board, BNY Mellon Wealth Management, June, 2022

- A Proven Process for Recruiting and Retaining Top Family Enterprise Leadership Talent, by Mack International, June, 2022

- Private Placement Insurance Products, by The Madison Group, May, 2022

- 2022 Family Office Trends, by Pathstone, April, 2022

- Navigating “Company Value” in Times of Choppy Market Activity, MPI, April, 2022

- Considerations in Making a Gift of a Business Interest to a Public Charity, BNY Mellon Wealth Management, April, 2022

- An Opportunity to Save on Income Taxes, BNY Mellon Wealth Management, April, 2022

- From Generation to Generation, by Pathstone, February, 2022

2021

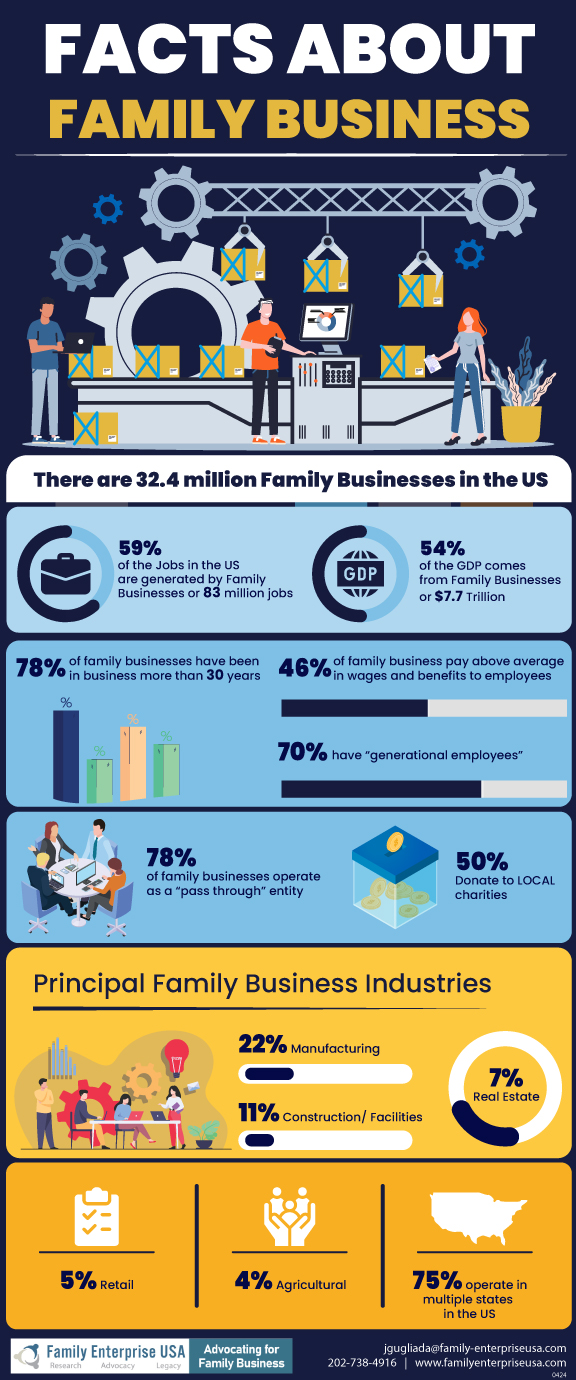

