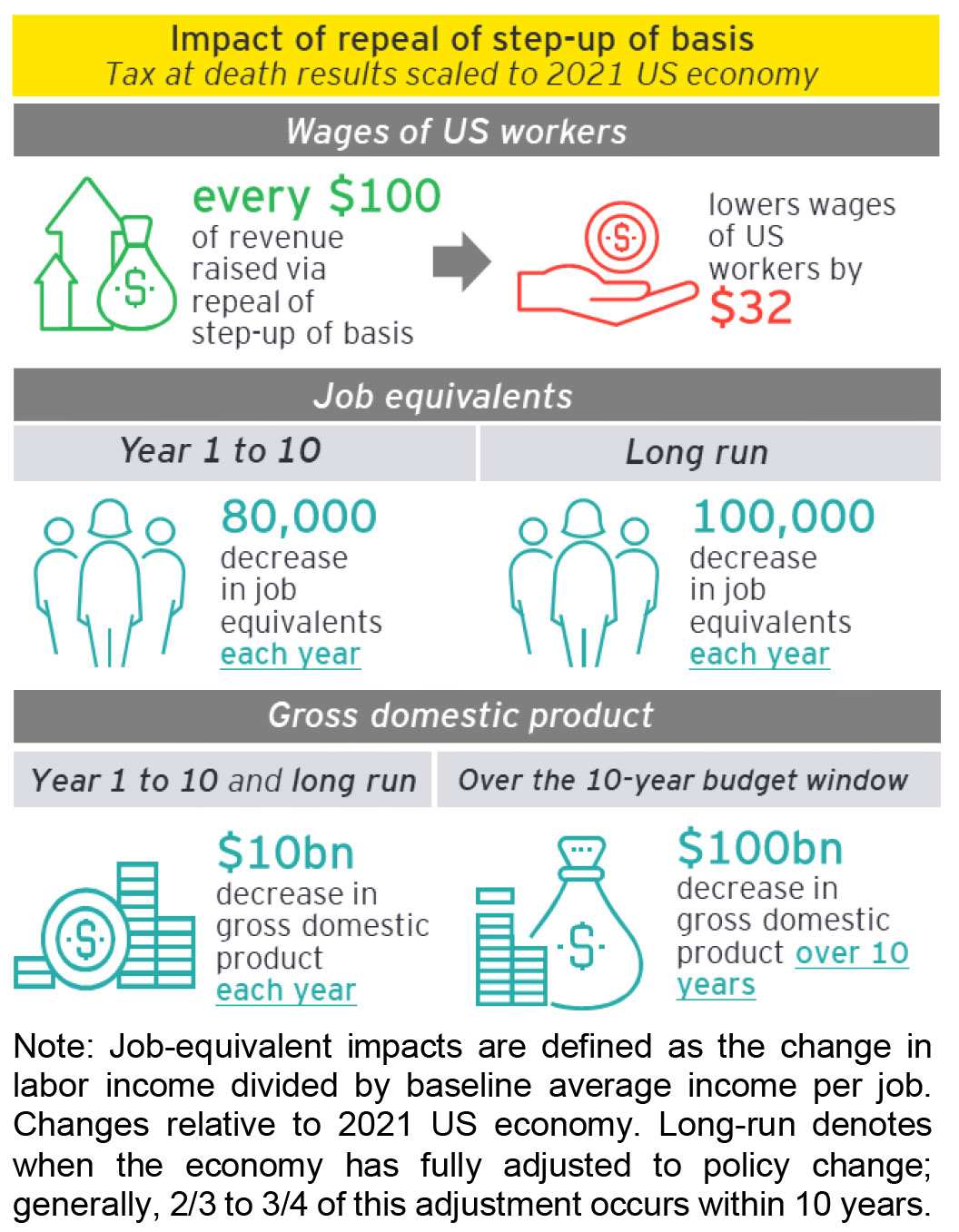

President Biden has proposed the elimination of the “step up in basis,” while keeping the 40% (or higher) estate tax on the full value of a family business owner’s assets.

That means that each person who inherits a business will pay taxes on the same appreciation over and over again, each time the business changes hands. And he wants to raise the capital gains tax rate to 39.6 %. (Basically the same as the estate rate).

Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families to fully enjoy the economic liberties and benefits of a robust free market unique to our nation. For over 25 years, we have been the loudest voice in the nation’s capital on eliminating the death tax. This ill-conceived tax has a destructive impact on families, family businesses, job creation, and the national economy.