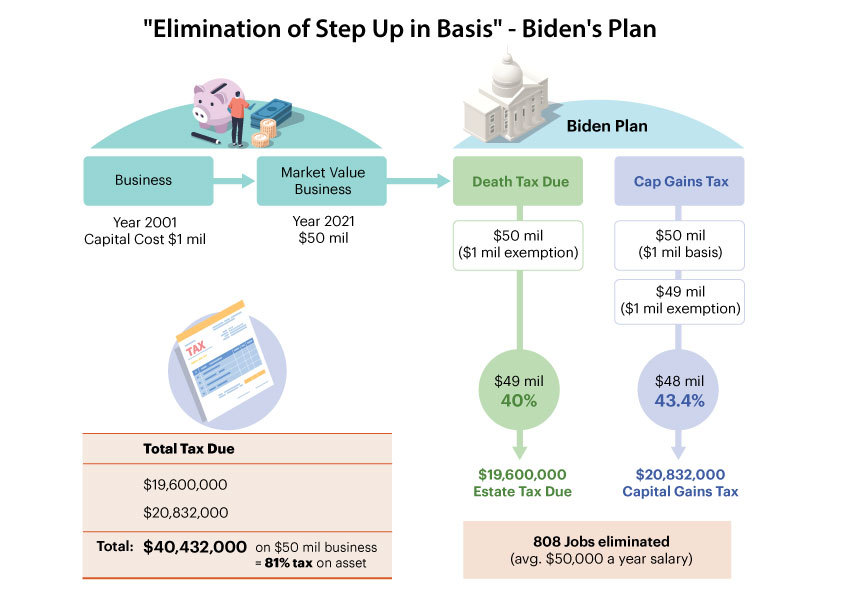

While the devil is in the details, it is possible that if President Biden’s elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%.

The graphic below shows an example of a business worth $50 million, and at the founder’s death, an 81% tax COULD be paid.

So pay close attention to what is being discussed and let your members of Congress know you do not support elimination of step up in basis.

Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families to fully enjoy the economic liberties and benefits of a robust free market unique to our nation. For over 25 years, we have been the loudest voice in the nation’s capital on eliminating the death tax. This ill-conceived tax has a destructive impact on families, family businesses, job creation, and the national economy.