Forming a family office is often a logical step for families that have created substantial wealth. Indeed, many single-family offices emerged from family businesses created in the U.S. after World War II, where the liquidity generated by these enterprises began to require professional management.

In some cases, it makes sense to take the family office one step further and form a for-profit family office. A for-profit family office:

- Manages investment partnerships/LLCs in exchange for a management fee and an interest in the investment profits (“carried interest”)

- Deducts its expenses as ordinary and necessary business expenses

- Must be considered a trade or business seeking a profit

In this piece we lay out the key considerations that should go into such a decision.

Family Office Structures: A Brief Review

Overall, single-family office (SFO) structures convey these benefits:

- Consolidated management of affairs and services

- Protection of family privacy along with wealth

- Path to transition wealth and manage it effectively for future generations

- Cost-sharing efficiency in managing wealth across multiple individuals, trusts, private foundations, and other entities

- Comprehensive and coordinated approach to investment policy, estate planning and execution, and philanthropy

- Tax-efficient wealth management

The functions of a family office can remain embedded within a family business, as is often the case at the start; be established as a separate entity; or made into a for-profit concern. In all of these cases, some or all of the family office functions can also be outsourced to expert service providers such as Pathstone.

What Sets a For-Profit SFO Apart?

While a standard family office structure conveys the benefits highlighted above, the for-profit structure extends and deepens certain of those benefits. It also requires adherence to important organizing principles in order to be deemed a for-profit business.

The for-profit structure supports the maximization of these benefits:

- Investment opportunities

- Enhanced allocation options for clients with different risk profiles and investment goals

- Cohesive strategic and tactical adjustments to investment policy across multiple beneficiaries

- Access to investment opportunities for smaller investors by pooling investments with others

- Economic efficiencies

- Cost-sharing opportunity for full range of services, including administration, accounting, and tax management

- Tax benefits

- Deductibility for certain expenses as ordinary and necessary to the Family Office

- Operations funded primarily from profit interest – the allocation of income from partnerships or LLCs

- Structural/management advantages

- Focused support on multi-generational wealth conservation and management

- Opportunity to introduce next generation to wealth management over time, in a structured environment

- Key employees or advisors coordinate efforts to serve all clients

To realize these benefits a for-profit structure must possess certain key characteristics. In essence, the family office must be a stand-alone, professionally managed entity with an economic interest in the success of the business.

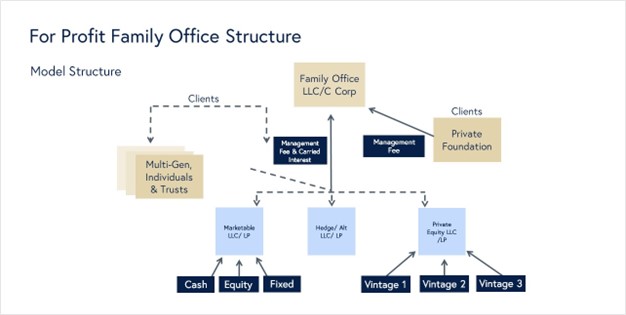

In evaluating whether a family office qualifies, the IRS will look at factors such as the structure of the entity (must be LLC or C-Corp); the expertise of employees and advisors as well as their time and effort running the business; and the history and magnitude of profits. The family office must demonstrate an appropriate compensation structure as well. Typically, a for-profit family office is compensated mainly through “carried interest,” i.e., a share of the investment profits, along with a management fee where appropriate;.

Further, ownership of the family office itself must be separate and distinct from ownership of the investment assets. This is handled through the creation of LLCs to manage the different asset pools, typically representing different asset classes/risk profiles. Clients (family members) own partnership stakes in these LLCs in accordance with their investment policy.

In addition to meeting the criteria above, a for-profit family office often will want to qualify for the “family office exception” from registration under Securities and Exchange Commission regulations. This means clients of the family office must be part of the same extended family. If the family office were to accept non-related clients, they would need to become a Registered Investment Advisor.

In Sum: Is This Structure Right for You?

Families with significant wealth may want to consider the for-profit family office structure if they are sizeable enough, have members with different asset allocation requirements that warrant customized portfolios, and seek optimization of intergenerational wealth transfer. Of course, each circumstance is different, and professional guidance and oversight is important to successful execution of a plan to transition to a for-profit family office model.

Our thanks to Pathstone for this article. To read the PDF version of the full text, please click.

About Pathstone

Pathstone is a partner-owned multi-family office dedicated to serving ultra-high net worth families, single family offices, foundations, and endowments. We are a Registered Investment Advisor and serve our clients as a fiduciary. Our advisors provide an integrated suite of services designed to empower our clients to realize their unique goals and maintain their legacy. Our expansive capabilities and personal, in-depth approach enable us to customize our solutions and leverage best practices to accommodate our clients’ unique needs.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness #taxes #taxseason #federaltaxpolicy #FamilyEnterpriseUSA #PolicyAndTaxationGroup #DitchTheEstateTax