Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

Advanced Estate Planning Tactics for Wealthy Families – Register Now

Register Now May 30, 2025 | 10:00 AM – 11:00 AM PDT "Estate Planning for High-Net-Worth Families: Beyond the Basics" When it comes to estate planning for high-net-worth and ultra-high-net-worth families, the basics are just the beginning. Join us for a live...

Tax Update: House Passes Reconciliation Package

On May 22, just before 7 am ET, the House of Representatives passed Republicans’ multi-trillion-dollar reconciliation package, the One Big Beautiful Bill Act (H.R. 1), by a vote of 215-214-1, with Reps. Warren Davidson (R-OH) and Thomas Massie (R-KY) joining all...

Build a Family Office That Works: New Podcast + Webcast with EY Experts

Building the Right Family Office, Using Parallel Governance Strategies Detailed by EY’s Family Enterprise and Office Leaders New Podcast, Webcast Hosted by Family Enterprise USA Now Available Creating the right family office and establishing separate governing...

Elevate Your Estate Plan: Strategies for High-Net-Worth Families

Register Now May 30, 2025 | 10:00 AM – 11:00 AM PDT "Estate Planning for High-Net-Worth Families: Beyond the Basics" When it comes to estate planning for high-net-worth and ultra-high-net-worth families, the basics are just the beginning. Join us for a live...

Tax Update: House Budget Committee Blocks Reconciliation Bill

Today, the House Budget Committee rejected Republicans’ multi-trillion-dollar border, energy, and tax package 16 to 21, in a likely temporary setback for the reconciliation bill over concerns from conversative Republicans over several aspects of the legislation....

House Ways and Means Committee Budget Completes Reconciliation Markup

On Tuesday afternoon, May 13, the Ways and Means Committee (“Committee”) started its markup of the tax title for the FY2025 budget reconciliation bill. The Committee favorably reported the bill on Wednesday morning, May 14, by a party-line vote of 26-19. During...

Translating the Initial Ways and Means Legislative Language Ahead of Tuesday’s Markup

Key Takeaways and Implications of this Initial Tax Language On Friday evening, Ways and Means Committee Chairman Jason Smith (R-MO) released initial legislative language for the Committee's scheduled markup on Tuesday, May 13, at 2 p.m. In general, the 28-page...

Quick Poll – Share Your Thoughts on Tariffs

We’re gathering feedback from family-owned business leaders like you on how tariffs are impacting your business. It’s just one quick question and takes less than a minute! Click here to vote now Thanks for sharing your input. We hope you’ve enjoyed this article. While...

Tax Update: Ways and Means Notices Tuesday Markup

Tax Update: House Ways and Means Committee Notices Tuesday Markup, Releases Preliminary Legislative Text On May 9, the House Ways and Means Committee noticed a markup of its portion of the House reconciliation bill to be held on Tuesday, May 13, at 2 pm ET. ...

Unlock Smarter Estate Planning for High-Net-Worth Families – May 30

Register Now May 30, 2025 | 10:00 AM – 11:00 AM PDT "Estate Planning for High-Net-Worth Families: Beyond the Basics" When it comes to estate planning for high-net-worth and ultra-high-net-worth families, the basics are just the beginning. Join us for a live...

Preserving Legacy, Building Value: Real Estate for Families

Family businesses face a unique challenge: balancing near-term needs with long-term legacy. At Buchanan Street Partners, we understand that real estate can be more than just an asset—it can be a strategic lever for multi-generational success. Whether you're evaluating...

Family Business Voices Heard on Capitol Hill – Read the Full Recap by Pat Soldano

In a time of economic uncertainty and policy shifts, family owned business leaders are stepping up to make their voices heard. In a recent article for Family Business Magazine, Pat Soldano shares highlights from the March Congressional Family Business Caucus event,...

Family-Owned Businesses Essential to American Dream New Luntz Survey Shows

Family-Owned Businesses Essential to American Dream, Most Trusted Businesses in the Economy, New Luntz Survey Shows Communications Expert, Pollster Dr. Frank Luntz Surveys Voters on Family-owned Businesses, the American Dream, and Tax Fairness Family-owned...

Weekly Washington Tax Update and More: Trump, Johnson Push Back on Tax Hikes for Wealthy

Trump and Johnson Reject Proposal to Raise Taxes on Wealthy: On April 23, House Speaker Mike Johnson (R-LA) publicly stated his opposition to creating a new, higher marginal income tax rate on the most affluent taxpayers, an idea that has been floated in some...

Demystifying the Family Office: Expert Insights on Structure, Models, and Best Practices with EY

In this insightful episode of the Family Enterprise USA podcast, host Pat Soldano welcomes Catherine Fankhouser and John Fitton, Family Office Advisory executives from Ernst & Young. Together, they delve into the complex world of family offices, providing clarity...

