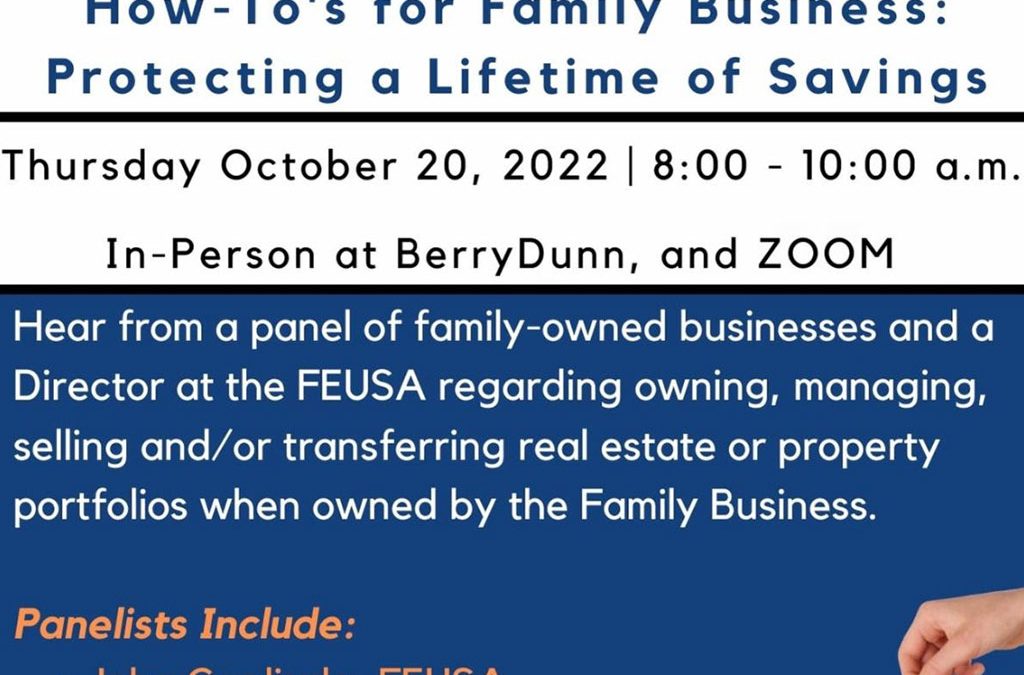

What Washington Needs to Know and Benefits of Businesses Owning Their Own Real Estate

Thursday, October 20, 2022 | 8:00 – 10:00 a.m.

Join John Gugliada, Family Enterprise USA’s (FEUSA) Director of Strategic Partnerships & Business Development, who will set the stage as he shares important insights collected from the organization’s annual Family Business survey and meetings with members of Congress including their top tax concerns, succession data, and significant family business challenges. Family businesses will learn how important they are to the economy and how to advise Congress of their importance, along with proposals that will change their businesses.

From this theme of protecting a lifetime of savings, we’ll then discuss breaking down the “bricks & mortar” of owning, managing, selling and/or transferring real estate and property portfolios when owned by the family business. We’ll hear from Spinnaker Trust and their commercial real estate investment group, the Boulos Company, a local commercial real estate brokerage and family-owned business, Renys who owns multiple retail locations throughout the state, and Hardypond Construction, a local family-owned construction company.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Policy and Taxation Group is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Policy and Taxation Group is the Voice for Family Offices and Successful Individuals in Washington, DC focused exclusively on the critical tax and economic policies that impact them.

Since 1995, Policy and Taxation Group has been the leading advocacy group working to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income tax and capital gains taxes, the creation of a wealth tax, and other hostile tax policies that punish hardworking taxpayers and success.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness #taxes #taxseason #federaltaxpolicy #FamilyEnterpriseUSA #PolicyAndTaxationGroup #DitchTheEstateTax