Tell Us What Matters Most to Your Family-Owned Business

Constant, Consistent Education with Congress Pays Off in ‘One Big Beautiful Bill’ for Family-owned Businesses, Family Offices

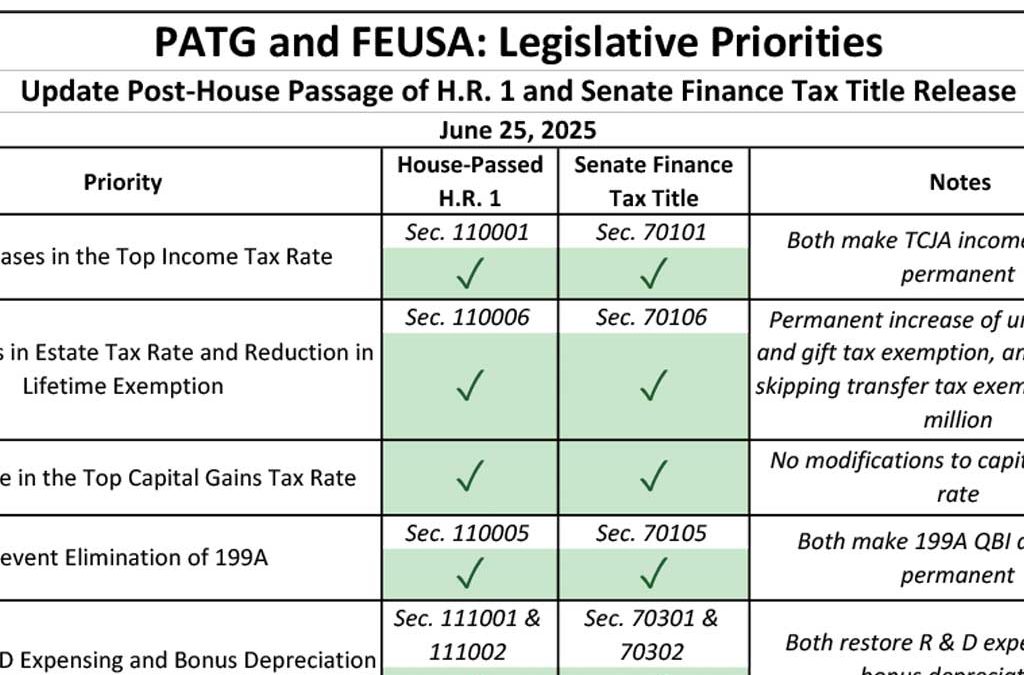

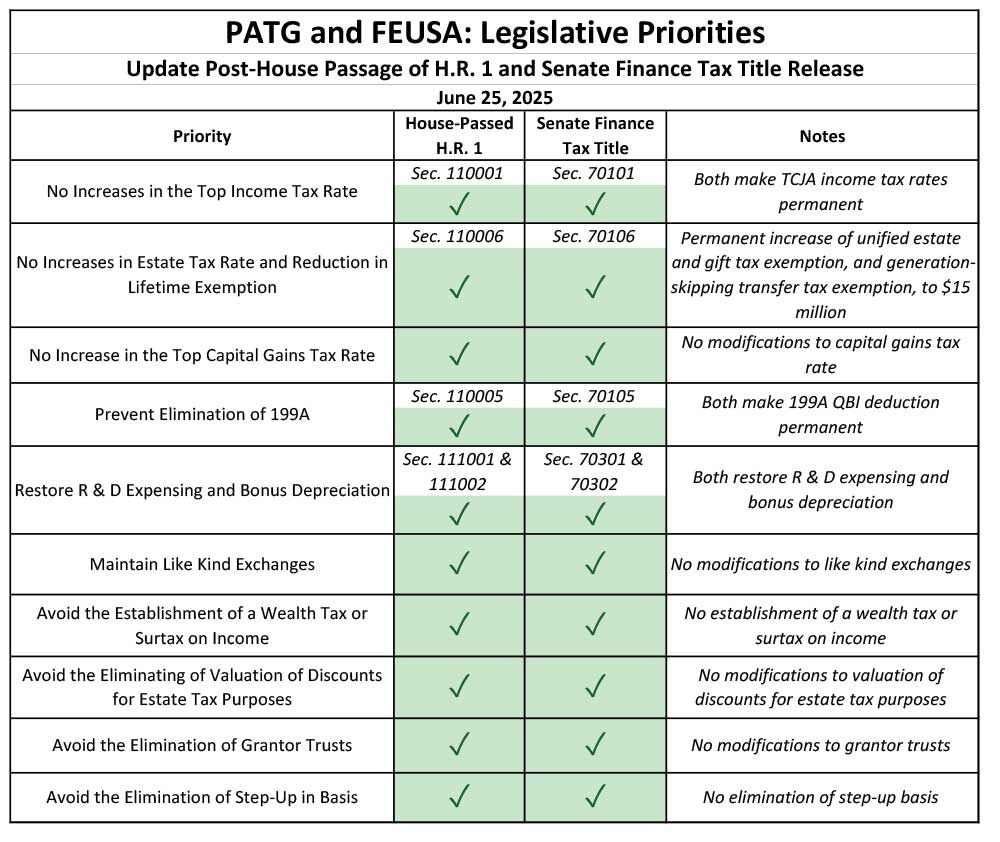

Working with Congress on the critical tax and economic policies affecting family-owned businesses, family offices, and successful individuals has paid off with the passage of the One Big Beautiful Bill Act (H.R. 1).

With the bill signed into law on July 4, family businesses, family offices, and successful individuals are digesting what it all means and what new education and pressure are needed to make sure hard-fought policies don’t get reversed in the next round of elections. Here’s the checklist of notable wins Family Enterprise USA, the Policy and Taxation Group, its team on Capitol Hill, and family-owned business leaders helped make happen with House and Senate members:

TCJA Extension: The bill makes permanent or extends several expiring provisions from the 2017 Tax Cuts and Jobs Act (TCJA), including making permanent the individual income tax rates enacted by TCJA. The bill does not include a new bracket for high-income individuals.

Estate and Gift Tax: The bill permanently increases the estate and gift tax exemption level to $15 million from $14 million, beginning after December 31, 2025, and indexes the increase to inflation. The bill avoids the eliminating of valuation of discounts for Estate Tax purposes.

