Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Hiring: Director, Business Development Non- Profit

FEUSA, 501 (C)(3), Family Enterprise USA, (FEUSA) is THE organization that represents all family businesses on a national level in DC. FEUSA is different from other organizations; it represents and advocates for the families of family businesses and the issues, they...

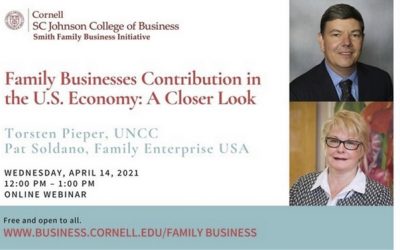

Connected Conversations – Family Businesses Contribution to the U.S. Economy: A Closer Look on April 14

You are invited to the next Connected Conversations - Family Businesses Contribution to the U.S. Economy: A Closer Look, on Wednesday, April 14 at 12:00 EDT. We have all been asking for these updated research numbers, and here they are finally. A quarter of a century...

Labor Updates From Washington, D.C.

Thank you to Brandon Roman and the team at Squire Patton Boggs (US) LLP for this report. Biden Administration Labor Leadership Update On Monday, March 22, the Senate voted 68 to 29 to confirm Mayor Marty Walsh as the next Secretary of Labor. He is the last...

Tax and Financial Services Week Ahead

Thank you to Russ Sullivan and the team at Brownstein Hyatt Farber Schreck LLP for this report.Over The Weekend Now that the American Rescue Plan (P.L.117-2) has been enacted, lawmakers are pivoting to consider economic recovery legislation. Up first in House will be...

A Tough Road Ahead for Democrats’ Ambitious Policy Agenda

Thank you to Russ Sullivan and the team at Brownstein Hyatt Farber Schreck LLP for this report.President Joe Biden campaigned on a promise to address income inequality and ensure that corporations, especially those that offshore jobs, pay their fair share. Biden now...

Hydraflow: Operating Business During Pandemic

We sent out our first memo regarding COVID-19 government recommendations on March 11 to employees. Then there were a rapid series of emails because the government recommendations kept changing. On March 27 we divided Hydraflow in 4 sections and people were not...

Colette’s Catering: Managing Business During Pandemic

Early March or late February, we began to get the postponement and cancellation calls for our upcoming catering events and weddings. Many would postpone and reschedule, more than once even, but not all. Some just wanted us to give back their full deposits, and we had...

Loutech: Dealing with COVID-19

The unraveling of the economy was not in the plans for Loutech in So Cal. We thought we would be bringing our machining capacity to at least 95% from the existing 75%, improving our Quality system, and building our 100+ strong workforce. Instead, we found ourselves...

Root Family of Florida and COVID-19

Our 120 year old family business operates a commercial real estate business with a staff of 13 in our offices. Our approximately 50 tenants employ 1000’s of people, jobs, lives that depend on us. From grocery baggers to Fortune 500 CEO’s. Every possible employment...

Pomerleau Real Estate Supports Local Community During COVID19

We placed local ads….”support local business”/ thank you ads and inspirational…not only good to community to see, but helps local newspapers who are getting killed with no advertising. Also doing stories on non profits organizations that need business and survive on...

Give a Voice to Family Business Concerns

We are reaching out for assistance for the Family Enterprise USA, (FEUSA) Annual Family Business Survey. All survey responses are completely confidential. The 2021 FEUSA Family Business survey takes just a few minutes and it is anonymous.For over 10 years we have...

Ways and Means Releases Budget Reconciliation Text

Thank you to Russ Sullivan and the team at Brownstein Hyatt Farber Schreck LLP for this report.The House Ways and Means Committee released legislative text for its portion of the COVID-19 relief package both chambers have begun advancing through the budget...

Tax and Financial Services Week Ahead

Thank you to Russ Sullivan and the team at Brownstein Hyatt Farber Schreck LLP for this report.Over the Weekend Appearing on the Sunday talk shows, Treasury Secretary Janet Yellen advocated for President Biden’s American Rescue Plan partially in response to...

Analysis of Legislative/Administrative Developments in the 117th Congress

President Biden was sworn in as the 46th President of the United States on January 20 and quickly issued a series of Executive Orders and signed memoranda. Prior to taking office, the President-elect had released legislative proposals on comprehensive immigration...

Taxation & Representation

TAX TIDBIT Advancing the Biden Tax Policy Agenda. With Jon Ossoff and Raphael Warnock winning both Senate runoff elections in Georgia last week, the Senate will be evenly divided 50-50 this Congress. A newly sworn-in Vice President Kamala Harris will give Democrats...

