Second Congressional Family Business Caucus Sees Congressmen Schneider, Cuellar Focus on Family Business Awareness

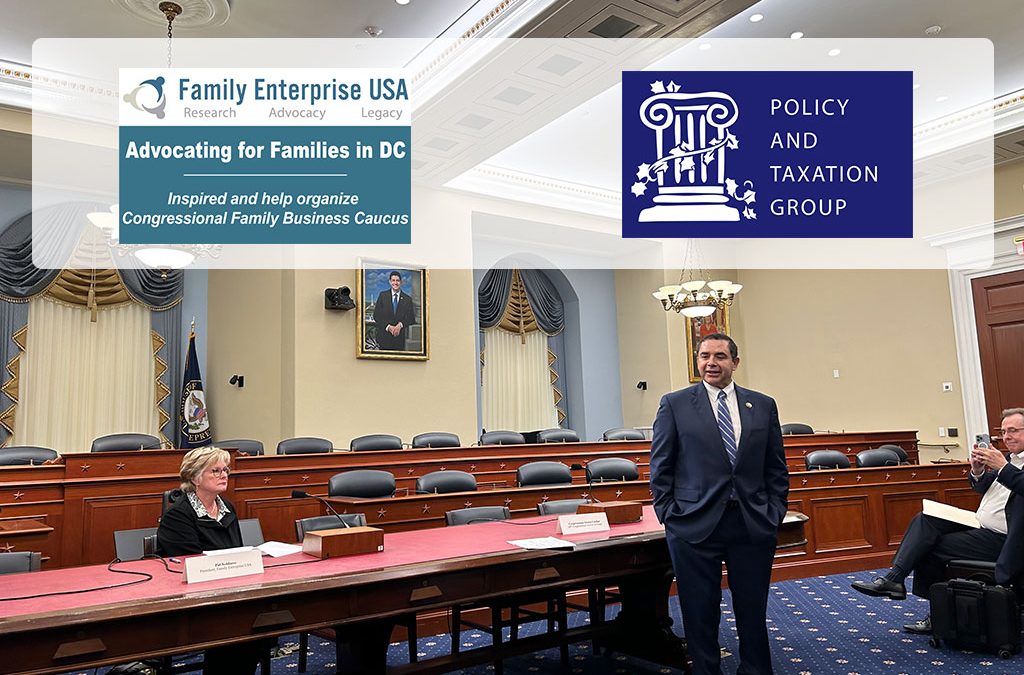

Capitol Building’s House Budget Committee Room Holds Caucus Co-Chairs Brad Schneider (D-Ill), Henry Cuellar (D-TX) and Executives Speak on Key Issues Facing Family Businesses

The bi-partisan Congressional Family Business Caucus held its second meeting here last week in the U.S. Capitol Building’s House Budget Committee Room, with a focus on keeping America’s largest private employer, family business, adding jobs and staying healthy.

The meeting featured two of the four co-chairs of the caucus, Rep. Brad Schneider (D-Ill) and Henry Cuellar (D-TX). The other co-chairs are Rep. Claudia Tenney (R-NY) and Rep. Jodey Arrington (R-TX).

During the meeting in in the Capitol’s Budget Committee Room, caucus attendees heard a variety of multi-generational family business executives, directors of family business centers, and family business legal experts tell their stories.

The first caucus meeting, held in February, focused on introducing the new caucus and educating Congress on the importance of family businesses to the U.S. economy, which contributes $7.7 trillion annually to the U.S. gross domestic product, according to research.

The second meeting, with host Pat Soldano, President of Family Enterprise USA and the Policy and Taxation Group, began with an overview of the importance of family businesses to the US economy and the continued need to educate Congress on the power of family businesses. Family Enterprise USA and Policy and Taxation Group, organizers of the event, are advocates for family businesses across the country. Caren Street, a lawyer with Washington DC-based Squire Patton Boggs, also helped introduce and organize the gathering.

Rep. Schneider addressed the group by detailing his family’s business history and emphasized how “getting more congresspeople into the caucus was truly important.” He cited the many elected leaders who come from their own family businesses, including a number of auto dealership owners, manufacturers, and agricultural businesses, all now elected officials.

Next, Rep. Cuellar offered family businesses “any support we can,” including promoting policies that help family businesses and “killing those bills that hurt family businesses.” The congressman then provided a history of debt ceiling talks and how to stay competitive with China.

Caucus attendees included many family business owners and family business center and office executives. The group heard from Steve Wells, President, American Food and Vending, Syracuse, N.Y., David Plimpton, Chief Executive Officer, Inolex, Philadelphia, and Steve Schroeder, founder of Creative Works, Chicago. Each told their multi-generational family business stories and the issues they face today.

Several university-based family business centers and media were also in attendance, including Dann Van Der Vliet, Executive Director, Smith Business Initiative, Cornell University, in Ithaca, N.Y., Angie Jones, Director, University of Toledo Family Business Center, and David Shaw, Publishing Director, Family Business Magazine.

The next Congressional Family Business Caucus meeting is scheduled for September.

“This second meeting set the stage for not only educating Congress members on the importance of family businesses to our economy, but on the urgency for more members to get involved so they understand the full scope and size of family businesses in this country,” said Soldano.

Family businesses are the largest private employers in the country, accounting for 83.3 million jobs, or 59 percent of the country’s private workforce, research shows.

“Family business is big business,” she said. “This caucus is helping get the word out about the importance of family businesses to job growth and the health of our country.”

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #incometaxrates #repealestatetax #FamilyOffice #SuccessfulFamilies @PolicyAndTaxationGroup @DitchTheEstateTax #PolicyAndTaxationGroup #DitchTheEstateTax #FamilyEnterpriseUSAAction