Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Analysis of Proposed Tax Regulations for “Pass-Through” Entities

The US Department of the Treasury and the IRS have released Proposed Regulations on Internal Revenue Code Section 199A, the 20% pass-through deduction designed to provide tax relief to pass-through businesses and proprietorships. The Proposed Regulations provide...

Plan To Attend September Policy and Taxation Group Dinner & Meeting

Wednesday, September 26, 2018 6:00pm Supporters and Members Dinner Acqua Al 2 212 7th Street SE Washington DC Thursday, September 27, 2018 10:00am-2:00pm Supporters and Members Meeting 20 F Street NW Conference Center; Washington, DC Speakers Frank Luntz Congressman...

Estate Tax Update August 2018

Chairman Brady intends to have the House address the 2018 Tax Bill 2.0 when they return from August recess; note that it will include making the estate tax life exemption doubling permanent. Click here for a brief recap of the legislation. Many meetings last week in...

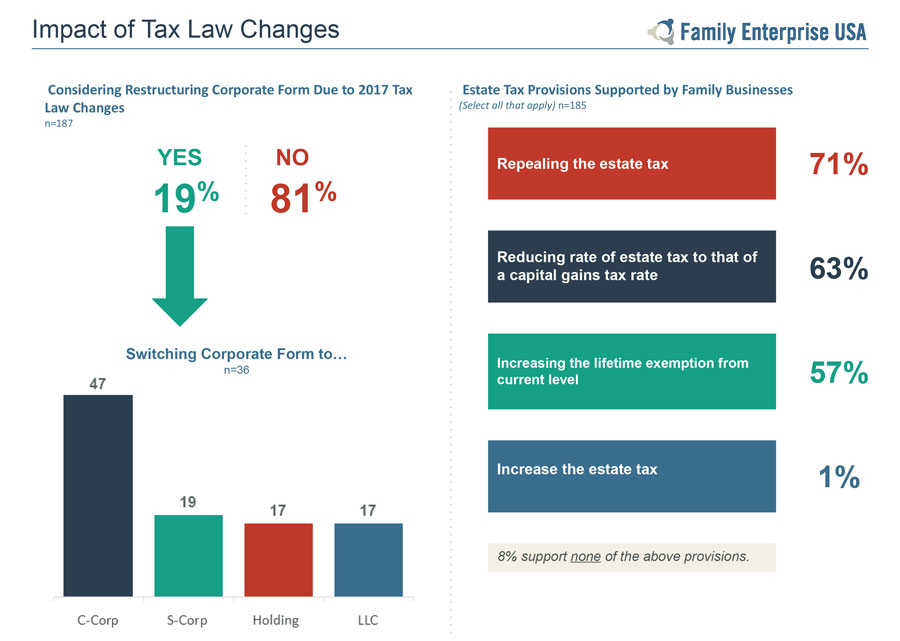

2018 Family Businesses Survey Commitments, Challenges, & Concerns

New Survey of Family Businesses Reveals Commitments, Challenges, & Concerns Ahead Family business are key drivers of economic development, but taxes and regulations hinder growth Two-thirds of participating business owners employed more than 50 employees in 2017;...

Nunes Introduces Bill to End Capital Gains Taxes on Inflation

Congressman Devin Nunes (CA-22) has introduced a bill in the House of Representatives to eliminate capital gains taxes on inflation. By ending this unfair tax, the Capital Gains Inflation Relief Act (H.R 6444) will encourage both individual and business investment...

SAVE THE DATE: Policy and Taxation Group Dinner & Meeting

Policy and Taxation Group Supporters Meeting When Thursday, September 27, 2018 from 10:00 AM to 2:00 PM EDT Where Washington D.C. TBD Would you like updates on our estate tax activities, discuss the status of estate tax repeal, the politics of repeal, and estate tax...

H.R. 6228 Would Permanently Increase Estate Tax & Gift Tax Exemption

Before leaving for last week’s Fourth of July Recess, Ways and Means Committee Member Rep. Kenny Marchant (R-TX) introduced H.R. 6228, which would permanently increase the estate and gift tax exemption from $5 million to $10 million. As we have previously reported,...

