Tell Us What Matters Most to Your Family-Owned Business

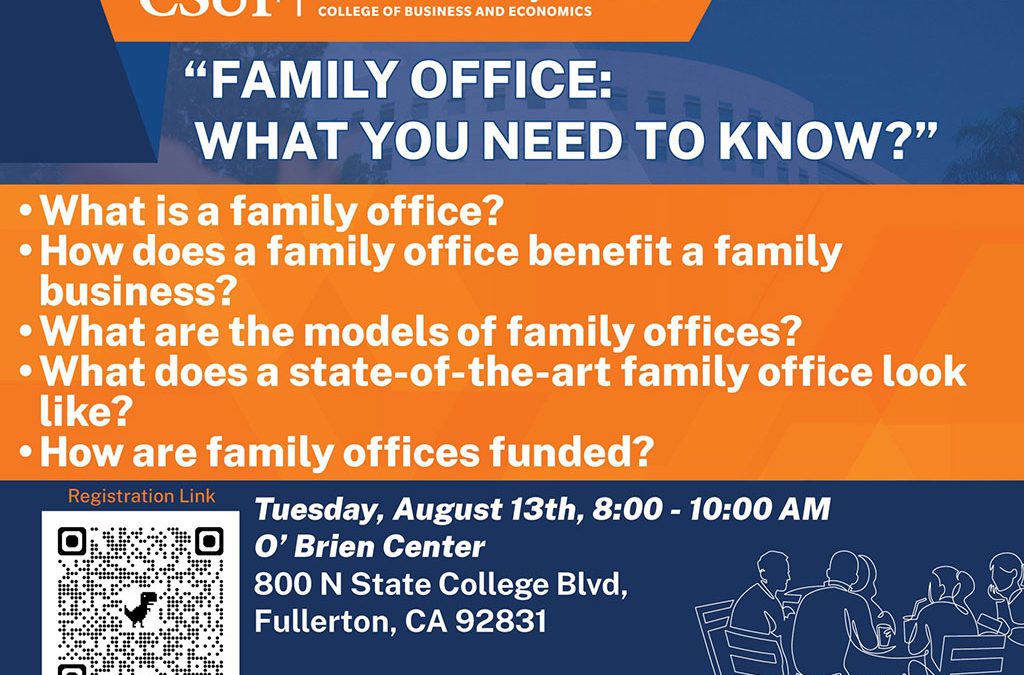

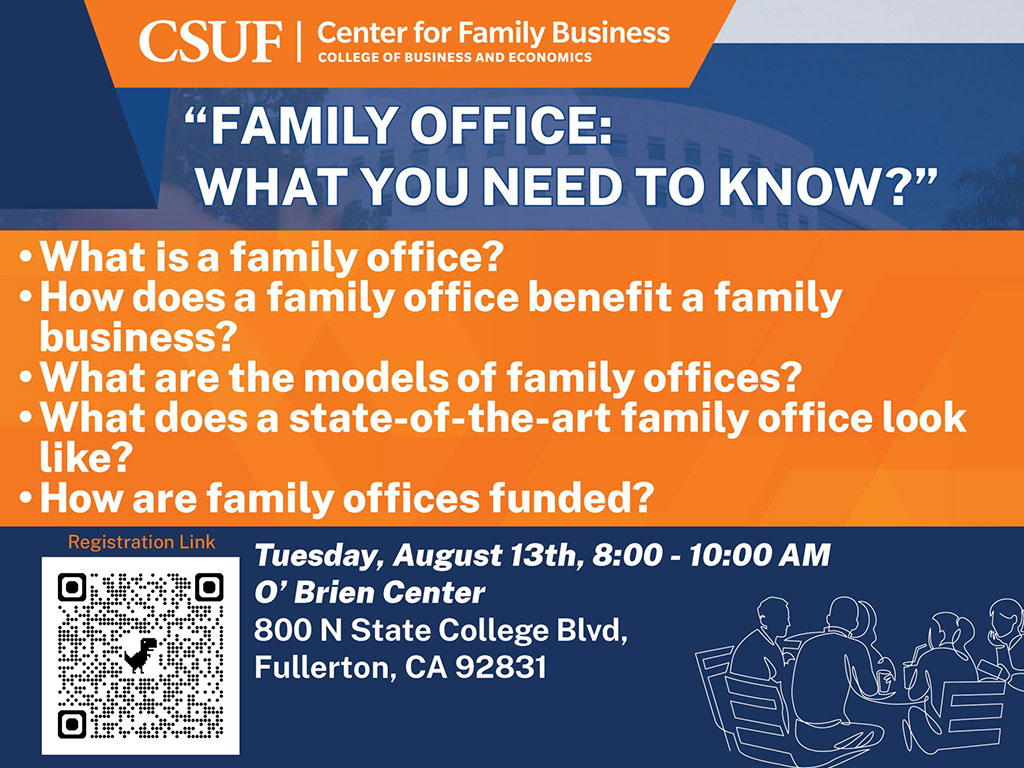

CSUF Family Business Center Workshop; “Family Office: What You Need To Know?”

August 13, 2024

You will learn, “what is a family office”, the different models of family offices, and the services they provide. We will help you answer the question; do you need a family office and if so, what model will work for you. You will learn about the different models of family offices and hear from an Executive in a Single-Family office, Sandy Juranich and an Executive from a Multi Family Office, Whit Batchelor from Whittier Trust.

Pat Soldano, who has worked in the Family Office industry for 30 years, will explain the family office model, various structures and services and then lead a discussion between a Single-Family Office Executive, (SFO), Sandy Juranich, and a Multiple Family Office, (MFO) Executive., Whit Batchelor of Whittier Trust

Sandy Juranich, CPA, is a family office professional, starting in a Multi-Family office for twenty years. Currently Sandy is the financial planning manager for a Southern California single-family office, where she oversees all of the family’s personal finances and business interests. This includes coordinating accounting, taxes, estate planning, investments, risk management, and personal business interests, using both internal and external resources.

Whit Batchelor is a Senior Vice President and Client Advisor at Whittier Trust’s Orange County office, where he manages the complex needs of affluent individuals and families.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #incometaxrates #repealestatetax #FamilyOffice #SuccessfulFamilies @PolicyAndTaxationGroup @DitchTheEstateTax #PolicyAndTaxationGroup #DitchTheEstateTax #FamilyEnterpriseUSAAction