Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Saying It Out Loud, By Pat Soldano. July 2023.

How Family Businesses Can Change the Tune on Capitol Hill By Pat Soldano America is back on the road. Planes are full. Overhead bins are bulging. I am part of this post-COVID travel warrior surge. Every week I am somewhere meeting with multi-generational family...

AI’s Transformative Potential: Rational Interest vs Irrational Exuberance

By Alex Hart, Executive Managing Director As a wealth management and investment advisory firm, we at Pathstone are often asked about the latest developments in technology. Investors, particularly entrepreneurs, are often interested in “hot” trends. It is part of our...

Peter Latta of A. Duie Pyle Discusses Common Sense Policy Making in Family Enterprise USA Video

A. Duie Pyle CEO, Peter Latta, Talks Common Sense Policy Needed From Lawmakers in New Family Enterprise USA Video Part of Family Business Series, Latta Video Hosted by Family Enterprise USA’s President Pat Soldano Peter Latta has few good ideas about common...

Weekly Washington Update: Impeachment, Dobbs Anniversary, Economic Bills, and More

House Sends Biden Impeachment Effort to Committees: Yesterday, the House voted 219-208 to refer articles of impeachment against President Biden to the Judiciary and Homeland Security committees. Sending the measure to committees helped avoid political tensions between...

House Approves GOP Tax Package, But SALT Relief Still in Limbo

House Tax-Writing Committee Advances GOP Economic Bills. The House Ways and Means Committee approved a trio of Republican tax bills along party lines during a markup last week. The economic-growth package, which is comprised of the Tax Cuts for Working Families Act...

Luntz and Mulvaney Ask: ‘Is Democracy at Risk?’ in New Video

New Video Release: Frank Luntz and Mick Mulvaney Ask: ‘Is Democracy at Risk?’ Conversation Between Expert Pollster Luntz and Former White House Chief of Staff Mulvaney Debate Critical Political and Cultural Issues Facing America Family Enterprise USA has...

Attention Entrepreneurs: Help Shape the Future of Family Businesses – Contact Your Representatives Today!

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional Family Business Caucus Now! There are many reasons why you should contact your representative in Congress to support the Congressional Family Business...

Calling All Supporters of Family Businesses: Act Now to Support the Congressional Family Business Caucus!

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional Family Business Caucus Now! There are many reasons why you should contact your representative in Congress to support the Congressional Family Business...

Selecting Modern Trust Structures Based on a Family’s Assets

By Al W. King III & Pierce H. McDowell III A round-up of the available options Trusts have grown enormously in popularity since the mid-1990s as a result of the development of modern trust laws, the dramatic increase in wealth and evolving family needs and...

Family Business Leaders Hear From Pollster Frank Luntz

Family Enterprise USA, Policy and Taxation Group Holds Quarterly Members and Supporters Webcast with Pollster Frank Luntz Insights On Current Political Landscape, Presidential Election Offered Along with Updates on Congressional Family Business Caucus ...

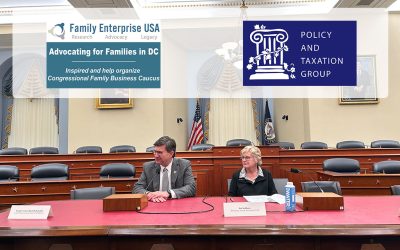

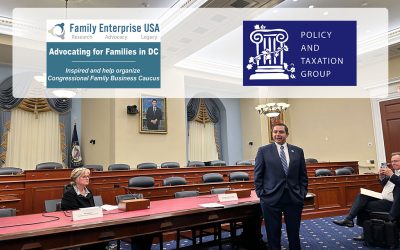

Family Business Leaders Share Insights at Congressional Caucus Meeting

Second Congressional Family Business Caucus Sees Congressmen Schneider, Cuellar Focus on Family Business Awareness Capitol Building’s House Budget Committee Room Holds Caucus Co-Chairs Brad Schneider (D-Ill), Henry Cuellar (D-TX) and Executives Speak on Key...

Tax Policy Updates, Tax-Reform Proposal, Proposed Rules, and More

GOP Lawmakers Prepare Expansive Tax-Reform Proposal. House Republicans are expected to unveil an economic-growth package in the coming weeks that will encompass tax provisions relevant to a broad cross-section of the U.S. economy. Last month, House Ways and Means...

Protecting What You’ve Spent a Lifetime Building

Is your limit sufficient to protect your assets and lifestyle? You’ve worked hard for your success. You deserve an insurance partner who recognizes that. The more your assets grow, the higher your liability risks are. No matter how well you’ve covered your...

Register Now for Frank Luntz’s June 7 Webcast on the State of the Union

Last Chance: Register Now for June 7 Supporters Webcast: See Frank Luntz on “Where Are We Now?” and New Legislation Affecting Family Businesses. This is a Family Enterprise USA and Policy and Taxation Group Exclusive Supporters Only Webcast June 7, 2023. ...

