Mar 26, 2019 | Blog, Death Tax, Estate Tax, Family Businesses, Family Enterprise USA, Policy And Taxation Group

A MESSAGE FROM OUR FOUNDER – Pat Soldano I am contacting you to request your help in reaching business-owning families and asking them to complete the 2019 Family Enterprise USA survey. To access the short, online survey, the link...

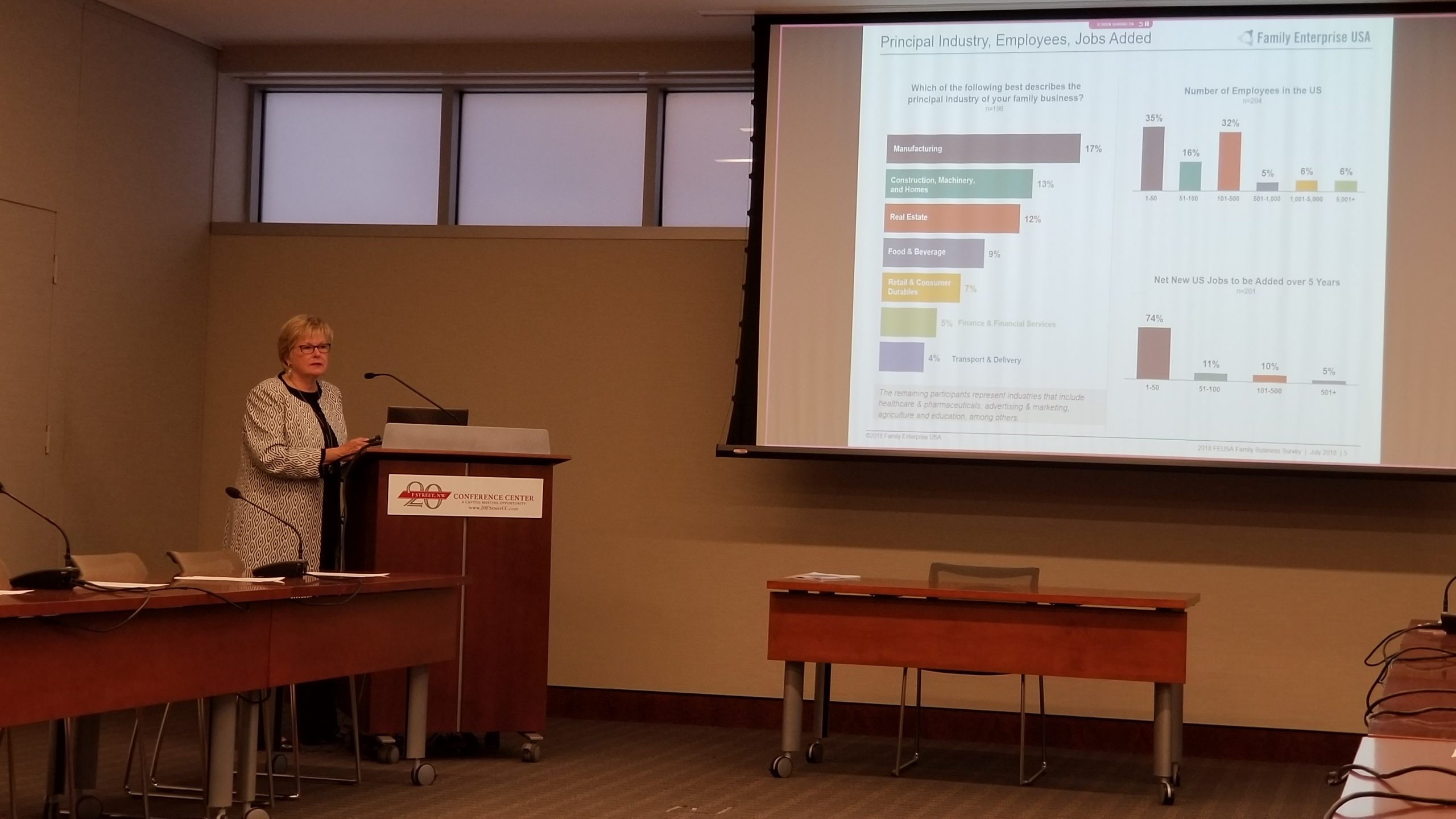

Oct 5, 2018 | Family Enterprise USA, Policy And Taxation Group

Below is a summary of the PATG-FEUSA Supporters and Members Meeting held on September 27, 2018. I opened the meeting by pointing out that after enactment of tax reform last year – which included a temporary doubling of the estate tax exemption – we had anticipated a...