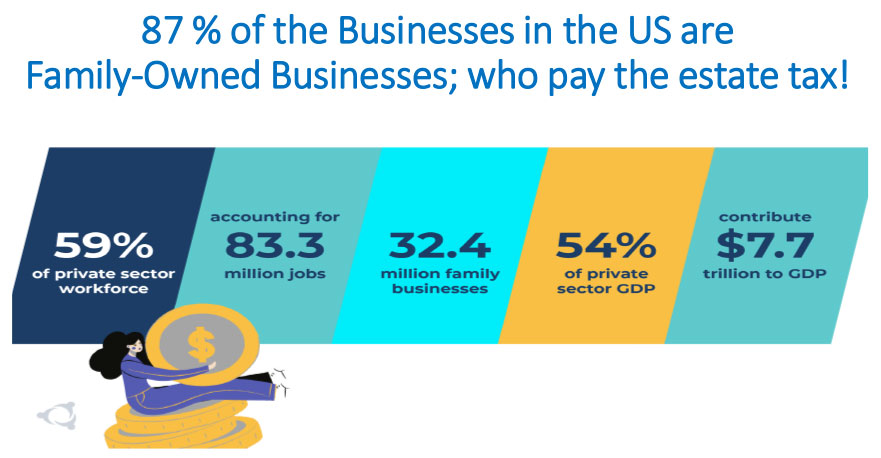

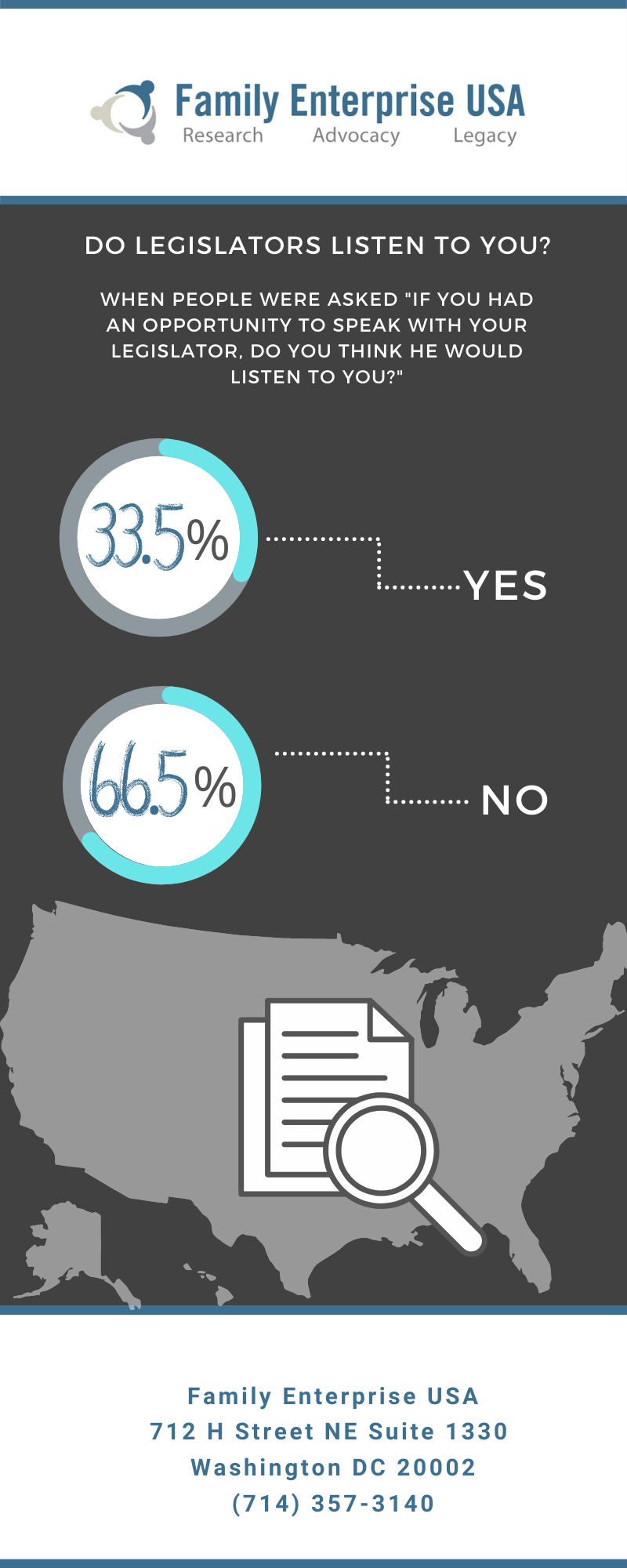

- 87% of the Businesses in the US – Policy and Taxation Group, May 2021

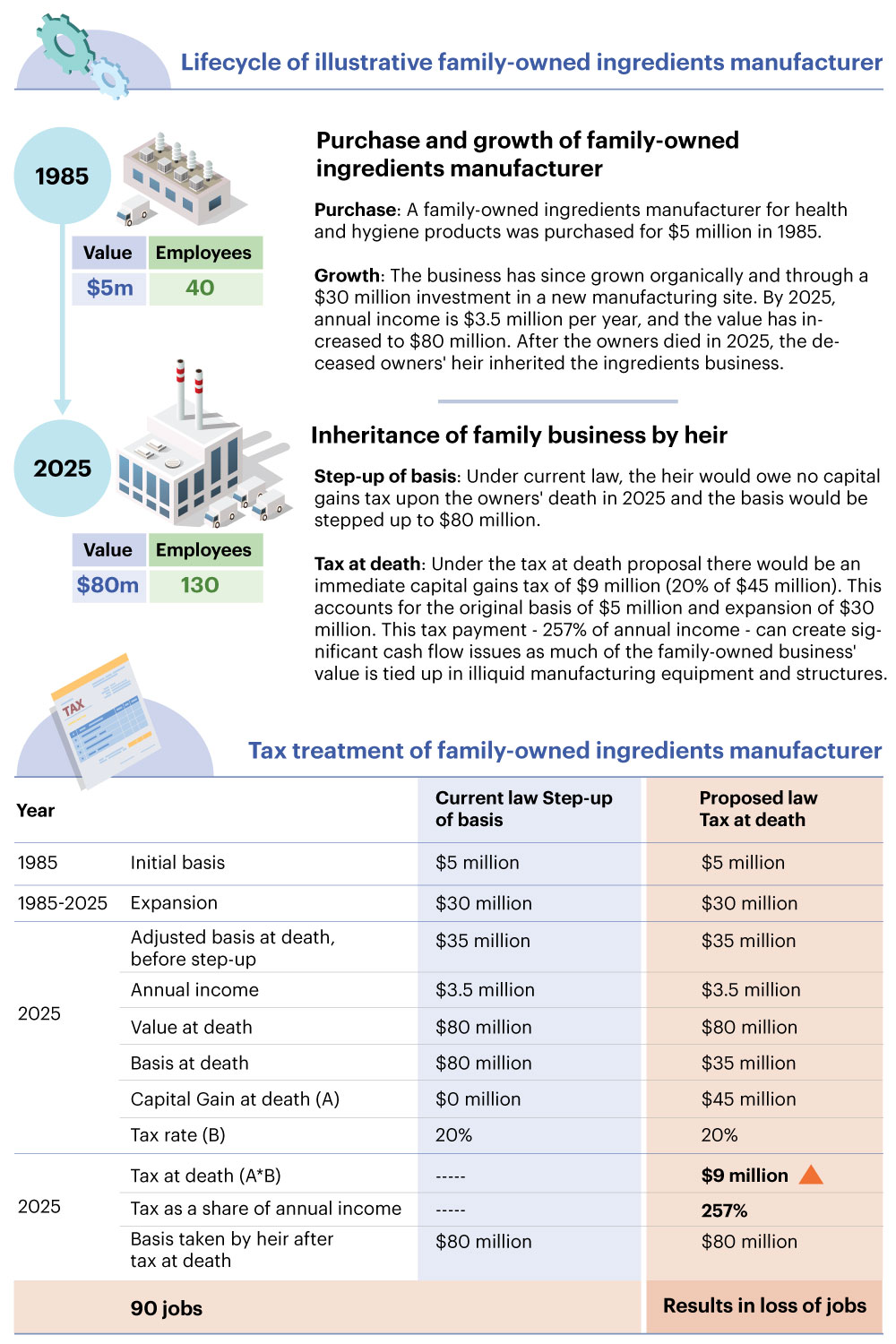

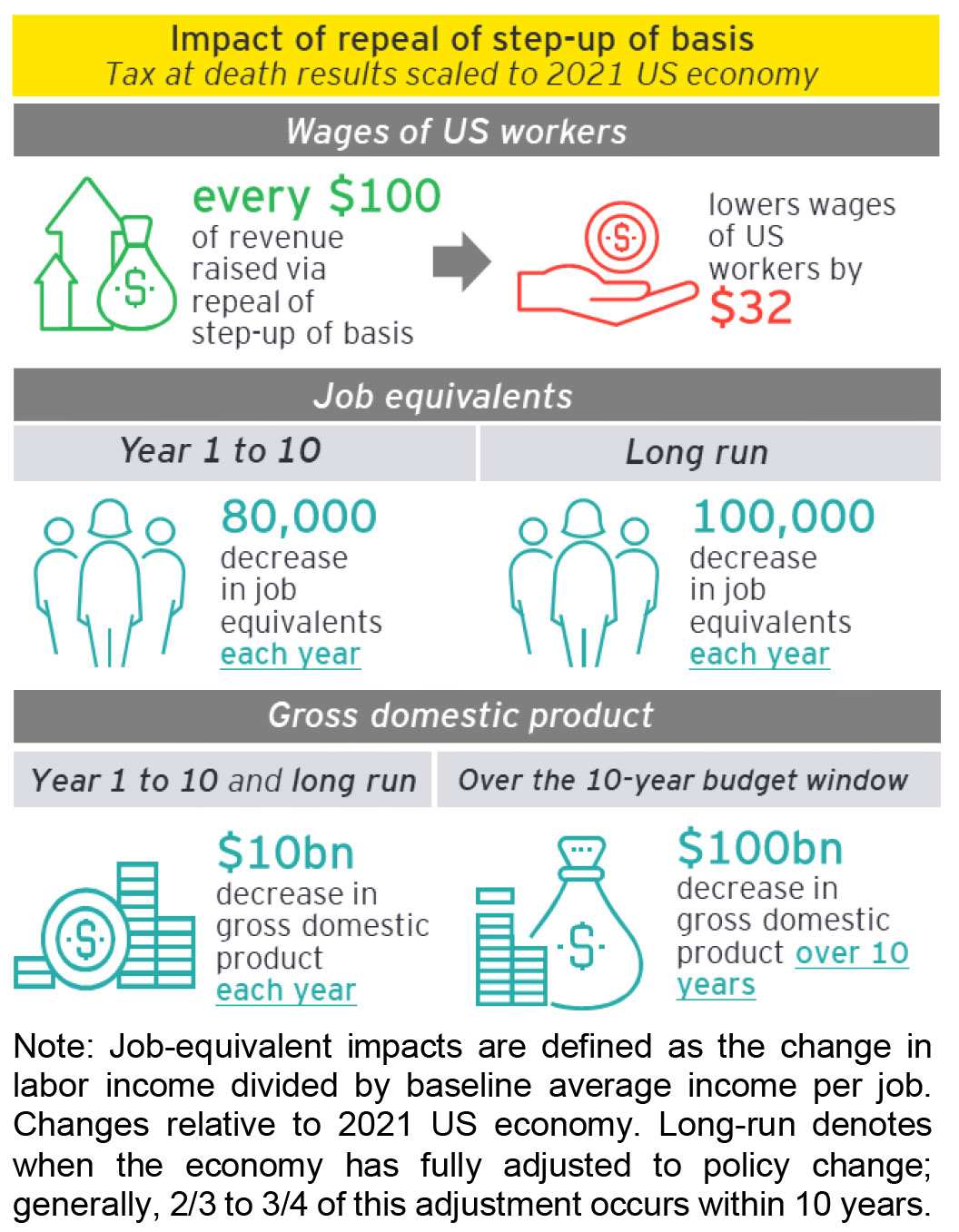

- Job Loss Example Due to Repeal of Step up on Basis – Policy and Taxation Group, May 2021

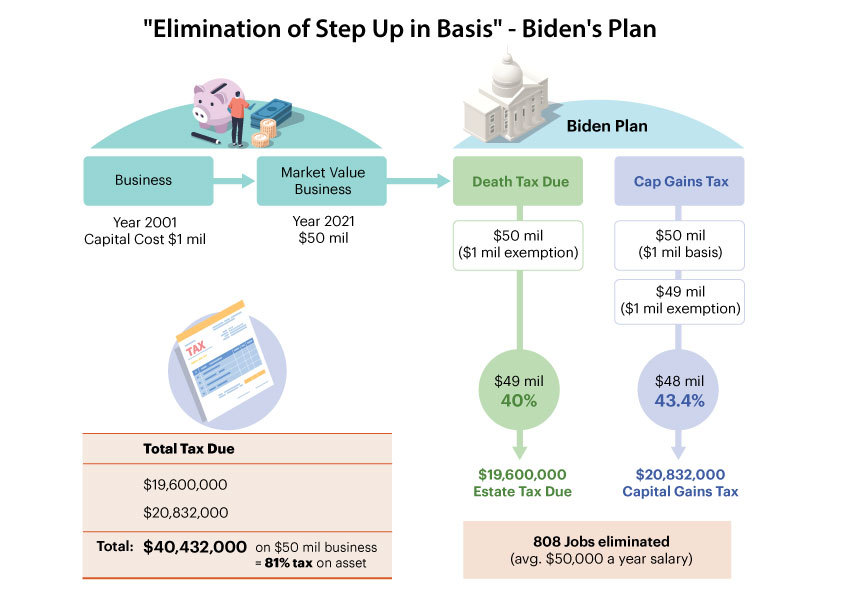

- Elimination of Step up of Basis – Policy and Taxation Group, May 2021

- Impact of Repeal of Step-up of Basis – Policy and Taxation Group, May 2021

- House Ways & Means Select Revenue Measures Subcommittee: “Funding Our Nation’s Priorities: Reforming the Tax Code’s Advantageous Treatment of the Wealthy” – by Squire Patton Boggs (U.S.) LLP, May 14, 2021

