Below is a summary of the PATG-FEUSA Supporters and Members Meeting held on September 27, 2018.

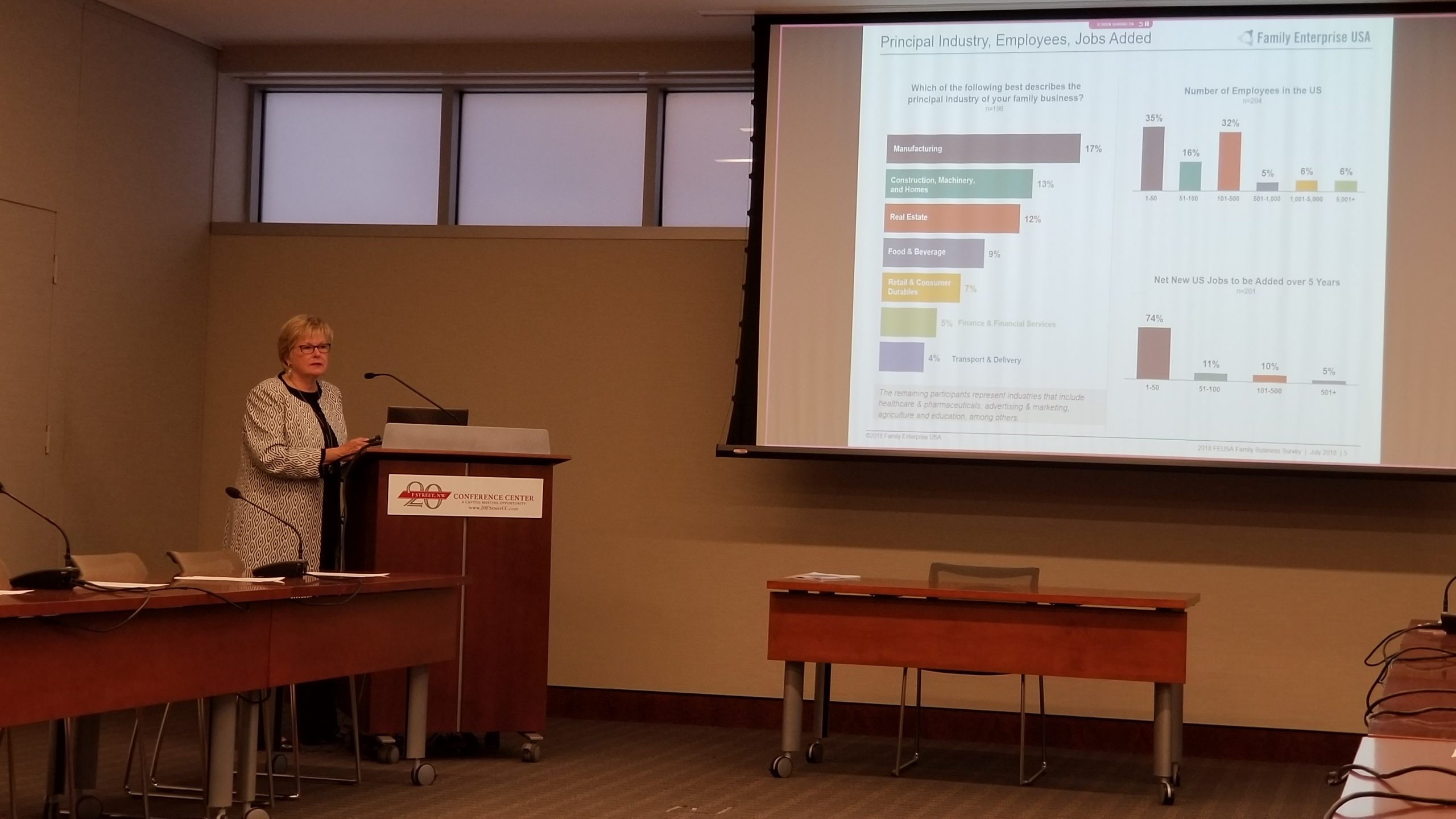

I opened the meeting by pointing out that after enactment of tax reform last year – which included a temporary doubling of the estate tax exemption – we had anticipated a less busy 2018; that has not been the case. PATG has been active this year advocating for a reduction in the rate of the estate tax that would be tied to capital gains. We continue to search for sponsors of our legislation, with the goal of seeing a bill introduced before the end of the year. I also discussed the results of FEUSA’s survey, which shows that estate tax reform remains a top priority for family-owned businesses. Lastly, I discussed my intention to transition out of my role next year and my commitment to work with the board to find an appropriate successor.