Saying It Out Loud Special Report May 2025, By Pat Soldano

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupWho Should Pay More Taxes? Hard-Working Family-owned Businesses Are Caught in the Movement to ‘Tax the Rich’ Keeping Successful Family-Owned Businesses Strong, Creating Tax Policies to Help...

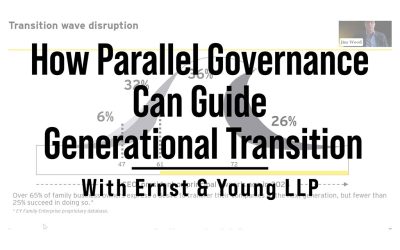

How Parallel Governance Can Guide Generational Transition with EY

Complex family and business dynamics can derail the generational transition of a family enterprise. Addressing this risk demands clear boundaries between family, ownership, governance and management. Parallel governance, or the establishment of separate governance...

Community Involvement Highlights May 14 Meeting with Members of the Congressional Family Business Caucus

Community Involvement Highlights May 14 Meeting with Members of the Congressional Family Business Caucus, Family Businesses Family-Owned Business Leaders Share Importance of Family Businesses Supporting Local Communities, Charities with House Members; Frank Luntz...

Taxation & Representation: What’s in Reconciliation?

Budget Reconciliation Outlook—Committees Schedule Markups as Congress Addresses Details of Reconciliation Measure: After the two-week recess for Easter/Passover, congressional Republicans returned to Washington looking to finalize tax and other provisions to be...

Estate Planning for High-Net-Worth Families: Beyond the Basics

Register Now May 30, 2025 | 10:00 AM – 11:00 AM PDT "Estate Planning for High-Net-Worth Families: Beyond the Basics" When it comes to estate planning for high-net-worth and ultra-high-net-worth families, the basics are just the beginning. Join us for a live...

Million Dollar Question: Will the Top 1% See a Tax Increase in 2026

With the reconciliation framework in place, congressional Republicans face the challenge of crafting a final bill. As they aim to solidify tax provisions from the Tax Cuts and Jobs Act, deliver on promises President Trump made to working-class voters and...

Saying It Out Loud, By Pat Soldano. April 2025.

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupHouse, Senate Leave Capitol Hill as ‘One, Big, Beautiful’ Tax Bill Edges Closer to Reality for Family Offices, Successful Families Also, New Annual Survey Ranks Personal Income Taxes as...

2 Days Left to Register: How Parallel Governance Can Guide Generational Transition

Register Now for the April 25 Webcast: Starting at 10:00 AM Pacific Time "How Parallel Governance Can Guide Generational Transition" Complex family and business dynamics can derail the generational transition of a family enterprise. Addressing this risk demands...

Advocacy Small Business Roundtable on Anti-Competitive Regulations

Speak Up: Share Your Input on Regulations That Hurt Small Business The Small Business Administration (SBA) Office of Advocacy is hosting a virtual Small Business Roundtable next Wednesday, April 30 from 1-3 pm ET on “Anti-Competitive Regulations.” Are...

FEUSA Reaches Million Member Milestone with Outreach to Associations with Family-Owned Businesses

Family Enterprise USA Reaches Million Member Milestone with Outreach to Associations with Family-Owned Businesses Family Enterprise USA Attracts Wide Range of Industries, From Trucking to Restaurants, Creating a Stronger Voice on Capitol Hill for Family-owned...

Secure Your Legacy: Don’t Miss This Exclusive Webcast

Complex family and business dynamics can derail the generational transition of a family enterprise. Addressing this risk demands clear boundaries between family, ownership, governance and management. Parallel governance, or the establishment of separate...

Lido Consulting’s Annual Family Office Investment Symposium Features Soldano and Luntz

Lido Consulting’s 19th Annual Family Office Investment Symposium Features Family Enterprise USA President Pat Soldano, Communications Expert Frank Luntz Three-Day Lido Event Kicks-off April 29 with Closed-Door Family Office Roundtable with Pat Soldano; Ends May 1...

Pat Soldano and Mark Warren Highlight Family Business at Sonoma Authors Festival

Family Enterprise USA’s Pat Soldano, Brownstein’s Mark Warren Speak at Sonoma Authors Festival on Importance Family Businesses Over 25 Well-Known Authors, including Isabel Allende and Michael Connelly, Discuss Successful Writing, Business of Writing, and...

Secure Your Legacy: Don’t Miss This Exclusive Webcast

Complex family and business dynamics can derail the generational transition of a family enterprise. Addressing this risk demands clear boundaries between family, ownership, governance and management. Parallel governance, or the establishment of separate...

Family Business and Successful Family Insights from John Gugliada & Pat Soldano – Watch Now

IFA’s recent webinar, Protecting the Legacy of Family Businesses & Successful Individuals in Today’s Legislative Environment, featured key insights from John Gugliada, Director of Family Business Engagement, and Pat Soldano, President of Family Enterprise USA....