Sep 5, 2018 | Estate Tax, Tax Cuts

House tax writers will meet to consider legislation. This makes permanent, expiring individual and business tax provisions in the 2017 tax law during the week of September 10. House Ways and Means Committee Chair Kevin Brady, R-Texas, said he wants the legislation...

Jul 24, 2018 | Blog, Family Businesses, Family Enterprise USA

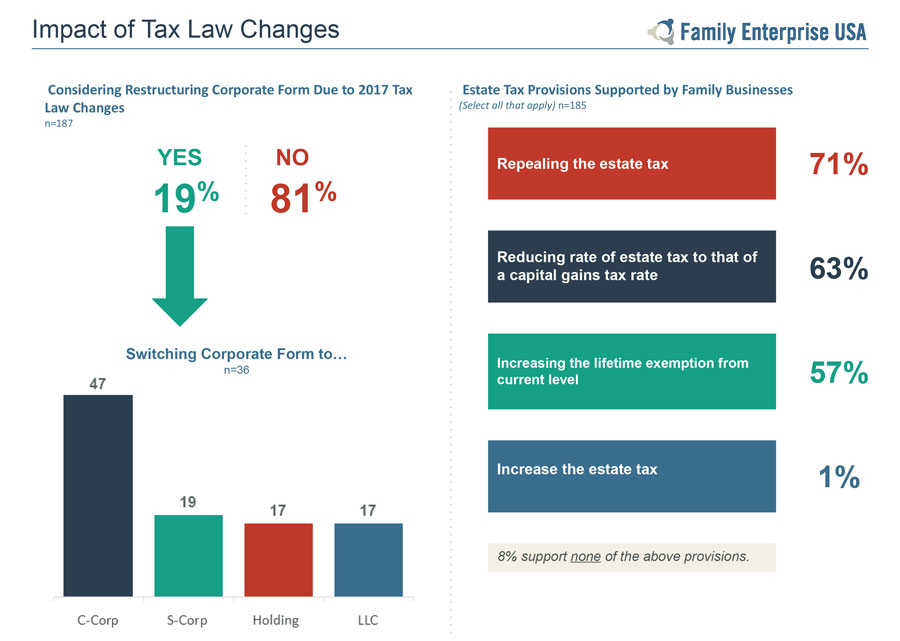

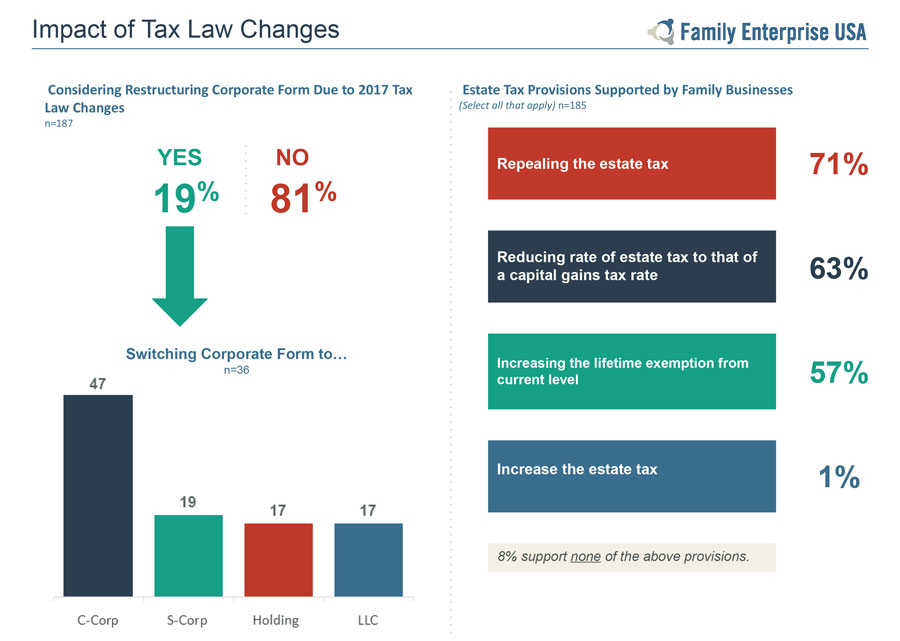

New Survey of Family Businesses Reveals Commitments, Challenges, & Concerns Ahead Family business are key drivers of economic development, but taxes and regulations hinder growth Two-thirds of participating business owners employed more than 50 employees in 2017;...

Jul 23, 2018 | Policy And Taxation Group

Congressman Devin Nunes (CA-22) has introduced a bill in the House of Representatives to eliminate capital gains taxes on inflation. By ending this unfair tax, the Capital Gains Inflation Relief Act (H.R 6444) will encourage both individual and business investment...

Jul 17, 2018 | Policy And Taxation Group

Policy and Taxation Group Supporters Meeting When Thursday, September 27, 2018 from 10:00 AM to 2:00 PM EDT Where Washington D.C. TBD Would you like updates on our estate tax activities, discuss the status of estate tax repeal, the politics of repeal, and estate tax...