Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Each American Dream Hispanic Research Project

Policy and Taxation Group's sister organization Each American Dream (EAD) is in the midst of an exciting research project among Hispanic voters, studying how Latinos view wealth, taxes and the economy, and the American Dream. We kicked off this research in April by...

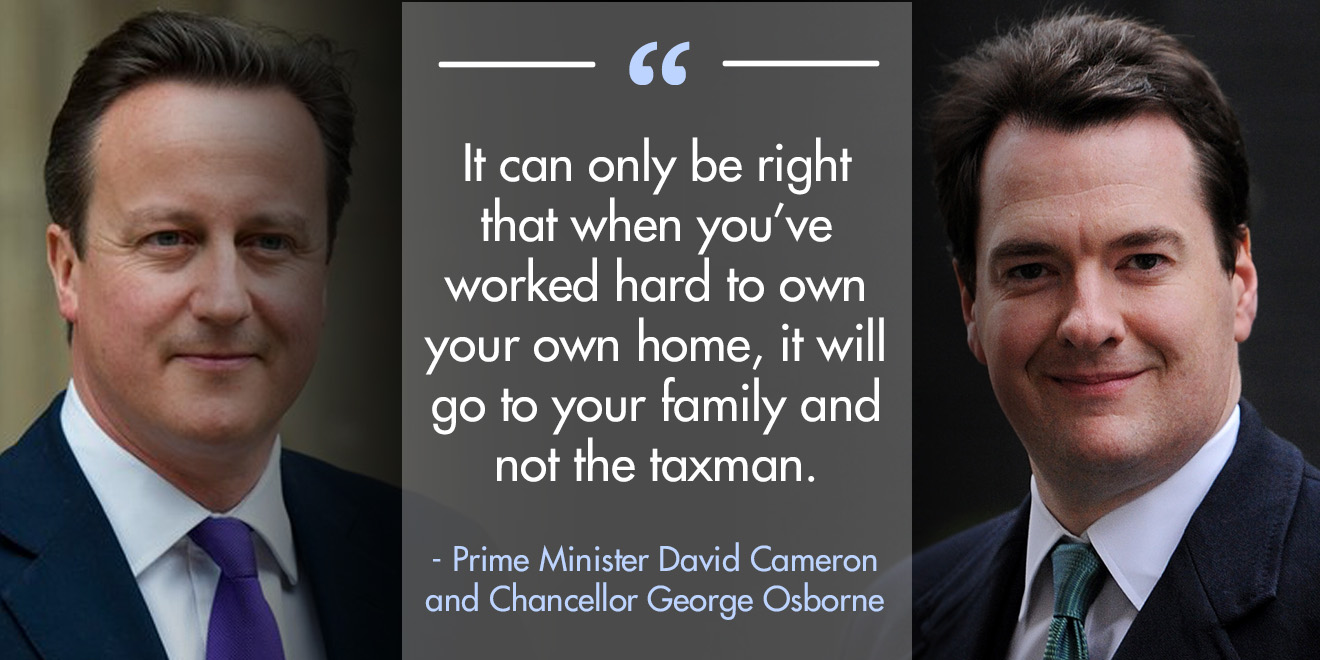

British Proposal to Reduce Estate Tax a Reminder of International Competition

Over the weekend, it came to light that the British Conservatives will soon announce plans to reduce the scope of the United Kingdom's estate tax by dramatically expanding exemptions allowed for a person's main residence. This proposed relief is a positive sign, but...

Sen. Sanders introduces “Responsible Estate Tax Act” to raise the estate tax to 65%

On June 25, U.S. Presidential hopeful Sen. Bernie Sanders (I-VT) presented legislation calling for an across the board hike on federal estate tax rates with the introduction of the "Responsible Estate Tax Act". Sen. Sanders' bill is accompanied by a companion bill in...

Obama’s Double Death Tax

This was originally posted as an op-ed in Roll Call. By Tyler Deaton For the first time in a decade, Congress has decided to seriously examine the burden the death tax — also known as the estate tax — places on grieving families and their small businesses and...

President Proposes Over $400 Billion in New Estate Taxes

This week, President Obama released his budget proposal for Fiscal Year 2016, outlining his spending and tax agenda for the coming year. As with previous proposed budgets, the outline relies heavily on more than $1.5 trillion in new taxes, mostly on high income and...

Treasury Response re: Estate Tax

As we previously reported, PATG has been tracking speculation from inside and outside Washington that the IRS may issue proposed regulations aimed at curbing the availability of valuation discounts for interests in closely-held entities. As you know, such a change...

