Jun 20, 2021 | Blog, Family Businesses, In The News

Register Now Family Business Matters; Research, Data and Issues Facing Family Businesses in 2021 Family Businesses employ 59% of all workers in the US and generate 54% of GDP, (“2021 Contribution of Family Businesses to the US Economy”; Piper and Astrachan by FEUSA),...

Jun 18, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group, Video Post

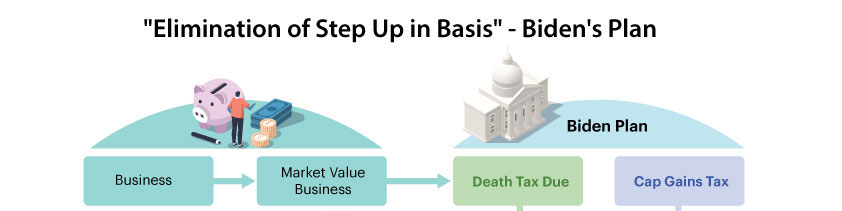

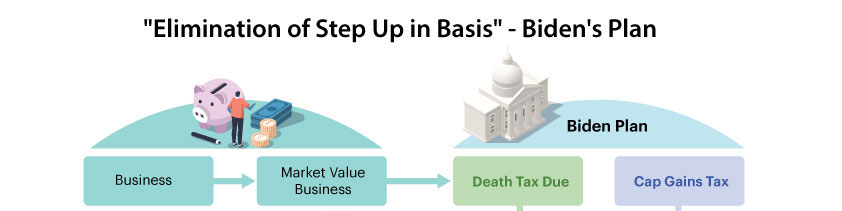

Contact Your Member of Congress President Biden has proposed the elimination of the “step up in basis,” while keeping the 40% (or higher) estate tax on the full value of a family business owner’s assets. That means that each person who inherits a business will pay...

Jun 15, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group

Contact Your Member of Congress While the devil is in the details, it is possible that if President Biden’s elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%. The graphic...

Jun 8, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group

Contact Your Member of Congress - It Only Takes A Minute A significant portion of the burden of repeal of step-up of basis would fall on workers through reduced labor productivity, wages, and employment. Please Take Action Today Policy and Taxation Group is your voice...

Jun 5, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group

Contact Your Member of Congress - It Only Takes A Minute President Biden has proposed the elimination of the “step up in basis,” while keeping the 40% (or higher) estate tax on the full value of a family business owner’s assets. That means that each person who...

May 27, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group, Tax Cuts

While the devil is in the details, it is possible that if President Biden’s elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%. The graphic below shows an example of a...