- Submission for May 12 House Ways and Means Hearing on Reforming the Tax Codes Advantageous Treatment of the Wealthy – by Policy and Taxation Group, May 12, 2021

- Estate Tax Rate Reduction Act One Pager – Policy and Taxation Group, May 2021

- Repealing step-up ofbasison inherited assets: Macroeconomic impacts and effects on illustrative family businesses – by Family Business Estate Tax Coalition(FBETC), April 2021

- An Inside Look at SevenFamily-Owned Businesses – by Patricia N. Soldano & Dawn S. Markowitz, March 2021

- The Importance of Family Businesses’ Contribution to the U.S. Economy – By Torsten M. Pieper, Franz W. Kellermanns, Joseph H. Astrachan & Nina Anique Hadeler, March 2021

- Update 2021: Family Businesses’ Contribution to the U.S. Economy – by Torsten M. Pieper, Ph.D. February 2021

2019

- Socialism Survey by Frank Luntz — June, 2019

2018

- Death Tax Election Night Polling by Frank Luntz — December, 2018

- Senator Kyl Again Seeks to Cut the Death Tax by FEUSA — November, 2018

- New IRS Data Reiterates Shortcomings of the Estate Tax by Scott Eastman – October, 2018

- Family Businesses; Jobs and Revenue Generated in the US by FEUSA— September, 2018

- Family Businesses; Charitable Giving; 2018 – May, 2018

- Update and Extend Earlier Estimates of Proposals to Modify The Estate, Gift and Generation-Skipping Transfer Taxes – March 28, 2018

2017

- Estate Tax Is Hurdle For Minority American Business Owners by Harry Alford – December, 2017

- Support for Death Tax Repeal by Frank Luntz – November, 2017

- Revenue Analysis Of Options to Reform The Federal Estate, Gift and Generation-Skipping Transfer Taxes by Quantria Strategies – September 2017

- As Congress debates repeal of estate tax, why not consider ending the gift tax? by Pat Soldano – June, 2017

- American Voter Attitudes On Estate, Gift, And Generation-Skipping Taxes – January 30, 2017

2016

- Killing the Death Tax Would Resurrect Growth by Stephen Entin – October, 2016

2014 and Earlier

- Frank Luntz Presentation on Women Voters – June 18, 2014

- Frank Luntz Presentation on Income Inequality & Taxes – January 28, 2014

- Impacts on Small Businesses and Families – September 2010

- How the Death Tax Kills Small Businesses, Communities—and Civil Society by Patrick Fagan – June, 2010

- Statement of Terry Neese: Distinguished fellow, National Center Of Policy Analysis Family Policy Center – November 4, 2009

- Let The Death Tax Rest In Peace – August 5, 2009

- Afro American Newspapers: Families need a permanent, certain fix of Estate Tax – April 26, 2006

- Death Tax Squeezes Smaller Companies – May 17, 2005

- Death Tax Chronicle – 2005

- Hispanic Family-Owned Business Interviews – June 1, 2004

- Family Businesses Contribution to the U.S. Economy_ A Closer Look by Joseph H. Astrachan and Melissa Carey Shanker — September, 2003

- The Effects on Government Revenues from Repealing the Federal Estate Tax and Limiting the Step-Up in Basis for Taxing Capital Gains – June 30, 2003

- Women & The Death Tax – April 2002

- The Death Tax & Gay and Lesbian Americans – April 24, 2002

- Post-Election Survey Results, Groundbreaking Data On The Efforts Of The Death Tax – November 27, 2000

- A Declaration Of Independence From Death Taxation: A Bipartisan View – July 2000

- Survey Of The Impact Of The Federal Estate Tax on NAWBO Member Businesses – February 23, 2000

- Policy Analysis: Grave Robbers, The Moral Case Against The Death Tax – October 4, 1999

- Family Businesses In The US Economy – 1998

- An Analysis Of The Descent Distance Into The Defects Of The Estate Tax On Entrepreneurship – June 1, 1994

- Federal Transfer Taxation: A Study In Social Cost – 1993