Anthony Timberlands

My personal view, for what is might be worth, is that lowering the corporate tax rate from the current 35% to 20% is too big a cut and unnecessary to serve the purpose intended. Certainly, a cut is needed, but just as certainly a reduction to 25% would provide the...

My Estate Tax Experience

June 13, 2018 My father started an aerospace component manufacturing business March 31, 1961 in Maywood, California. He started it by himself investing $7,500 dollars in the business. He hired one person. He struggled for 10 years before he finally made a profit. His...

Why White Castle Supports Repealing the Death Tax

As a family owned business for 97 years now, White Castle has learned a lot about what it takes to create an enterprise that’s sustainable and capable of nourishing our team members, and the communities where we live, work and raise our families. Along the way, not...

Family Operating 100 Hardware Stores

A family operating 100 hardware stores in the Midwest had to sell the business to a private equity firm in the 3rd generation of the family businesses. The family had already endured 2 generations of paying the estate tax and realized they could not survive another....

More Than One Bill in Tax Cut 2.0 Package

House Ways and Means Committee Chairman Kevin Brady (R-Texas) said that tax-cut legislation he hopes to unveil in August will include a package of bills, the centerpiece of which will be a proposal to make some individual and business tax cuts permanent. "I don't see...

Chairman Would Like The House Vote In July 2018

Chairman Kevin Brady has indicated that he would like the House to vote in July, on making all individual tax cuts permanent, which were included in last year’s tax bill. This would include the doubling of the lifetime exemption for gift, estate and...

State Death Tax Chart Update July 9, 2018

Revised July 9, 2018 PATG State Death Tax Chart - July 9, 2018 This chart is maintained for the Policy and Taxation Group Website and is updated regularly. Any comments on the chart or new developments that should be reflected on the chart may be sent to...

Chairman Brady Hopes to Have New Tax Bill by August to Pass in September or October

Politico: MARK YOUR CALENDARS: Might there be another tax vote in Congress around the time fall rolls in? House Ways and Means Chairman Kevin Brady said on Tuesday that he hopes the GOP can have a new tax bill introduced by the time Congress leaves for its August...

The Politics Of It All. Minneapolis Luncheon and Discussion

TAX POLICY: THE POLITICS OF IT ALL Last year was a historic year for tax reform with the "Tax Cuts and Jobs Act of 2017". Families and their businesses were helped and hurt at the same time. Over the years, tax law has changed many times due to various factors; wars,...

White House Plans to Release Phase 2 Tax Package by Summer’s End

I wanted to share the below that was published by Tax Notes on Friday, May 25th, 2018. The White House is working with House and Senate tax writers to draft a second phase of tax cuts, with the goal of unveiling a legislative package before the summer is out, a top...

