Sep 6, 2018 | Estate Tax, Policy And Taxation Group

Excellent news as our good friend and supporter, Senator Kyl will be back in the Senate. From AZ Central Jon Kyl, once one of the most powerful Republicans in the U.S. Senate, will return to Capitol Hill to succeed the late Sen. John McCain, The Arizona Republic has...

Sep 5, 2018 | Estate Tax, Tax Cuts

House tax writers will meet to consider legislation. This makes permanent, expiring individual and business tax provisions in the 2017 tax law during the week of September 10. House Ways and Means Committee Chair Kevin Brady, R-Texas, said he wants the legislation...

Sep 2, 2018 | Blog, Death Tax, Estate Tax

The US Department of the Treasury and the IRS have released Proposed Regulations on Internal Revenue Code Section 199A, the 20% pass-through deduction designed to provide tax relief to pass-through businesses and proprietorships. The Proposed Regulations provide...

Jul 24, 2018 | Blog, Family Businesses, Family Enterprise USA

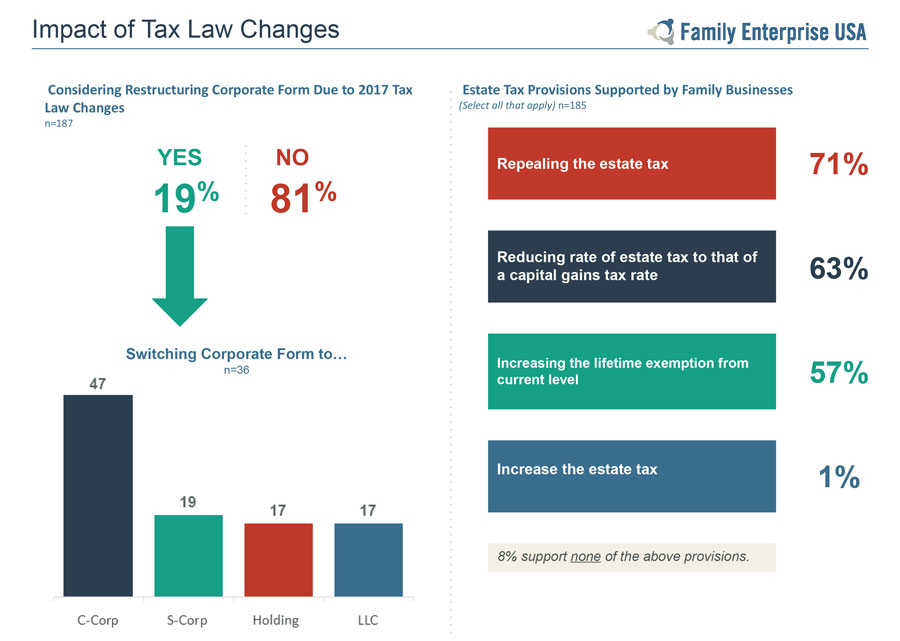

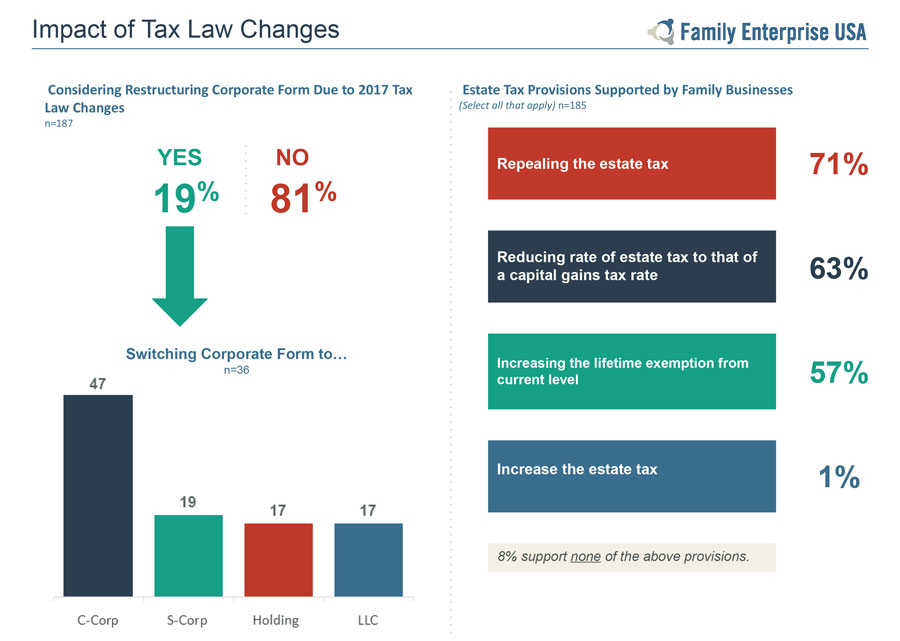

New Survey of Family Businesses Reveals Commitments, Challenges, & Concerns Ahead Family business are key drivers of economic development, but taxes and regulations hinder growth Two-thirds of participating business owners employed more than 50 employees in 2017;...

Jul 23, 2018 | Policy And Taxation Group

Congressman Devin Nunes (CA-22) has introduced a bill in the House of Representatives to eliminate capital gains taxes on inflation. By ending this unfair tax, the Capital Gains Inflation Relief Act (H.R 6444) will encourage both individual and business investment...