Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

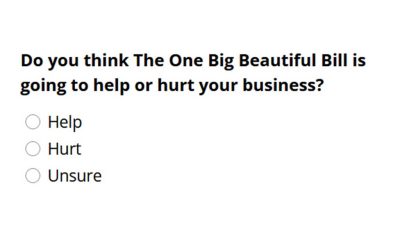

Quick Poll: Share Your Thoughts on The One Big Beautiful Bill

We’d love to hear from you! Please take a moment to participate in our quick poll on The One Big Beautiful Bill . Your input helps us better understand and represent the interests of family owned businesses across the country. Click here to vote. Thank...

Family-Owned Businesses Succeed 20 Years Plus, While Fostering Generations of Employees, According to Survey

America’s Family-Owned Businesses Succeed 20 Years Plus, While Fostering Generations of Employees, According to Family Enterprise USA Survey Study Shows 66% of “Next Generation” Work in Their Family Businesses, While Employee Family Members Also Stay for...

Taxation & Representation: Senate Unveils Tax Package That Could Reshape 2025 Policy – Read the Highlights

Senate Finance Committee Releases Full Text of Tax Package: On June 16, Senate Finance Committee Chairman Mike Crapo (R-ID) released text of the committee’s tax title for the Senate’s fiscal year (FY) 2025 budget reconciliation bill, as well as a section-by-section...

Controlling Risk and Maximizing Protection Through Consultation and State of The Art Technology

Family Enterprise USA has partnered with USI to help our members make informed insurance decisions while maximizing protection for their businesses. PATH is USI’s game-changing platform that guides you through the entire risk control process, from identifying...

Family Business Governance

In this episode of “Voice of Family Business on Capitol Hill” host Pat Soldano of Family Enterprise USA speaks with Bill Rock, CEO of MLR Media, a media and events company that publishes Family Business, Directors & Boards, FO Pro, and Private Company Director...

Tax Update: Senate Republicans Release Tax Text

We’ve completed our initial analysis of the Senate Finance Committee’s legislative text. Below is a detailed summary along with key supporting documents. TCJA Extension – As with the House-passed bill, the legislation makes permanent or extends several...

Stronger Teams. Stronger Legacy.

Register Now June 27, 2025 | 10:00 AM – 11:00 AM PDT "Better Together: Strengthening Family Enterprise Teams" Join us for a webcast featuring Eliza Orleans, Principal at CFAR. How can family business leaders design and motivate teams across the...

Will “The One Big Beautiful Bill” Deliver for Family Offices? Pat Soldano breaks it down.

‘Big Beautiful’ tax bill gets Senate review as family businesses anticipate tariff impactBy Pat Soldano | Family Business Magazine As the “One Big Beautiful Bill Act” winds through Congress, family-owned businesses are watching closely. The bill includes...

Tax Update: Senate Republicans Finalizing Tax Bill Changes

Senate Republicans continue to weigh counterproposals to key provisions of the House-passed reconciliation package, the One Big Beautiful Bill Act (H.R. 1), this week as the Senate races to pass the tax and spending bill by July 4. On Wednesday, Senate Finance...

Taxation & Representation: Senate Eyes Major Changes to H.R. 1 – What’s at Stake for Family Offices and Successful Individuals

The Senate Republicans continue to meet internally and with stakeholders regarding the provisions of a reconciliation package (H.R. 1). Senate Majority Leader John Thune (R-SD) made it clear that the Senate will make modifications to the bill in the next two...

Discover What Makes Great Family Enterprise Teams Tick

Register Now June 27, 2025 | 10:00 AM – 11:00 AM PDT "Better Together: Strengthening Family Enterprise Teams" Join us for a webcast featuring Eliza Orleans, Principal at CFAR. How can family business leaders design and motivate teams across the...

Women’s Business Owners Group Gains Momentum

Women’s Business Owners Group Gains Momentum, While Power of Women Entrepreneurs Gets Noticed in Congressional Record Family Enterprise USA Organized Women Business Events Getting Heard by Senate, House Leaders; Top Women Business Owners Get Recorded in...

Taxation & Representation: Senate Gears Up to Rewrite House Tax Package – Here’s What’s Changing

House Passes Reconciliation Package, with Senate Expected to Make Changes: On May 22, the House of Representatives passed H.R. 1, “The One, Big, Beautiful Bill Act,” legislation authorized under the FY 2025 concurrent budget resolution (H. Con. Res. 14). The bill...

Register Now to Strengthen Your Family Business Teams

Register Now June 27, 2025 | 10:00 AM – 11:00 AM PDT "Better Together: Strengthening Family Enterprise Teams" Join us for a webcast featuring Eliza Orleans, Senior Manager at CFAR. How can family business leaders design and motivate teams across the...

{PODCAST} Top 10 Tax Changes the Senate Will Make to the One Big Beautiful House Bill

Before heading into the Memorial Day recess, House Republicans met their self-imposed deadline by narrowly passing the One Big Beautiful Bill Act. Now, the reconciliation package moves to the Senate, where it faces criticism from both fiscal conservatives and...