Exciting Changes at Policy and Taxation Group

I wanted to take this opportunity to notify you of some changes at Policy and Taxation Group (PATG), and formally welcome Tyler Deaton to the team. Tyler will replace Jeff Cook-McCormac as Senior Advisor to the organization. For some time, I have been planning my...

State of the Union Recap

Last night, the President gave his sixth State of the Union address where he outlined his policy agenda for the coming year (video, transcript). The tone of the speech was decidedly optimistic, with broad language urging Congress to work with him to get things done....

Views: Cut waste, fraud and abuse

Source: The Hill By Jeff Cook-McCormac If there is a lesson to be learned from the 2014 midterm elections, it is that Americans are frustrated with the status quo. Voters did not cast their ballots in favor of one political party or the other. Instead, they went to...

News: CBS This Morning – Frank Luntz Cites EAD Election Night Survey

News: New York Times – The Midterms Were Not a Republican Revolution

Source: The New York Times By Frank Luntz On election night 1994, as Republicans recaptured the House for the first time in 40 years, I stood in the audience and watched my client Newt Gingrich, who would soon become speaker of the House, declare the beginning of the...

Thune Sends Letter to IRS Defending Family Businesses

Over the past several months, PATG has been tracking speculation from inside and outside Washington that the IRS may issue proposed regulations aimed at curbing the availability of valuation discounts for interests in closely-held entities. As you know, such a change...

Editorial: Death tax imposes cost on family business stability

Seattle Times NEWS that the last family farm in Issaquah is being sold for residential development is a reminder of one of the subtle ills of our tax system: a death tax that forces many farm families and business owners either to liquidate their assets, or go through...

Frank Luntz Presentation on Women Voters

By Frank Luntz June 18, 2014 To see the full presentation, click here.

News: FOX News reports on EAD Poll

Frank Luntz - an Each American Dream survey found that 78% of Americans now say that working hard and doing the right thing isn't enough to get ahead. Responders point to politicians, corruption, and debt as sources. See the video ...

Frank Luntz Presentation on Income Inequality & Taxes

By Frank Luntz January 28, 2014 To see the full presentation, click here.

Views: Sen. Jim DeMint on Income Inequality

Economic inequality has become the left's great hope for recovering its political integrity after the Obamacare disaster. President Obama, trying to change the subject, has latched onto the issue and is sure to make many more speeches about it in the New Year. New...

News: New York Times – Colorado Voters Reject $1 Billion Tax Hike

DENVER - They had $10 million in contributions, a barrage of advertising and support from the usually warring factions of the educational establishment. But Democratic leaders in this swing state were dealt a stinging defeat on Tuesday as voters resoundingly rejected...

News: Forbes – What is a Wealthy Tax Payer’s Fair Share?

Beginning early in his re-election campaign, President Obama began voicing his belief that our broken tax system and mounting deficit could be fixed — in part, at least – by asking the nation’s wealthiest taxpayer’s to pay their “fair share” of federal income tax. By...

Views: Arthur Brooks on the Value of ‘Earned Success’

I learned to appreciate the American free enterprise system by quitting a job in Spain. At age 19, I dropped out of school to pursue a career as a French horn player. After a few twists and turns, I wound up in the Barcelona Symphony, which was a Spanish government...

Election Results Create New Dynamic for Fiscal Cliff Talks

With the November 6 elections in the rear view, thoughts turn to the lame duck session and the coming 113th Congress. Observers inside the beltway continue to work to interpret the election results and determine how they will shape the near- and long-term prospects...

Election Results Create New Dynamic for Fiscal Cliff Talks

Array

Tax Talk Heats Up in Election

With just a little more than 2 weeks left until election day, the candidates are angling on tax policy and lawmakers are beginning to lay the groundwork for the lame duck session. Here’s the latest from Washington and the campaign trail: Romney and Repeal – On October...

Policy and Taxation Group Welcomes New Team Member

Array

House Passes Tax Extension Package

Array

House Prepares for Action Affecting Estate Taxes

Array

House Prepares for Action Affecting Estate Taxes

On August 1, it was another busy day in Washington as Congress aimed to finish business (for now) on key items, including House consideration of an extension of current income, capital gains, dividend and estate tax parameters. House Action Today – The House was...

House Passes Tax Extension Package

August 1 was a significant day in the ongoing congressional battle over tax policy. Levin Amendment – During consideration of the Republicans’ one-year tax extension bill, Congressman Sander Levin (D-MI) offered an amendment to replace the measure with the...

Estate Tax Action on the Senate Floor

On July 25, intense activity in tax policy debate returned, and estate tax relief is back in the center of attention. Floor Action Today – As we reported on July 19, Senate Democrats have removed the estate tax provisions from their one-year tax extender measure,...

Senate Completes Tax Votes for Now

Array