Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

VIDEO: Election 2020 – Presidential Candidates’ Positions on Estate and Wealth Tax Policies

Election 2020 - Presidential Candidates' Positions on Estate and Wealth Tax Policies [button...

VIDEO: Election 2020 – Safety and Healthy Workplace Tax Credit

Election 2020 - Safety and Healthy Workplace Tax Credit [button link="https://policyandtaxationgroup.com/donate/"...

VIDEO: Corporate Transparency Act

The Corporate Transparency Act will create significant privacy concerns for families, family businesses, and family...

VIDEO: Pass Through and Small Business Legislation Under Trump or Biden

https://youtu.be/Qq7z7qVfAAw Pass Through and Small Business Legislation Under President Trump or former Vice...

VIDEO: Pass Through and Small Business Legislation Under Trump or Biden

https://youtu.be/Qq7z7qVfAAw Pass Through and Small Business Legislation Under President Trump or former Vice...

Status Of The November Election, Potential Tax Policy Opportunities, and Additional COVID-19 Relief Legislation

Pat Soldano welcomed supporters to the call and provided an overview of the topics to be discussed: the status of the November Election, potential tax policy opportunities, and additional COVID-19 relief legislation as well as an update on the activities of Policy and...

C&S Provides PTO, Bonuses To Employees For Covid-19 Challenges

Keene, New Hampshire-based C&S Wholesale Grocers Inc., the largest wholesale grocery supply company in the U.S., said it will provide frontline workers with a special appreciation bonus and all employees with additional paid time off (PTO), among other benefits...

Publix deploys contactless payment for extra COVID-19 safety

Publix Super Markets expects to complete the rollout of contactless payment to all of its more than 1,200 stores in the Southeast. Lakeland, Fla.-based Publix said yesterday the deployment provides an extra safety measure for customers and store associates amid the...

IRS Clarifies Payroll Tax Deferral Is at Employer’s Discretion

During an Internal Revenue Service monthly payroll teleconference today, Kelly Morrison-Lee, an agency attorney, confirmed that the payroll tax deferral is optional at the discretion of the employer. This confirms that employers, not employees, have the choice of...

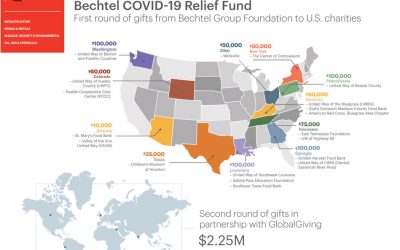

Bechtel Group Foundation Establishes Bechtel COVID-19 Relief Fund in Partnership with GlobalGiving

The Bechtel Group Foundation will donate $3 million to communities across the world coping with the coronavirus pandemic, in partnership with the crowdfunding nonprofit GlobalGiving. The newly established Bechtel COVID-19 Relief Fund will support local nonprofit...

Tyson Foods adopts weekly coronavirus testing for workers

Tyson Foods is launching weekly on-site coronavirus testing for employees at all 140 of its U.S. production facilities, making it one of the first major American employers to commit to such regular and expansive testing of its workforce. The food conglomerate behind...

This Is The Problem With Life Insurance As A Solution To The Estate Tax Issue

Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families to...

Lee Company pivots to aid ventilator-making effort

As General Motors and other companies push to make ventilators to help COVID-19 patients streaming into U.S. hospitals, the Lee Company of Westbrook, Conn., has adjusted its systems to join the effort. The family company, founded in 1948, makes miniature hydraulic...

This approach helps e-commerce company thrive during COVID

It’s a good time to be in the e-commerce business – but not exactly an easy time. “We didn’t think a global pandemic would be good for e-commerce, but it’s been fantastic for our business,” said Eric Weisser, senior vice president and majority owner of Weisser...

Ford Will Provide COVID-19 Testing for Employees As Plants Reopen

Symptomatic employees in Michigan, Kentucky, Missouri and Illinois will be tested at area healthcare facilities in order to get results within 24 hours. Ford announced on May 16 that it had signed contracts with health systems in four metro areas with major company...

Comcast employees reactivate their service to aid in COVID-19 response

In the midst of the COVID-19 surge in the United States, help has been needed across many fronts as the nation deals with an unprecedented pandemic. This year’s NASCAR Salutes Refreshed by Coca-Cola program is more than just a military appreciation platform – it’s a...

