Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

How the New Tax Law Will Affect Family Businesses: A Congressional Perspective

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask… As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter. The need for fact-based reporting of issues important to multi...

House Passes GOP Debt-Ceiling Bill, With Cuts to Spending and Green Energy Incentives

On Wednesday, April 26, the House of Representatives voted to pass the GOP proposal to avert the impending government default—the Limit, Save, Grow (LSG) Act. The measure was advanced by a margin of 217-215, with four Republican lawmakers—Reps. Tim Burchett (R-TN),...

Profile of the Family Office Leader of the Future

By Linda Mack, Mack International The Family Office of the future is evolving. Successful family offices recognize the future is now. There is a trend toward being more strategic and proactive while continuing to strengthen their value proposition. Technology is being...

Green-Energy Tax Credits, Proposal Faces Rejection, Business Tax-Incentive, and More

House GOP Offers Repeal of Green-Energy Tax Credits and Expanded IRS Funding in Initial Debt-Ceiling Proposal. On Wednesday, April 19, House Republicans released the text of their proposal to avert the impending government default—the Limit, Save, Grow Act. The...

PODCAST: Congresswoman Tenney Advocates for Family Businesses in New Podcast

Rep. Claudia Tenney Focuses on Family Business Struggles, Educating Congress on Strength of Multi-Generation Businesses in New ‘Voice of Family Business on Capitol Hill’ Podcast Rep. Tenney (R-NY) Talks with Podcast Host Pat Soldano, Family Enterprise USA, on...

May 10th Tax Policy Event Focuses On Family Businesses

May 10 New York Presentation Showcases Expert Discussion on Tax Policies Facing Congress, Impacts on Family Businesses Capitol Hill Expert Panel Dissects Policies That May Harm Family Businesses A panel of Washington DC experts and influencers will be...

Treasury and IRS Under the Spotlight, SALT New Proposal, FedEx Court Victory, and More

Treasury and IRS Under the Spotlight at Upcoming Congressional Tax Hearings. On Wednesday, the House Committee on Ways and Means will hold a full-committee hearing to discuss the green-energy tax incentives enacted in the Inflation Reduction Act (IRA). At the same...

Cornell Professor on How to Prepare the Next Generation for Leadership in Family Businesses

Cornell University’s Daniel Van Der Vliet Details Lessons Learned with Next Generation Leaders in Latest ‘Voice of Family Business’ Podcast Daniel Van Der Vliet of Smith Family Business Initiative at Cornell University’s S.C. Johnson Graduate School of Management...

The Power of America’s Family Businesses is All in the Numbers

Family businesses continue to anchor America’s economy. Every year we conduct research on America’s largest private employer: Family business. Both large and small, family businesses account for nearly 60 percent of private employment in the country,...

Saying It Out Loud, By Pat Soldano. April 2023.

On Capitol Hill, Accountability and Accomplishments Matter More Now Than Ever By Pat Soldano Fighting the good fight is a forward-looking enterprise, but sometimes it’s worth taking a breather, taking a long look back, and celebrating, if briefly, our wins....

What Every Family Business Owner Needs to Know About Succession Planning

Preparing Your Family Business for Next Generation is Focus of New Homrich Berg Webcast, by Family Enterprise USA Homrich Berg’s President Thomas M. Carroll and Abbey Flaum, Managing Director, Family Wealth, Discuss Complexities of Estate Planning,...

Family Business Expert Pat Soldano Shares Valuable Insights in Latest Publication

Family businesses are a vital part of the American economy, serving as a cornerstone of private employment, comprising nearly 60% of the workforce. Despite facing challenges such as inflation, tax policies, and pandemics, family businesses have shown remarkable...

Pat Soldano is Speaking at the 11th Annual FBA Capitol Conference

Pat Soldano, Founder & President, Policy & Taxation Group will be speaking at FBA's Eleventh Annual CAPITOL CONFERENCE Join the Family Business Association of California for the 11th Annual Capitol Conference. The day will include a legislative conference at...

SECURE 2.0 Act Changes Affecting Family Business Owners

The SECURE 2.0 Act was signed into law on December 29, 2022, and contains a number of provisions impacting employer retirement plans. As a family business owner, it is important to stay on top of changes in the law that may impact your business or your retirement...

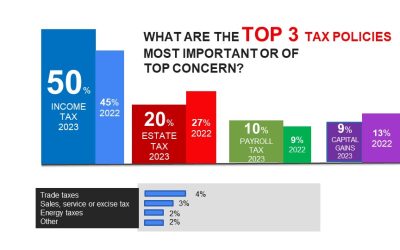

Study Finds High Personal Tax Levels Concern Largest US Private Employer: Family Businesses

High Personal Tax Levels Top Concerns of America’s Largest Private Employer, Family Businesses, New Study Finds New Data from Family Enterprise USA Annual Family Business Survey 2023 Show Taxes, Both Personal and Business, Are Biggest Worries Sky-high income and...

