Tell Us What Matters Most to Your Family-Owned Business

Key Takeaways and Implications of this Initial Tax Language

On Friday evening, Ways and Means Committee Chairman Jason Smith (R-MO) released initial legislative language for the Committee’s scheduled markup on Tuesday, May 13, at 2 p.m.

In general, the 28-page text is limited to extension of the expiring individual tax provisions of the Tax Cuts and Jobs Act of 2017 (“TCJA”).

This text is expected to be expanded to include other parts of the tax title in the Chairman’s comprehensive amendment—the amendment in the nature of a substitute (“AINS”)— which could be released late this weekend or Monday morning, unless the markup is postponed to later in the week.

Despite the limited nature of the initial language, there are several key takeaways and implications of the text, including the following:

1. The Individual SALT CAP Remains Unresolved. The initial language did not make any changes to the individual SALT cap of $10,000. This does not mean that Republicans want the cap to expire after December 31, 2025. Rather, it means that House Republicans have not reached consensus on how much to increase the cap. While Rep. Nicole Malliotakis (R-NY), who serves on the Ways and Means Committee, endorsed a cap of $30,000, four of her Republican colleagues from New York publicly rejected that amount. The discussions regarding the cap will continue this weekend and into next week. If an agreement is reached soon, it could appear in Chairman Smith’s expected amendment prior to the markup. Alternatively, Republicans may wait until the Rules Committee before including a provision that increases the cap. Unless the SALT cap, with or without an expansion, is extended or made permanent, the bill will lose as much as $1 trillion of revenue essential to meeting the Committee’s instructions under the budget resolution.

2. The Passthrough Deduction Is Increased to 22% from the Current 20%. While not a dramatic increase, this change can reduce the effective rate of taxation for passthrough income to less than 29% assuming the current top 37% rate. The increase also is a partial hedge in the event that Congress increases the top 37% marginal rate or imposes a new 39.6% rate for millionaires. Either way, this increase indicates strong support for section 199A and gives it momentum as the process moves forward.

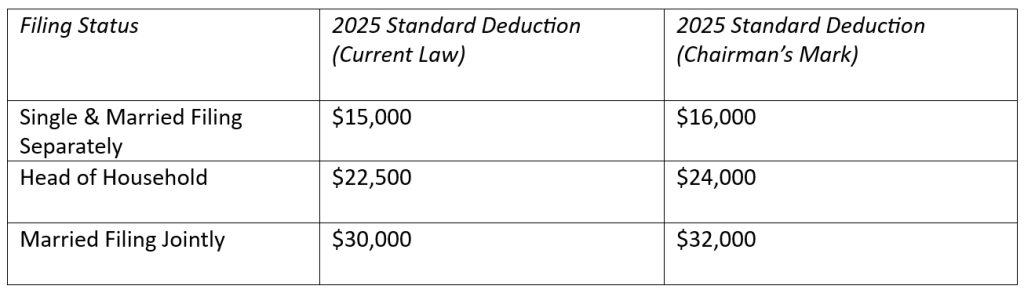

3. The Initial Language Increases the Standard Deduction by Up to $2,000. The text increases the standard deduction for tax years 2025 through 2028 by $1,000 for single filers, $1,500 for head of household filers and $2,000 for married filers.

The benefit of this increase depends on the tax bracket a taxpayer is in, but for a taxpayer in the 24% bracket, the tax reduction could be $240 for single filers, $360 for head of household filers, and $480 for married filers.

4. Additional Family Tax Relief. The text increases the Child Tax Credit to $2,500 for four years, and targets additional relief to low- and middle-income families through a number of provisions. In addition to the increase in the standard deduction noted above, it would expand the individual tax brackets by an additional inflation amount for all but the top two brackets (e.g., 35% and 37%) to increase the amount of taxable income subject to lower rates, which would also be made permanent.

5. Extension of Current Law for International Tax Provisions. The legislation would lock in current law for U.S. multinationals under the international tax rules adopted in TCJA. It would prevent the rate increase scheduled to apply under the Global Intangible Low-Taxed Income (GILTI) in 2026, while preserving the current 37.5% deduction for exports of domestically produced goods under the Foreign-Derived Intangible Income (FDII) deduction. Similarly, the legislation would make permanent the 10% tax rate and current treatment of tax credits under the Base Erosion Minimum Tax (BEAT) rules.

About Brownstein Hyatt Farber Schreck

Brownstein Hyatt Farber Schreck is a unique law firm. Walk into any of our offices and you’ll immediately recognize a different type of energy. Complacency doesn’t have a place here. Flexibility and inspiration do. Our culture and enthusiasm allow our attorneys, policy consultants and legal staff to stay ahead of our clients’ needs and provide them with the resources they require to meet their business objectives.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #incometaxrates #repealestatetax #FamilyOffice #SuccessfulFamilies @PolicyAndTaxationGroup @DitchTheEstateTax #PolicyAndTaxationGroup #DitchTheEstateTax #FamilyEnterpriseUSAAction