Jan 30, 2026 | Family Offices, Family Businesses, Family Enterprise USA, Successful Families

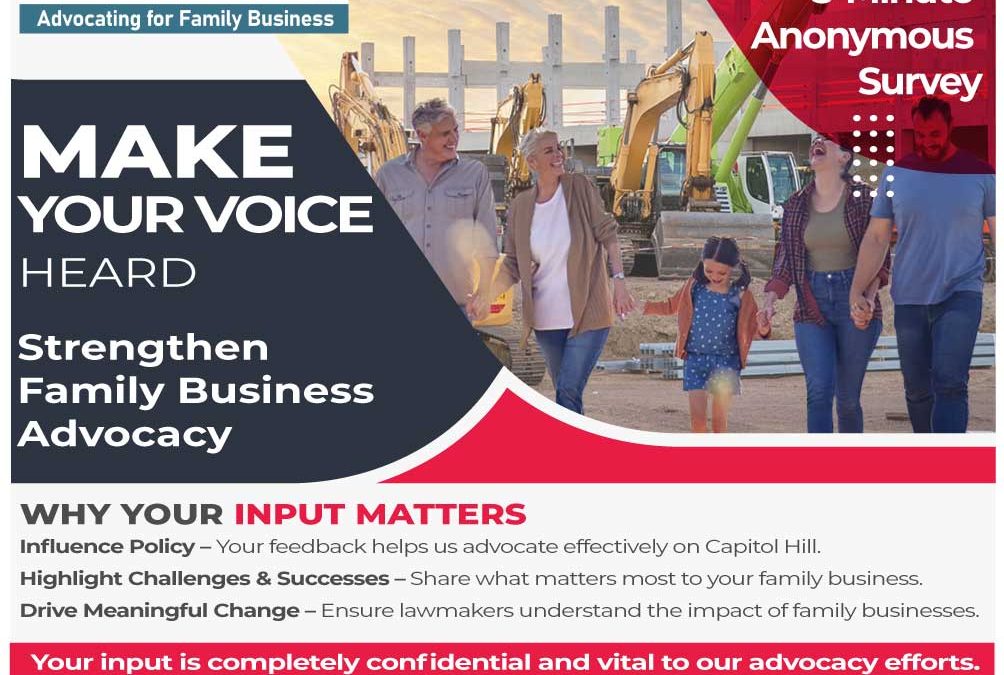

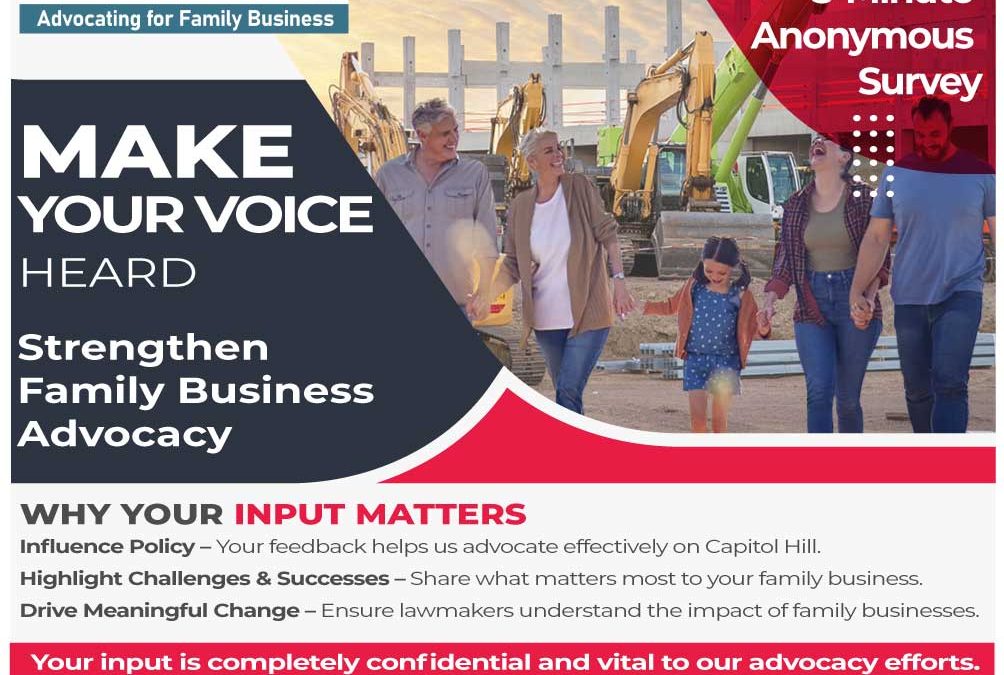

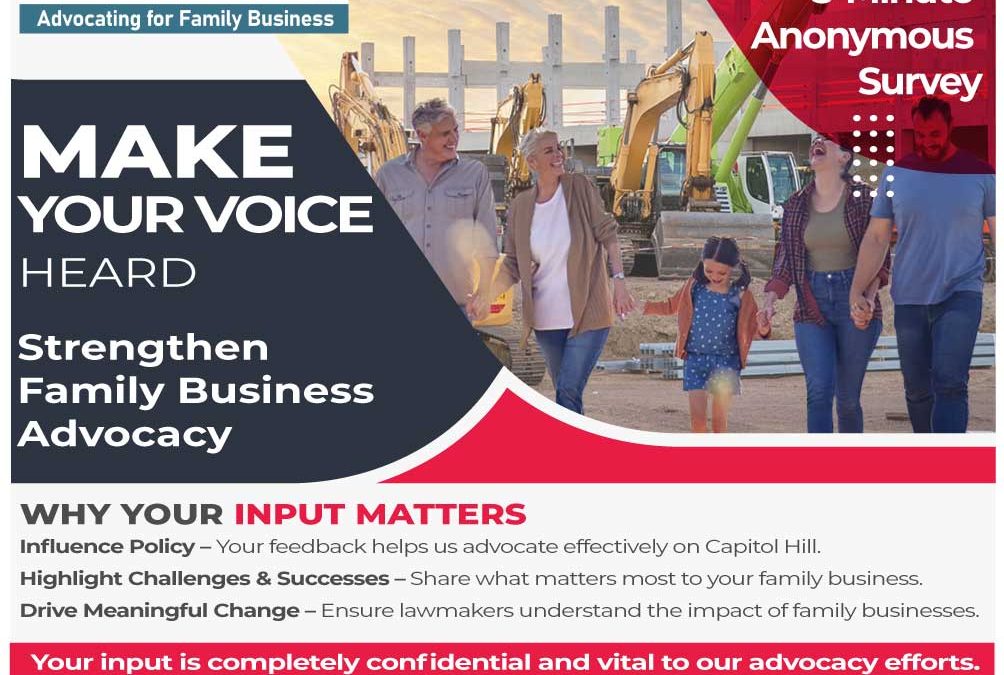

Your Company’s Story Could Shape National Policy – Do You Have 5 Minutes? At Family Enterprise USA, we champion family-owned businesses like yours every day in Washington. But to win real policy victories, we need your help. Share quick facts about your...

Jan 16, 2026 | Family Offices, Family Businesses, Family Enterprise USA, Successful Families

Your Company’s Story Could Shape National Policy – Do You Have 5 Minutes? Share quick facts about your family-owned business anonymously – help us fight for better laws on Capitol Hill and unlock exclusive 2026 webcast access. Your data makes the...

Jan 13, 2026 | Family Offices, Family Businesses, Family Enterprise USA, Successful Families

At Family Enterprise USA, we’re dedicated to advocating for family-owned businesses across America. Your perspective is crucial to this mission. Why Your Input Matters:Your insights help us represent family-owned businesses effectively on Capitol Hill....

Jan 9, 2026 | Family Offices, Family Businesses, Family Enterprise USA, Successful Families

Lido Consulting, Family Enterprise USA Discuss New Wealth Tax Proposals, Impact of H.R. 1 on Family Businesses Lido’s Greg Kushner, FEUSA’s Pat Soldano Provide Insider Views on How Legislation Will Affect Family Businesses, Family Offices, Successful Families ...

Jan 8, 2026 | Family Offices, Family Businesses, Family Enterprise USA, Successful Families

At Family Enterprise USA, we’re dedicated to advocating for family-owned businesses across America. Your perspective is crucial to this mission. Why Your Input Matters:Your insights help us represent family-owned businesses effectively on Capitol Hill....

Dec 22, 2025 | Family Offices, Family Businesses, Family Enterprise USA, Successful Families

Hydraflow’s CEO Cindy Ayloush Joins Family Enterprise USA’s Advisory Board; Advocates for Family-Owned Businesses Board Provides Strategic Guidance, Expertise, Support Family Enterprise USA has named Cindy Ayloush, Chief Executive Officer and Chairman of...