Sep 2, 2018 | Blog, Death Tax, Estate Tax

The US Department of the Treasury and the IRS have released Proposed Regulations on Internal Revenue Code Section 199A, the 20% pass-through deduction designed to provide tax relief to pass-through businesses and proprietorships. The Proposed Regulations provide...

Jul 24, 2018 | Blog, Family Businesses, Family Enterprise USA

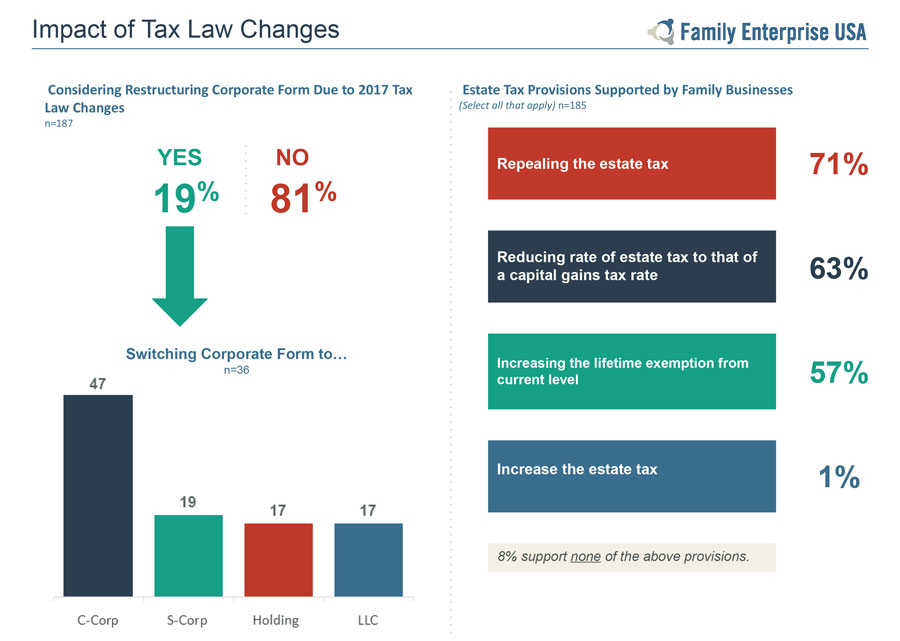

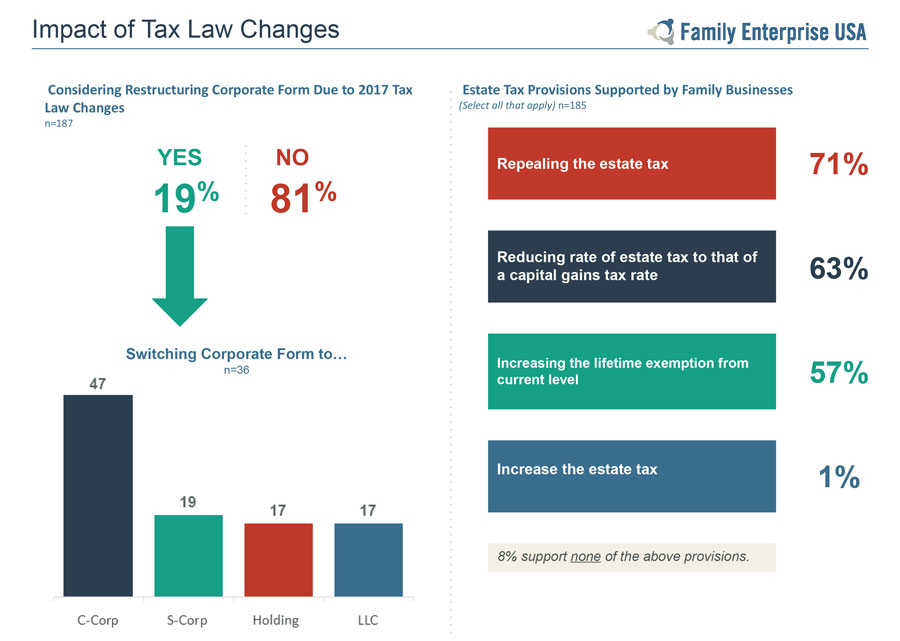

New Survey of Family Businesses Reveals Commitments, Challenges, & Concerns Ahead Family business are key drivers of economic development, but taxes and regulations hinder growth Two-thirds of participating business owners employed more than 50 employees in 2017;...

Jul 9, 2018 | Blog, Estate Tax, Tax Cuts

Before leaving for last week’s Fourth of July Recess, Ways and Means Committee Member Rep. Kenny Marchant (R-TX) introduced H.R. 6228, which would permanently increase the estate and gift tax exemption from $5 million to $10 million. As we have previously reported,...

