Jul 23, 2025 | Family Offices, Estate Tax, Family Businesses, Generationally Owned Business, Income Tax, Successful Families, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Passthrough Deduction Eyed for Bigger Boost in Future Bill: House Republicans are weighing the...

Jul 11, 2025 | Family Offices, Family Businesses, Generationally Owned Business, Income Tax, Successful Families, Tax Cuts, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Constant, Consistent Education with Congress Pays Off in ‘One Big Beautiful Bill’ for Family-owned...

Jul 10, 2025 | Family Offices, Family Businesses, Generationally Owned Business, Income Tax, Successful Families, Tax Cuts, Taxes

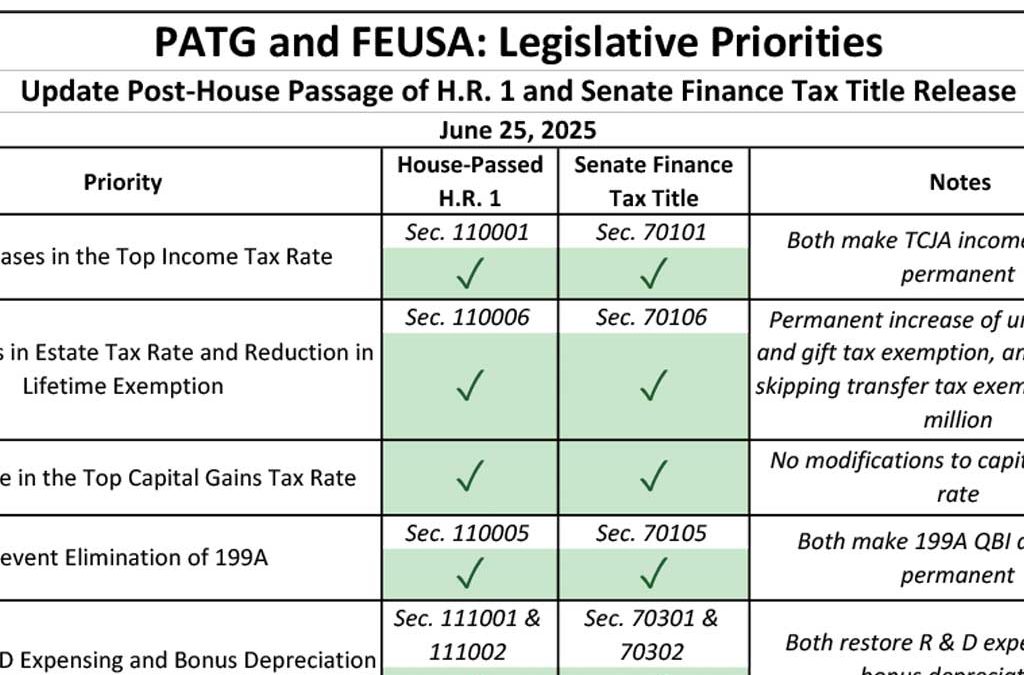

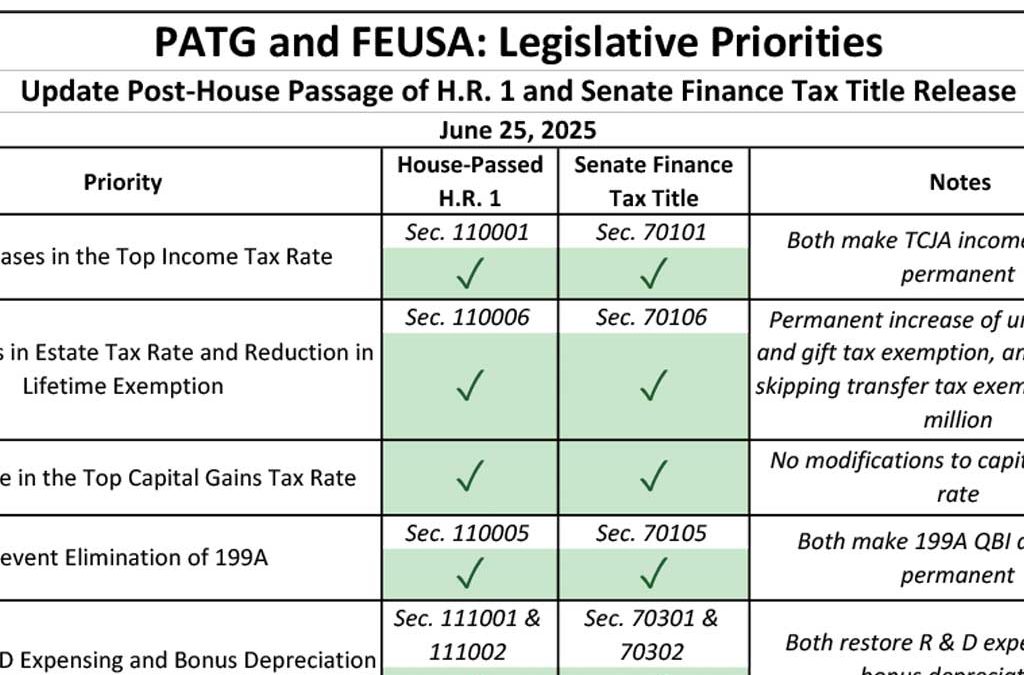

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. On July 3, the House adopted the Senate substitute to H.R. 1, the One, Big, Beautiful Bill Act (OBBBA)...

Jul 3, 2025 | Family Offices, Estate Tax, Family Businesses, Generationally Owned Business, Income Tax, Successful Families, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Today, the House approved the Senate’s version of Republicans’ multi-trillion-dollar reconciliation...

Jul 1, 2025 | Family Offices, Estate Tax, Family Businesses, Generationally Owned Business, Income Tax, Successful Families, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. The Senate approved a revised version of the One Big Beautiful Bill Act (OBBBA) (H.R. 1) on July 1,...