Former Congressman Jack Kingston (R-GA) – who is currently a principal at Squire Patton Boggs – shared with us the importance of getting our message through to Congress and the Administration and provided his three C’s to do so: contribute, campaign, and candidate. First, he emphasized the importance of making contributions to candidates that support our efforts. In addition to having supportive policymakers in office, it also provides an opportunity to have “off-campus” interactions that are impactful. Second, Congressman Kingston suggested that our supporters volunteer for campaigns as part of our efforts to ensure that we have a supportive political environment. Third, he urged supporters with interest to run for office, as there is a need for policymakers in Washington who understand our issue.

Next, Congressman Warren Davidson (R-OH) provided an overview of ongoing tax reform efforts, which include further reforms to the estate tax – with the ultimate goal being full repeal. He also discussed the need to find a compromise on the next phase of estate tax reform given the current makeup of Congress. As such, he remains supportive of our rate reduction bill and plans to reassess how to proceed with the legislation following the November mid-term Elections, as this will allow a “tactical pause” to build support with Democrats and strategically assess the political landscape to expect in the next Congress.

Jeff Forbes of Forbes-Tate and Russ Sullivan of Brownstein Hyatt Farber Schreck then discussed the shift in the political landscape over the last 20 years and the growing ideological gap between Republicans and Democrats, which has made estate tax reform a more challenging effort. They indicated that there is no need to negotiate against ourselves in pursuing reforms but suggested that we need to be creative in our efforts if we are to be successful. For example, they offered that identifying a “pay for” to offset the cost of our rate reduction legislation could be helpful.

Next, Aubrey Rothrock of Squire Patton Boggs provided an overview of PATG’s work on estate tax repeal and rate reduction. While the score of full repeal was a hurdle that we were ultimately not able to overcome, he noted that the exemption increase indexed to inflation is nonetheless a win. He also stressed the importance of the Administration undoing the Sec. 2704 regulations. That said, Aubrey also made clear that we must remain vigilant if Democrats take back control of one or both branches of government next Congress; since some of them have indicated they would roll back the doubling of the lifetime exemption. As part of our strategy, he echoed Congressman Davidson’s point that pursuing rate reduction without bipartisan support could weaken our position going forward.

Chris Campbell, former Assistant Secretary of the Treasury, then discussed potential obstacles to further reforming the estate tax. Though the Administration remains supportive of estate tax reform, the changing political dynamic and likely shift in control of Congress next year could complicate our efforts. Thus, similar to other presenters, he underscored the need for bipartisan support – something he thinks could be achieved by helping to take control of the messaging around the estate tax. Chris also suggested that finding a way to pay for reform could improve our chances for success.

We then heard from Frank Luntz of Luntz Global, who discussed the current political and public affairs landscape in Washington and what that means for estate tax reform. Like others, he is concerned about the polarization of both parties and the country. Frank also indicated that 58% of individuals from ages 17 to 29 think. Socialism is better than Capitalism; a disturbing statistic. PATG plans to engage Frank Luntz to do an election night poll and will be requesting special funds from Supporters to do so.

To conclude, Thomas Sanchez, CEO of Social Driver, provided an overview of our social media campaign. Our campaign – “Ditch the Estate Tax” – currently uses Facebook and Twitter to push out content aimed at changing people’s minds about estate tax reform and encouraging them to engage with policymakers to increase support for our efforts. Here is a link to our most-recent report from Social Driver, which provides an overview of our social media campaign results.

As always, thank you for your support.