Aug 25, 2021 | Blog, Death Tax, Estate Tax, Family Businesses, Family Enterprise USA, In The News, Step-Up In Basis, Video Post

Contact Your Member of Congress - It Only Takes a Minute Casey Roscoe with Seneca Jones Timber Company Talks about Managing Today’s Resources for Tomorrow Casey Roscoe is a 3rd generation family member of Seneca, a women owned timber business, in Eugene Oregon. Listen...

Aug 24, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group

Participate in our latest poll question and see what others are saying: How long is your longest-term employee?(Required) 1 to 4 years 5 to 9 years 10 to 14 years 15 to 19 years 20 or more years Policy and Taxation Group is your voice in Washington on economic...

Aug 20, 2021 | Blog, Death Tax, Estate Tax, Family Businesses, In The News, Step-Up In Basis

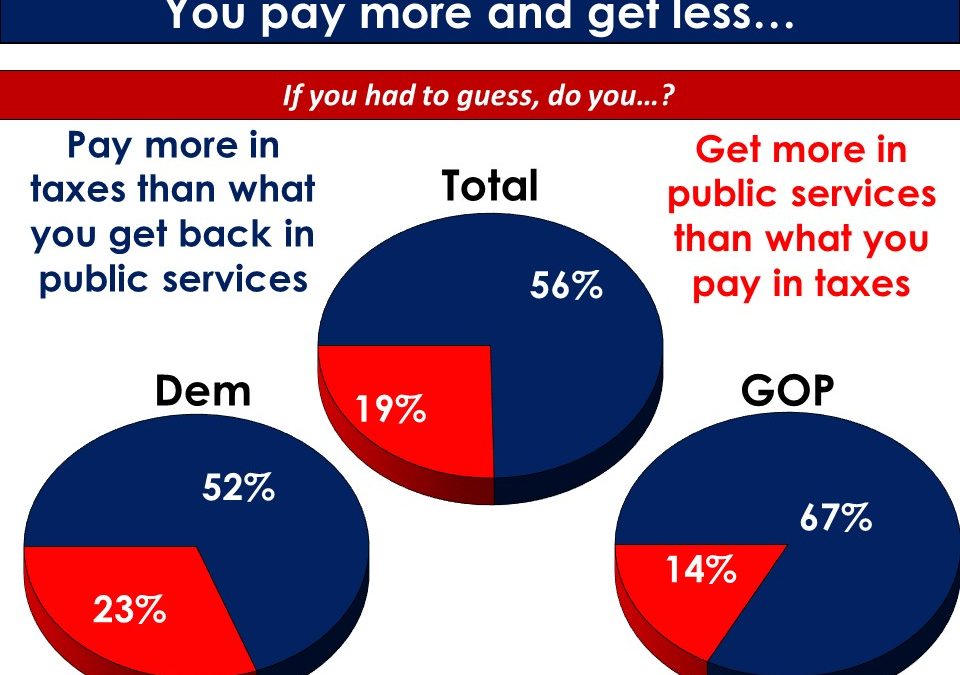

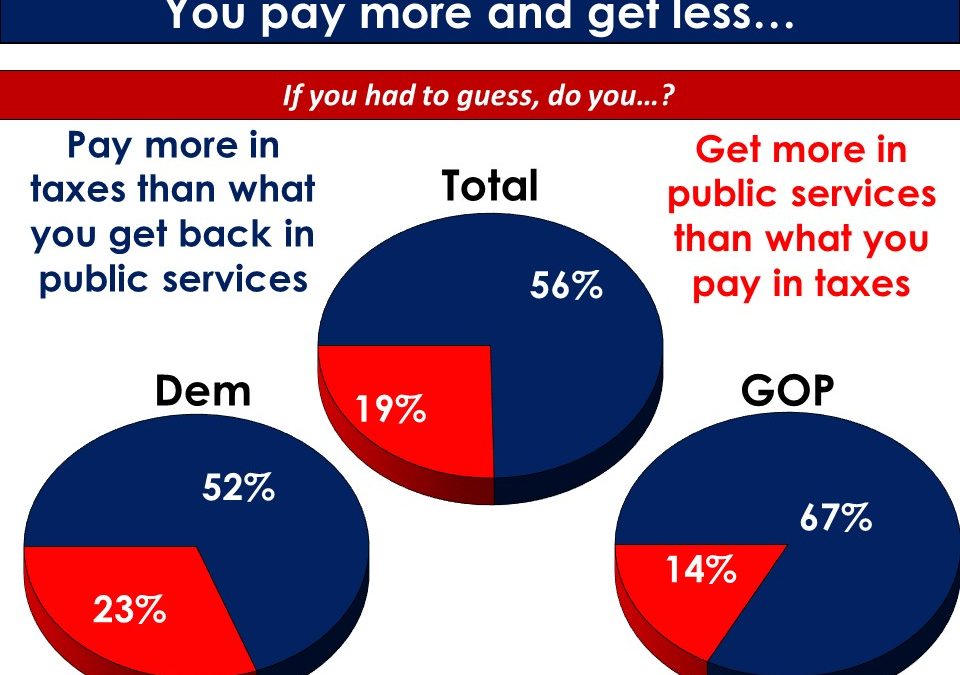

Contact Your Member of Congress - It Only Takes a Minute With proposals emerging from the Biden White House that would raise the estate and capital gains taxes on America’s family-owned businesses, we were commissioned to ask the American people where they...

