Revised July 17, 2017

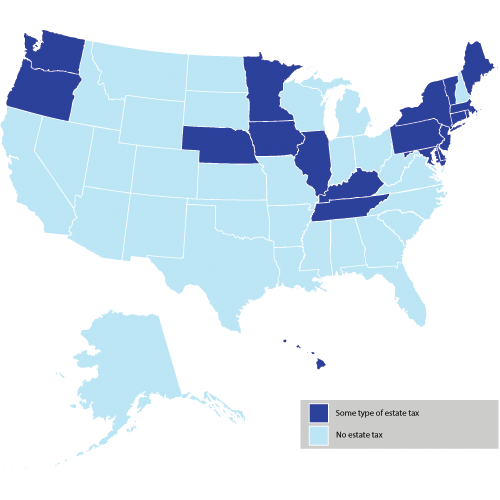

PATG State Death Tax Chart — July 17, 2017

This chart is maintained for the Policy and Taxation Group Website and is updated regularly. Any comments on the chart or new developments that should be reflected on the chart may be sent to [email protected].