President Trump’s Aug. 8 Tax Executive Orders

On Saturday, Aug. 8, 2020, President Donald Trump signed four executive orders (EO) to defer payroll taxes, set up an assistance program for lost wages to supplement unemployment benefits, extend the federal moratorium on evictions and defer student loan payments....

News Corp campaign thanks front-line retail staff for their work during COVID-19

Newsagents, and supermarkets, convenience stores, and petrol station staff are among the front-line worker's News Corp thanks in its latest print campaign. The ‘Thank You’ campaign launches today across the company’s regional and metro newspapers and will run for a...

Walmart is considering testing its employees for the novel coronavirus and COVID-19 antibodies

Walmart CEO Doug McMillon said Tuesday that the company is considering implementing employee testing for the novel coronavirus. Walmart's testing approach could include diagnostic tests to confirm COVID-19 infections in employees, as well as antibody testing to...

Saturno and Plimpton Join The Board of Directors of Family Enterprise USA

Lex Saturno Fourth Generation Mckee Foods; McKee Foods (makers of Little Debbie, Drakes and Sunbelt Bakery) and David Plimpton, Chairman, CEO and President of Inolex, joins the Board of Directors of Family Enterprise USA “Our Board of Directors is comprised of a...

HEALS Act Safe and Healthy Workplace Tax Credit Guide for Employers

The July 27, 2020, Senate draft of the Health, Economic Assistance, Liability Protection and Schools (“HEALS”) Act provides a tax credit for employers who incur certain expenses in response to COVID-19. Referred to as the Safe and Healthy Workplace Tax Credit...

HEALS Act Comparison to HEROES Act and Current Law

On Monday, July 27, Senate Majority Leader Mitch McConnell (R-KY) released the Health, Economic Assistance, Liability and Schools (HEALS) Act—a $1 trillion stimulus package in response to the ongoing effects of the COVID-19 pandemic. In addition to our initial...

Family Business Report Presented to BNY Mellon Wealth Management Group

The 2020 Family Business Report was presented to BNY Mellon Wealth Management’s National Private Business Advisory practice group, which consists of over 100 advisors across the organization who specialize in advising private business owners and their advisors through...

Survey of Family Enterprises Reveals COVID-19 Is Still a Big Concern

A recent survey, the 2020 Family Enterprise USA Family Business Survey of family businesses (conducted between late and January and mid-April of this year), found that they’re remaining somewhat optimistic about their future despite an unprecedented first quarter due...

When cupcakes met COVID: How one family business pivoted to sweet success

Inspiration had struck, and Melissa Johnson was going with it. “As I’ve grown older, I can’t say I’ve necessarily grown wiser. I know there is a whole lot I don’t know,” she wrote in a Facebook post one recent Friday. “The only thing I know for sure is that an act of...

Business is ‘popping’ during the pandemic for fifth-generation popcorn company

As soon as people nationwide began staying home to prevent the spread of COVID-19, they began watching movies. And then, they started popping popcorn. That has been a bright spot amid the pandemic for JOLLY TIME Pop Corn, a century-old family business based in Sioux...

Trump Visits Guilford, Maine to Thank Puritan Employees

June 5, 2020 – President Trump visited Guilford, Maine today, and toured the Puritan Medical Products headquarters. During his remarks, the President championed his Administration’s use of the Defense Production Act to bolster American manufacturing capabilities and...

Mother-daughter team draws on ‘wealth of experience’ to help clients through uncertain times

With nearly three decades of financial advising behind her, Mary J. Howard knows a lot about helping others navigate uncertainty and plan for the future. Her daughter, Megan, is now learning the same alongside her as their team has been working closely with clients to...

Family business owners weigh in on taxes, regulation

Family Enterprise USA’s 2020 survey sheds light on factors that family business owners see as obstacles to growth. Legislators must know what is important to family business owners — what helps or hurts them when it comes to operating their businesses and creating...

State News – Illinois

Hawaii Taxes could rise on high-end real estate on the island of Hawaii Illinois The top Republicans in the Illinois legislature are pushing for a vote that would remove from the November ballot a measure that would allow for a progressive income...