The United States has one of the highest rates of estate tax in the world. While other countries may call a tax on assets at death, an estate or inheritance tax it is still an additional tax on assets.

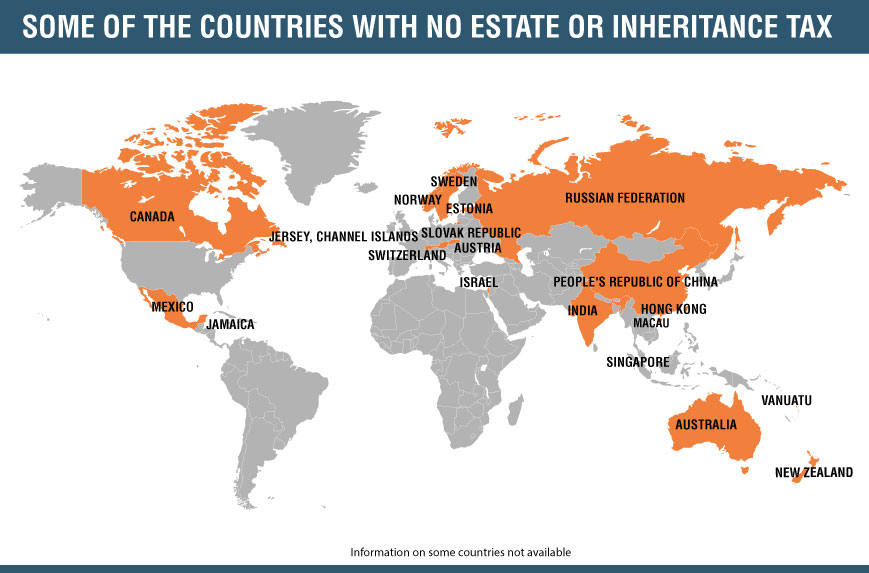

Many other developed countries have eliminated their estate or inheritance tax like Russia, India, China, Australia, Norway, Mexico, and more.

The United States continues to impose an estate tax on assets at death for over 100 years. This tax imposes additional costs to family businesses making competing with countries who do not impose an estate or inheritance tax very difficult. For those countries including the US who currently have an estate or inheritance see the image below.

Policy and Taxation Group is your voice in Washington on economic freedom. We advocate for policies that allow American families to fully enjoy the economic liberties and benefits of a robust free market unique to our nation. For over 25 years, we have been the loudest voice in the nation’s capital on eliminating the death tax. This ill-conceived tax has a destructive impact on families, family businesses, job creation, and the national economy.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness