Sep 13, 2021 | Blog, In The News, Policy And Taxation Group, Tax Cuts

Get Your Voice Heard in Congress. Please Take Action Today GIFTS AND ESTATES AND TRUSTS Final regulations establishing a user fee for estate tax closing letters. Proposed regulations were published on December 31, 2020. Final regulations under §§1014(f) and 6035...

Sep 10, 2021 | Blog, In The News, Policy And Taxation Group, Tax Cuts

Get Your Voice Heard in Congress. Please Take Action Today We wanted to call your attention to draft legislation that Senators Ron Wyden and Sherrod Brown released today that would make significant changes to the taxation of partnership distributions, allocations, and...

May 27, 2021 | Blog, Family Businesses, In The News, Policy And Taxation Group, Tax Cuts

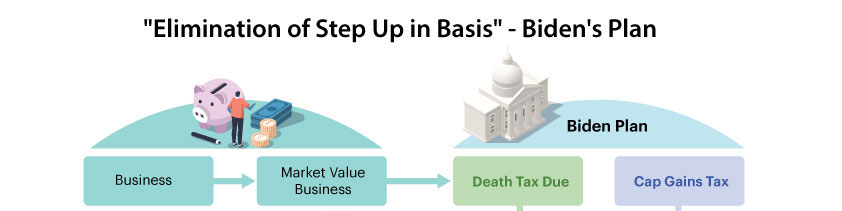

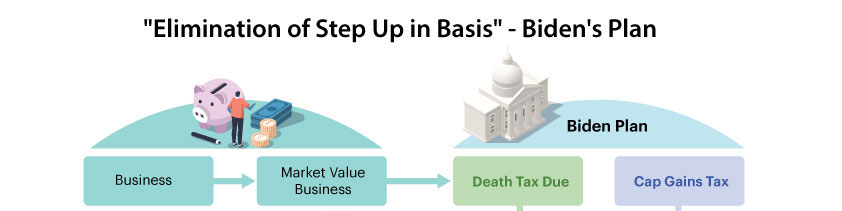

While the devil is in the details, it is possible that if President Biden’s elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%. The graphic below shows an example of a...

May 24, 2021 | Blog, Death Tax, Estate Tax, In The News, Policy And Taxation Group, Tax Cuts

Contact Your Member Of Congress There are efforts in DC to make the estate tax (death tax) worse; higher than a 40% tax on your business and all your assets! But there is hope; a bill to reduce the rate of tax from 40% to 20% has been introduced in the House HR 3178...

May 13, 2021 | Blog, Death Tax, Estate Tax, Family Businesses, In The News, Tax Cuts

Earlier today, Congressman Jodey Arrington (R-TX) and Congressman Henry Cuellar (D-TX) and Senator Tom Cotton (R-AR), on a bipartisan, bicameral basis, introduced the Estate Tax Rate Reduction Act of 2021 (H.R. 3178 and S 1627). This legislation would reduce the...

May 11, 2021 | Blog, Death Tax, Estate Tax, Family Businesses, In The News, Tax Cuts

Register Now Pat Soldano will be apeaking on “Family Business Economic Impact, Family Business Issues and Voter Attitudes”. Family Businesses employ 59% of all workers in the US and generate 54% of GDP, (“2021 Contribution of Family Businesses to the US...