Section 199A Pass-Through Deduction: The bill makes permanent the 20% Section 199A qualified business income deduction, among several other changes, which helps level the tax playing field versus lower corporate tax rates.

Capital Gains Tax Rate: No modifications or increase in the top Capital Gains tax rate.

R&D Expensing and Bonus Depreciation: Restores research and development expensing, allowing businesses to immediately deduct 100% of the cost of certain short-term investment and machinery from their taxable income in the first year rather than over fixed intervals (e.g., equipment interest). The legislation also permanently restores 100% bonus depreciation, effective January 20, 2025.

Like Kind Exchanges: No modifications to and maintenance of Like Kind Exchanges.

Wealth Tax: Avoided the establishment of a Wealth Tax or Surtax on income.

Alternative Minimum Tax: The bill makes permanent TCJA’s increase in the alternative minimum tax (AMT) exemption but reverts the exemption phaseout thresholds to 2018 levels. The reversion may result in additional individuals being subject to the AMT and therefore excluded from claiming the SALT deduction.

Grantor Trusts and Step-Up in Basis: Avoided and no modifications to Grantor Trusts and avoided elimination of Step-Up in basis.

Deductibility: The bill restores the EBITDA (earnings before interest, taxes, depreciation, and amortization)-based limitation on the net business interest deduction effective December 31, 2024.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #incometaxrates #repealestatetax #FamilyOffice #SuccessfulFamilies @PolicyAndTaxationGroup @DitchTheEstateTax #PolicyAndTaxationGroup #DitchTheEstateTax #FamilyEnterpriseUSAAction