January 28th Members Call Recap

Pat Soldano welcomed Supporters to the call, which focused on opportunities and challenges for family businesses as well as the estate tax repeal/reduction efforts in the 117th Congress. First, Frank Luntz (FILuntz, Inc) discussed the results of his new survey, which...

Join Us for the First 2021 Supporters Call on January 28th

Hear Frank Luntz talk about what the US will look like in the 117th session of Congress. Brandon Roman of Squire Patton Boggs, Russ Sullivan of Brownstein Hyatt, Farber Schreck, and Senator Mark Pryor (D) speak on possible 117th legislative agenda issues. Other...

Summary of COVID-19 Relief Provisions Relevant to Local Governments

On Sunday, December 27, President Trump signed into law a nearly 6,000-page end-of-year legislative package that included 12 FY 2021 spending bills totaling $1.4 trillion, a $908 billion COVID-19 relief package, the Water Resources Development Act (WRDA), and an...

Family Office Outlook 2021 Silicon Valley / Virtual Forum

We are pleased to tell you about an upcoming virtual luncheon with a focus on family business at which I am speaking. "Family Office Outlook 2021" Silicon Valley / Virtual Forum will be held on January 12th-13th from 8 a.m. until 5:00 p.m. Pacific Time. The agenda is...

#FamilyFirst webcast with Pat Soldano

Join Family Advisor and Performance Coach Dr. Jeremy Lurey in this intimate conversation with Pat Soldano of Family Enterprise USA as they discuss "What Successful Families Need to Know for 2021 & the New Administration." You don’t want to miss their rich dialogue...

A Family Business Tragedy

Many members of Congress do not believe that family businesses are sold to pay the estate tax or suffer economically. Family members suffer, employees lose jobs, and the local community loses the charitable giving from the business. Read the story of Anthony...

Congress Passes Omnibus, COVID-19 Relief

On Dec. 20, the House and Senate passed H.R. 133, The Consolidated Appropriations Act of 2021. The bill includes a $900 comprehensive package to provide COVID-19 relief to businesses and individuals, including a second round of Paycheck Protection Program (PPP) loans...

Taxation & Representation

TAX TIDBIT: Who Will Lead OIRA Under Biden? President-elect Joe Biden selected a host of economic experts to serve in top advisory roles early last week. If confirmed, the nominees will hold key positions in the Treasury Department, Council of Economic Advisers and...

IRS Releases Priority Guidance Plan

On Nov. 17, the Treasury Department and the Internal Revenue Service (IRS) released the agency’s initial 2020-2021 Priority Guidance Plan (PGP), which will serve as a blueprint for forthcoming regulatory guidance from the agency between July 1 and June 30, 2021. The...

Alan Hirschfeld joins the Board of Directors of Policy and Taxation Group

Alan Hirschfeld joins the Board of Directors of Policy and Taxation GroupAlan H. Hirschfeld is General Counsel of TFMG Associates, LLC, a family office in New York that serves four generations. Prior to joining TFMG, Mr. Hirschfeld served as the Senior Fiduciary...

Results of FEUSA 2020 COVID- 19 survey and impact on Family Businesses

Here is a recap of the family business responses to the COVID-19 survey that was sent out by FEUSA over the last 6 weeks. This is very helpful information that will be shared with Members of Congress in this session of Congress during the Lame Duck and next session of...

VIDEO: Watch 6-minute video with Pat Soldano; “Tax Legislation Issues for Family Businesses”

Family Business Magazine asked Pat Soldano to speak about tax Legislation Issues that family businesses are facing, including possible COVID 19 legislation during this Congress or the next. Watch this 6-minute video to get a brief update. [button...

2020 Election Results and Key Dates to Watch

The Day After the 2020 Elections - Post-Election Analysis and Outlook An election that was thought by many pollsters to be all but over for Republicans turned out quite differently Tuesday, as races in key states remain too close to call. Regardless of the ultimate...

Neal and Brady Introduce Retirement Legislation

The House Ways and Means Committee Chair Richard Neal (D-MA) and Ranking Member Kevin Brady (R-TX) introduced the Securing a Strong Retirement Act of 2020. The bill, which expands on the bipartisan Setting Every Community Up for Retirement Enhancement (SECURE) Act...

VIDEO: Election 2020: Presidential Candidates’ Positions on Individual Tax Policies

Election 2020: Presidential Candidates’ Positions on Individual Tax Policies [button...