Tell Us What Matters Most to Your Family-Owned Business

Senate Budget Committee Chairman Lindsey Graham (R-SC) released a draft budget resolution to provide for consideration of a national security, immigration, and energy spending package.

The Senate Budget Committee is expected to consider the budget resolution on Wednesday, February 12 and Thursday, February 13.

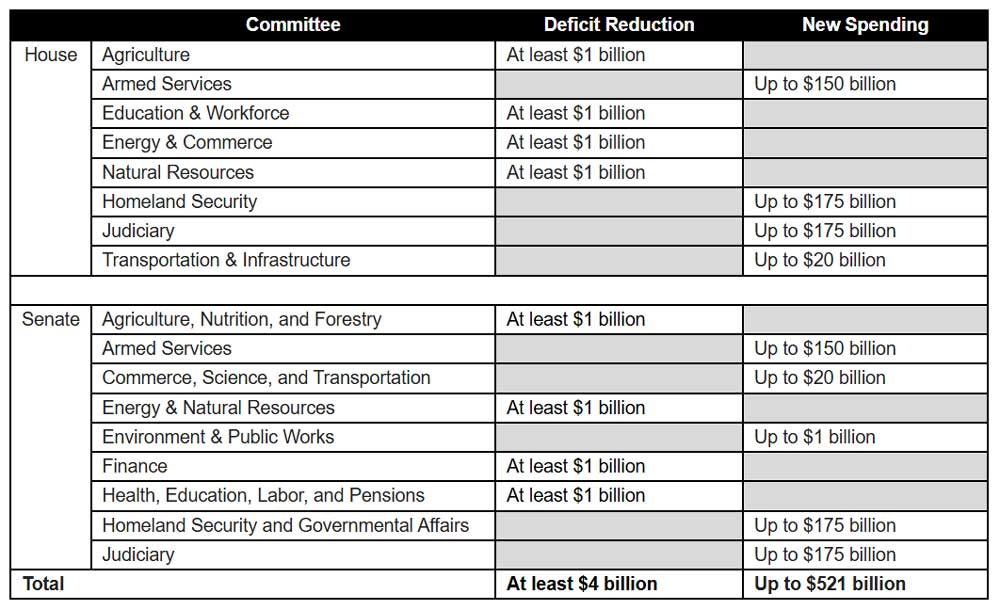

The resolution contains the below reconciliation instructions organized by committee. Notably, the draft Senate budget resolution does not include instructions to committees to propose tax or debt limit legislation. If agreed to by both chambers, committees are instructed to report their deficit reduction and spending recommendations to the House and Senate Budget Committees by March 7.

Under the budget reconciliation process, the House and Senate must pass identical budget resolutions prior to consideration of reconciliation legislation. The Senate draft resolution may face opposition from House Republican leadership and other members, who continue to negotiate their own budget resolution, reported to be announced next week. Notably, the Senate resolution would initiate the budget reconciliation process for fiscal year (FY) 2025, which would allow for the consideration of a second reconciliation package focused on tax under FY 2026.

This two-bill strategy supported by Chairman Graham and Senate Republicans is at odds with House Republicans’ preferred strategy to enact one reconciliation package focused on tax and spending legislation. Nevertheless, it is unclear whether the House can advance either a House- or Senate-led budget resolution due to pressure from conservative Republicans to secure significant budget cuts.

About Squire Patton Boggs

Squire Patton Boggs is an international law firm that offers comprehensive legal and public policy services and a global perspective. The New York office offering invaluable support across the full range of legal issues.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a supporter.

The need for fact-based reporting of issues important to family offices and successful families and protecting a lifetime of savings has never been greater. Now more than ever, family offices and successful families are under fire. That’s why Family Enterprise USA Action is passionately working to increase the awareness of issues important to family offices and successful families, while continuing to strengthen our presence on Capitol Hill.

Family Enterprise USA Action engages with legislators on Capitol Hill on behalf of family offices, successful families, and family-owned businesses. It is focused exclusively on the critical tax and economic policies that impact them. Since 1995, FEUSA Action has been the leading advocacy group working daily in Washington, D.C., to reduce and eliminate estate tax, gift tax, and generation skipping transfer tax while blocking increased income and capital gains taxes, the creation of a wealth tax, and other hostile policies that punish hardworking taxpayers and success in the U.S. It is a bipartisan 501.c4 organization.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #incometaxrates #repealestatetax #FamilyOffice #SuccessfulFamilies @PolicyAndTaxationGroup @DitchTheEstateTax #PolicyAndTaxationGroup #DitchTheEstateTax #FamilyEnterpriseUSAAction