Senators Kennedy, Thune Introduce New Death Tax Repeal Act of 2023

Senators John Kennedy of Louisiana and John Thune of South Dakota, along with dozens of other Republican senators, have introduced the Death Tax Repeal Act of 2023. The act aims to permanently repeal the federal estate tax, commonly known as the “death tax,” a...

WEBCAST REPLAY: It’s All Relative; Family Matters in Business Succession

Thank you to the Orange County Business Journal for publishing this article.Leadership Compensation, Hybrid Work Accelerate in Family Businesses, Family Business Offices Says Expert Linda MackOne of the 50 largest registered investment advisor firms in the country,...

Debt Ceiling Negotiation, FY2024 Budget Hearings, Lower Energy Costs Act, and More

General Updates Programming Update: This newsletter will be taking a hiatus during the congressional recess. We will resume publishing on Friday, April 21. Debt Ceiling Negotiation Update: Earlier this week, House Speaker Kevin McCarthy (R-CA) called for...

South Dakota Trust Co. Joins as New Sponsors Supporting Family Businesses

South Dakota Trust Co. Joins Family Enterprise USA as New Sponsors Supporting Family Businesses South Dakota Trust Company has joined Family Enterprise USA as a new sponsor. As a sponsor, South Dakota Trust Company will work with Family Enterprise USA in...

Treasury Department, Eliminate OECD Funding, Bipartisan Group Rebuffs Biden and More

Treasury Department and IRS Release Preliminary Guidance on Semiconductor Tax Credit. On March 23, the Treasury Department and IRS published proposed regulations for implementing the new section 48D advanced manufacturing investment tax credit (ITC) enacted through...

New York Times Spotlights Family Businesses, Family Enterprise USA Research in Sunday Business Section

The New York Times writer Martha White looks into five different family businesses and how they are dealing with transitioning their enterprises to the next generation. The businesses range from a gas equipment company to jewelry company to a construction services...

Join Us for a Discussion on Family Business, Legislation, and Voter Attitudes: 2023 Survey Results Live Event

We are pleased to invite you to be our guest for a presentation addressing the State of Family Business and the Critical Tax Issues Impacting the Wealthy in the New Congress on March 30 in Atlanta, GA. It is being hosted by Homrich Berg, in conjunction with the Policy...

Senators Renew Efforts, Yellen Defends 2024 Budget Proposals, CBO Report, and More

Senators Renew Efforts to Reverse R&D Tax Modification. Last Friday, a bipartisan coalition of 12 senators introduced the American Innovation and Jobs Act to increase incentives for businesses that invest in domestic research and development (R&D). Spearheaded...

PODCAST: Rep. Schneider Spotlights Importance of Educating Congress on Power of Family Businesses in New Podcast

Rep. Brad Schneider Spotlights Importance of Educating Congress on Power of Family Businesses in New ‘Voice of Family Business on Capitol Hill’ Podcast Rep. Schneider Talks with Podcast Host Pat Soldano, Family Enterprise USA, on Goals of New Congressional...

Keeping It in the Family: Why Succession Planning Matters

When planning for your family, you prepare, consult with experts, save, and make plans for your child’s future. The same is true in running your business; they are, in many ways, parallel experiences. March 22, 2023 11:00 AM Pacific Time / 2:00 PM...

Saying It Out Loud, By Pat Soldano. March 2023.

For Happier Workers, Businesses Need to Take a Chapter Out of Family Business Employee Handbook By Pat Soldano The findings are clear: family businesses treat their employees better, pay them better, and keep them longer. In our latest research report, The...

Future-Proof Your Business: The Importance of Succession Planning

When planning for your family, you prepare, consult with experts, save, and make plans for your child’s future. The same is true in running your business; they are, in many ways, parallel experiences. March 22, 2023 11:00 AM Pacific Time / 2:00 PM...

Family Businesses in America Sound the Alarm on Tax and Labor Challenges in 2023 Survey

Tax, Labor Issues Top Concerns of America’s Private Largest Employer, Family Businesses, Says New 2023 Family Business Survey Just Released Family Enterprise USA Annual Family Business Survey 2023Also Cites Supply Chain Issues, Inflation Damaging Business...

FY2024 Budget Request Includes Tax Proposals for Wealthy Americans. Summary and Analysis.

On Thursday, March 9, President Joe Biden released his $6.9 trillion Budget and various accompanying documents. Separately, the Treasury Department released its Green Book, which provides more detailed descriptions of the tax proposals in the budget along with...

The Benefits of Succession Planning: Family Matters in Business Succession

When planning for your family, you prepare, consult with experts, save, and make plans for your child’s future. The same is true in running your business; they are, in many ways, parallel experiences. March 22, 2023 11:00 AM Pacific Time / 2:00 PM...