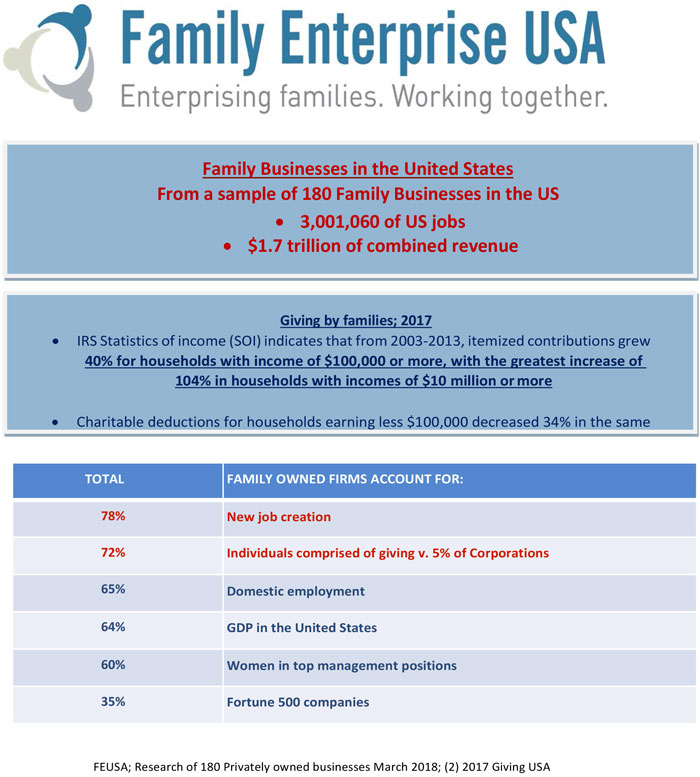

Family Businesses; Jobs, Economic Growth and Charitable Giving

Policy And Taxation Group Visits The Hill May 2018

Photos from a recent visit to The Hill by Policy And Taxation Group to talk about the estate tax and the impact on family businesses.

Jobs and Opportunity: Legislative Options to Address the Jobs Gap

The Honorable Adrian Smith U.S. Congressman, Third District of Nebraska Chairman, House Ways and Means Human Resources Subcommittee 1102 Longworth House Office Building Washington, DC 20515 Dear Chairman Smith, I write to you on behalf of the Policy and Taxation...

Family Businesses – Jobs, Economic Activity and Charity

Family Businesses in the United States Giving by Families; 2017 Individuals comprised 72% of giving; Corporation’s comprise 5% of giving (2) IRS Statistics of Income (SOI) data indicates that from 2003 to 2013 itemized contributions grew 40% for households with income...

Estate Tax Repeal And Impact Discussion

Policy & Taxation Group invites you to attend a reception and discussion hosted by Don and Greg Root. Last year was a historic year for tax reform with the "Tax Cuts and Jobs Act of 2017". Families and their businesses were simultaneously helped and hurt. Over the...

HR 5422 Death Tax Repeal Bill Introduced

As you know, with Rep. Kristi Noem (R-SD) running for Governor of South Dakota, we need a new champion for our issue in the House. To that end, House Ways and Means Committee Chairman Kevin Brady (R-TX) has tapped Rep. Jason Smith (R-MO) to continue leading the fight...

Update and Extend Earlier Estimates of Proposals to Modify The Estate Tax

Update and Extend Earlier Estimates of Proposals to Modify The Estate, Gift and Generation Skipping Transfer Taxes In this memorandum we update and extend our earlier estimates of three (3) proposals to modify the existing estate, gift and generation skipping transfer...

Individual Tax Cut Extension to Get Vote This Year, Ryan Says

By Anna Edgerton; Bloomberg BNA The House will hold a vote this year to make individual tax cuts permanent, according to House Speaker Paul Ryan, even though the effort is unlikely to become law during this Congress. The speaker's comments signal the GOP is plowing...

Get Estate Tax Relief Updates

Since it is possible that additional estate tax "relief" may be possible this year, and unlikely that we'll see total "repeal", PATG has drafted "Rate Reduction legislation" and are working with champions in the House and the Senate to get it introduced. Would you...

Estate Tax Rate Reduction Legislation

Since it is possible that additional estate tax "relief" may be possible this year, and unlikely that we'll see total "repeal", PATG has drafted "Rate Reduction legislation" and are working with champions in the House and the Senate to get it introduced. You can see...

Tax Cuts, Round 2 In 2018

Tax cuts, Round 2: GOP looks to punish Democrats in 2018 POLITICO Magazine By BURGESS EVERETT and RACHAEL BADE - 03/27/2018 06:08 PM EDT "It's the tax pony, and that's the only horse they have to ride," says one top Democrat. Read the full story Thank you for your...

Chairman Brady Announces Intention To Have Another Tax Bill In 2018

Just in case you missed it; In the House Ways and Means Subcommittee Tax Policy Subcommittee Hearing last week, Chairman Brady acknowledged that Republicans are working on a second round of tax cuts to be unveiled later this year. Though the Chairman did not indicate...

State Death Tax Chart Update March 18, 2018

Revised March 18, 2018 PATG State Death Tax Chart - March 18, 2018 This chart is maintained for the Policy and Taxation Group Website and is updated regularly. Any comments on the chart or new developments that should be reflected on the chart may be sent to...