Aug 13, 2021 | Blog, Family Businesses, In The News, Step-Up In Basis

Contact Your Member of Congress - It Only Takes a Minute Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report. Early Wednesday morning, Sen. John Thune (R-SD) offered Amendment #3106 to the Senate budget resolution,...

Aug 11, 2021 | Blog, Family Businesses, In The News, Step-Up In Basis

Contact Your Member of Congress - It Only Takes a Minute Thank you to Russell Sullivan and the team at Brownstein Hyatt Farber Schreck, LLP for this report. Early Wednesday morning, the Senate reached an agreement on S.Con.Res.14, FY2022 Budget Resolution. Over 40...

Jun 24, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group

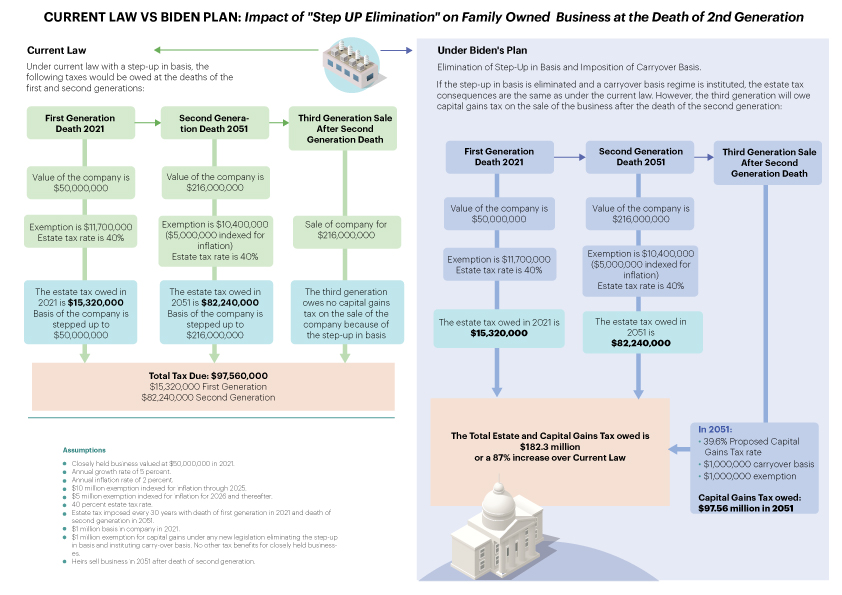

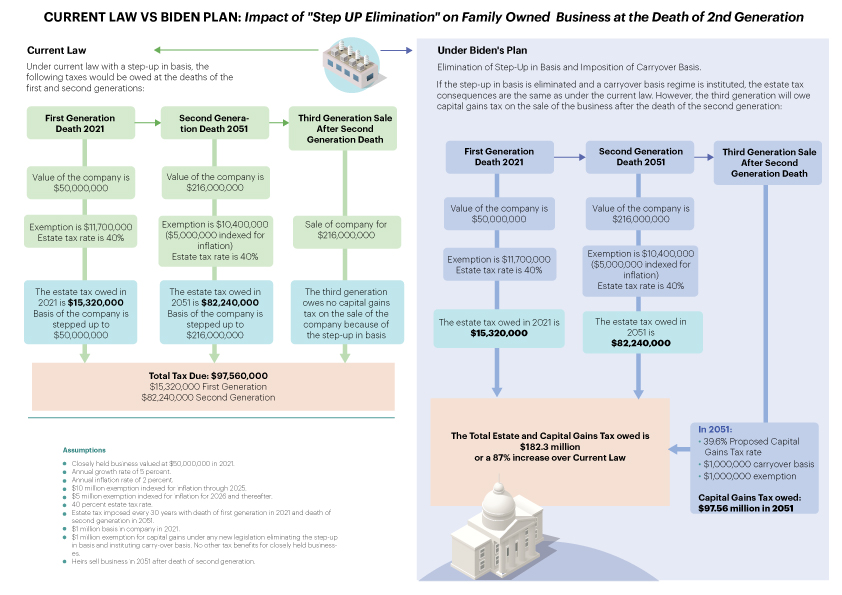

Contact Your Member of Congress President Biden has proposed an elimination of step up in basis and an increase in the capital gains tax; how much will this impact family businesses? See the example below. A $50 million family business could be subject to a $82...