Last Chance: Register Now for June 7 Supporters Webcast: See Frank Luntz on “Where Are We Now?”

Last Chance: Register Now for June 7 Supporters Webcast: See Frank Luntz on “Where Are We Now?” and New Legislation Affecting Family Businesses. This is a Family Enterprise USA and Policy and Taxation Group Exclusive Supporters Only Webcast June 7, 2023. ...

Caucus Sees Congressmen Schneider, Cuellar Focus on Family Business Awareness

Second Congressional Family Business Caucus Sees Congressmen Schneider, Cuellar Focus on Family Business Awareness Capitol Building’s House Budget Committee Room Holds Caucus Co-Chairs Brad Schneider (D-Ill), Henry Cuellar (D-TX) and Executives Speak on Key...

Is the IRS Preparing for Audit Storm Among High Net-Worth Individuals?

by Thomas C. Berg, JR., CFA, ASA, CVA & David M. Eckstein, CFA IRS Releases Inflation Reduction Act Strategic Operating Plan: Is an Audit Storm Brewing for High Net-Worth Individuals? In early April, the IRS released its long-anticipated Inflation Reduction...

Debt-Ceiling Deal Proposes Adjustment to IRS Funding and More

On Saturday, May 27, House Speaker Kevin McCarthy (R-CA) and President Joe Biden reached an agreement to suspend the debt ceiling until January 2025 in conjunction with new spending reforms intended to reduce the federal deficit. Text of the 99-page bill,...

Debt-Ceiling Deal Update, Bipartisan 1099-K Proposal, Supreme Court Ruling, and More

Negotiators Highlight Progress on Debt-Ceiling Deal Despite Lack of Public Agreement on Legislative Framework. President Joe Biden and House Speaker Kevin McCarthy (R-CA) emerged from the latest round of negotiations last night still without a deal to raise the debt...

Family Business Caucus Holds 2nd Meeting in House Budget Committee Room, May 2023

Pat Soldano opened the meeting by introducing representatives from family businesses and Family Business Centers in attendance. She then provided an overview of the Congressional Family Business Caucus, highlighting its unique role as a bipartisan Caucus aimed at...

Make Your Voice Heard: Contact Your Representatives Now

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional Family Business Caucus Now! There are many reasons why you should contact your representative in Congress to support the Congressional Family Business...

Saying It Out Loud, By Pat Soldano. May 2023.

Danger Lurks in Debt Reduction Battle By Pat Soldano In the debt ceiling struggle between the Republican-led House and the Biden Administration I never figured higher taxes as a likely result. But beware, danger lurks. In speaking with my good friend, and...

June 2nd Event: Important Tax Issues Affecting Successful Individuals, Family Offices and Family Businesses

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask… As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter. The need for fact-based reporting of issues important to multi...

Labor Worries Among Major Issues Facing America’s Family Businesses, New Study Finds

Finding, Keeping, and Training Labor Are Among Critical Issues Family Businesses Face, according to New Data in Family Enterprise USA Annual Survey Finding and holding on to workers are key issues facing America’s largest private employer, Family Business,...

Treasury and IRS Issue Guidance, Senate Scrutinize Tax Practices, Tax Writers Assert Jurisdiction Over Agreement

Senate Democrats Scrutinize Tax Practices of Pharmaceutical Companies, While Republicans Take Aim at Pillar Two. On Thursday, May 11, the Senate Finance Committee held a hearing that was intended to discuss the perceived tax avoidance by multinational pharmaceutical...

June 1st Event: Critical Tax Issues Impacting Successful Individuals, Family Offices and Family Businesses

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask… As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter. The need for fact-based reporting of issues important to multi...

It’s Time to Speak Up: Contact Your Representatives Now

We Need Your Help! Do It Now! The Caucus meeting is 5/16. Contact Your Representatives in Congress. We Need Them to Join the Congressional Family Business Caucus Now! Few in Congress understand the power of America’s family businesses. There are 32.4 million...

Your Voice Matters! Contact Your Representatives Today.

We Need Your Help! Do It Now! The Caucus meeting is 5/16. Contact Your Representatives in Congress. We Need Them to Join the Congressional Family Business Caucus Now! Few in Congress understand the power of America’s family businesses. There are 32.4 million...

Debt-Limit Increase Discussions, Taiwan Tax-Treaty, Energy & Solar, and More

Debt-Limit Increase Discussions Commence After Negotiators Mark Their Turf. President Joe Biden met with congressional leaders at the White House earlier this afternoon, May 9, to discuss increasing the debt limit and simultaneous legislative action on deficit...

The Most Difficult Challenge Our Business Clients Face

After many decades of counseling successful closely-held businesses, Brown and Streza knows that successfully transferring closely-held businesses is the most difficult challenge our clients face. It is far more than “positioning the business for a sale” or minimizing...