Jul 5, 2018 | Arkansas, Blog, Estate Tax Horror Stories, Family Businesses

My personal view, for what is might be worth, is that lowering the corporate tax rate from the current 35% to 20% is too big a cut and unnecessary to serve the purpose intended. Certainly, a cut is needed, but just as certainly a reduction to 25% would provide the...

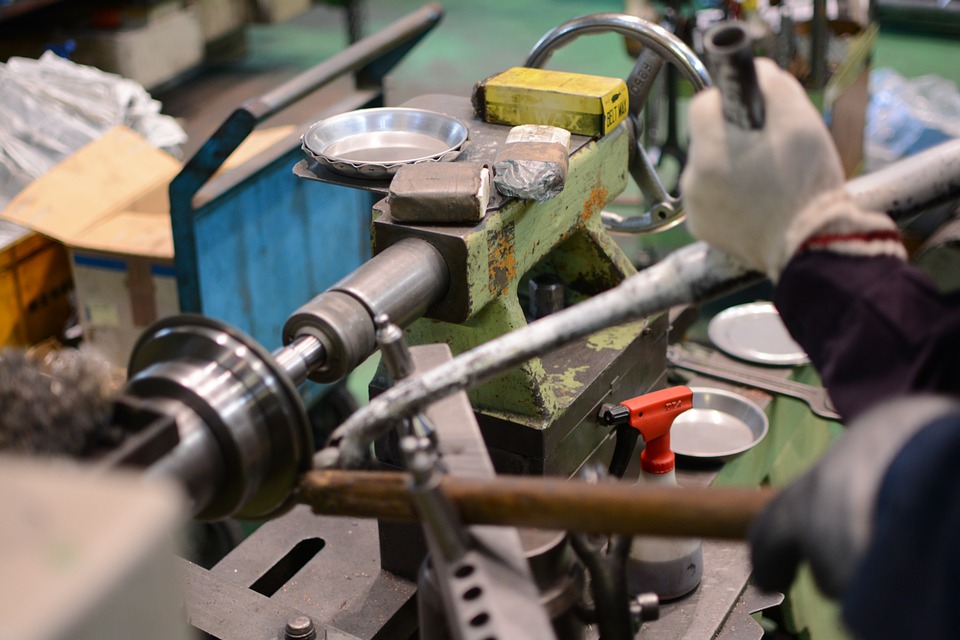

Jul 4, 2018 | Blog, California, Estate Tax Horror Stories, Family Businesses

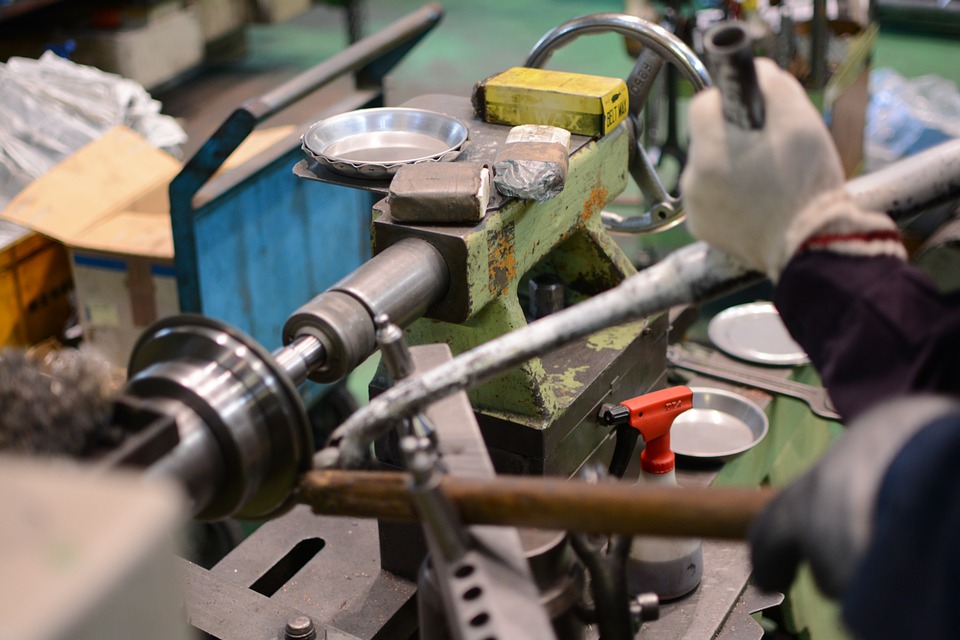

June 13, 2018 My father started an aerospace component manufacturing business March 31, 1961 in Maywood, California. He started it by himself investing $7,500 dollars in the business. He hired one person. He struggled for 10 years before he finally made a profit. His...

Jul 3, 2018 | Blog, Estate Tax Horror Stories, Illinois

As a family owned business for 97 years now, White Castle has learned a lot about what it takes to create an enterprise that’s sustainable and capable of nourishing our team members, and the communities where we live, work and raise our families. Along the way, not...