Tell Us What Matters Most to Your Family-Owned Business

In a time of economic uncertainty and policy shifts, family owned business leaders are stepping up to make their voices heard.

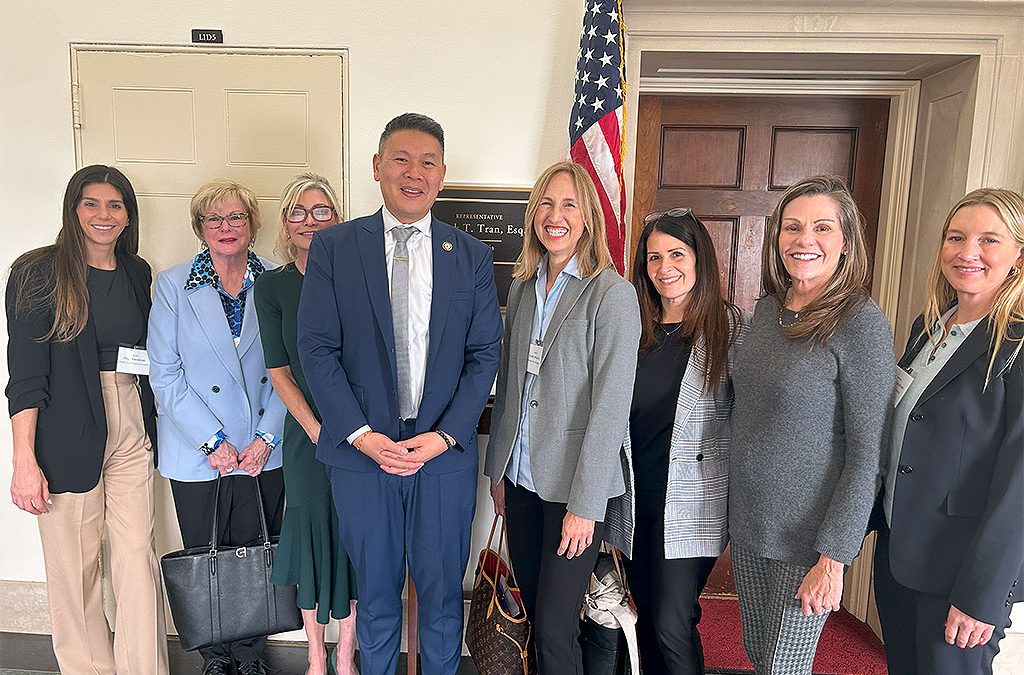

In a recent article for Family Business Magazine, Pat Soldano shares highlights from the March Congressional Family Business Caucus event, where more than 70 family owned business leaders met directly with members of Congress. From the powerful presence of women-owned businesses to key insights on tax challenges, trust in family owned businesses, and the latest IRS rule exempting domestic companies from the Corporate Transparency Act—this was a landmark moment for advocacy in Washington, D.C.

Soldano also breaks down early findings from Family Enterprise USA’s Annual Family Business Survey, and why consumer trust and tax fairness remain top priorities.

Don’t miss this inside look at how family owned businesses are influencing policy at the highest levels.

Read the full article here. Click Here.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #incometaxrates #repealestatetax #FamilyOffice #SuccessfulFamilies @PolicyAndTaxationGroup @DitchTheEstateTax #PolicyAndTaxationGroup #DitchTheEstateTax #FamilyEnterpriseUSAAction