Award Winning Youth Video Filmmaker Tackles Importance of Family-Owned Businesses

Award Winning Youth Video Filmmaker Tackles Importance of Family-Owned Businesses; Family Enterprise USA Annual Family Business Survey 2025 Data Used, Previewed at Recent Congressional Family Business Caucus Ava Skye Barton, an internationally award-winning student...

Take Action: Help Family-Owned Businesses Thrive. Support Extension of TCJA

The Tax Cuts and Jobs Act (TCJA) is set to expire at the end of 2025, putting key tax provisions that support America’s family-owned businesses at risk. These businesses generate nearly 60% of U.S. jobs and contribute 54% of the nation’s GDP. Your voice matters. Urge...

Estate Planning for High-Net-Worth Families: Beyond the Basics with Brown & Streza

This webcast, hosted by Pat Soldano of Family Enterprise USA and Policy and Taxation Group, features Michael Offenheiser from Brown & Streza discussing fundamental estate planning for high net worth families. Michael explains that effective estate planning for...

[WEBINAR] Top Priorities for Family Enterprises in 2025: Income Taxes, Policy Shifts, and What Comes Next

In a year marked by political transition, economic unpredictability, and the looming sunset of the 2017 Tax Cuts and Jobs Act, family enterprises are navigating a uniquely uncertain tax landscape. Join Tamarind Learning's Chief Learning Officer, Torri Hawley,...

Snapshots of Family-Owned Businesses Show 80% are Pass Through Entities, Pay Higher Taxes, According to Survey

Snapshots of America’s Family-Owned Businesses Show 80% are Pass Through Entities, Pay Higher Taxes, According to Family Enterprise USA Survey Manufacturing is No. 1 Family Business Industry; 81% in Business for 20 Years or More If you own a family business today...

The One Big Beautiful Bill (HR 1): A Deep Dive for Family Businesses

This podcast features a discussion with tax policy experts Russ Sullivan of Brownstein Law Firm and Michael Hawthorne of Squire Patton Boggs about the "One Big Beautiful Bill" (HR 1), an anticipated extension and modification of the 2017 Tax Cuts and Jobs Act. ...

White House Releases Additional FY26 Budget Details

On Friday, May 30, the Trump administration released the Technical Supplement to the 2026 Budget (“Appendix”). The appendix follows the May 2 release of the president’s recommendations on discretionary funding levels for fiscal year (FY) 2026 (“Skinny Budget”). ...

Quick Poll: Share Your Thoughts on Income Tax Policy

We’d love to hear from you! Please take a moment to participate in our quick poll on income tax policy. Your input helps us better understand and represent the interests of family owned businesses across the country. Click here to vote. Thank you for...

Saying It Out Loud Special Report on Tariffs May 2025, By Pat Soldano

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupFamily-Owned Businesses Feel the Impact of New Tariffs, ‘Weight of Uncertainty’ Family-owned businesses across America are keeping their fingers crossed they will survive the cost and...

Weekly Digest: House OKs Major GOP Tax Bill, H.R. 1 Advances Health Reforms, and more.

DOJ Issues New Guidance on White-Collar Prosecutions and Corporate MonitorsBy Greg Brower, Evan Corcoran, Jason Dunn and Will Moschella On May 12, 2025, the current head of the Department of Justice’s (DOJ) Criminal Division issued fresh guidance to all personnel...

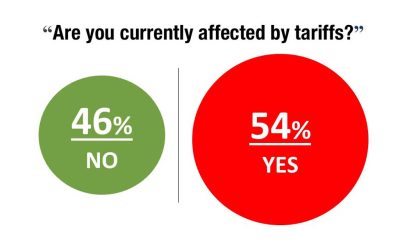

Are Tariffs Helping or Hurting? New Spot Survey Shows Family Business Leaders Split

Family Enterprise USA recently conducted a “Spot Poll” among family-owned businesses leaders on the Trump Administration’s tariff strategy. Over 60 family-owned business leaders replied to the survey asking if they “are affected by tariffs?” The survey found...

H.R. 1 Tax Title – Summary and Analysis

On May 22, the House of Representatives passed H.R. 1, “The One, Big, Beautiful Bill Act,” legislation authorized under the FY 2025 concurrent budget resolution (H. Con. Res. 14). The bill includes a broad range of tax-and-spending provisions developed by 11...

“Charitable Giving and Community Involvement” Event and Congressional Outreach Day – May 2025

Pat Soldano opened the event by thanking Members of Congress, congressional staff, and family-owned businesses for joining the second Family Enterprise USA (FEUSA) Capitol Hill event of 2025. Pat kicked off the panel discussion by highlighting FEUSA’s mission to...

New Webcast & Podcast Explore Family Office Hiring Trends, Family Biz Research with Pat Soldano

Family Office Hiring Trends Detailed in New Mack Intl. Webcast; New Family Business Magazine Podcast Features Pat Soldano, Results from Family-owned Business Research Securing Talent, Family-owned Business Concerns Spotlighted in Two New Online Episodes Now...

Saying It Out Loud May 2025, By Pat Soldano

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupNew Coalition of Women Business Owners Empowers Women Entrepreneurs, Engages Directly with Congress In a recent meeting in Washington, D.C., with Congressional Family Business Caucus members,...

![Content [WEBINAR] Top Priorities for Family Enterprises in 2025: Income Taxes, Policy Shifts, and What Comes Next](https://policyandtaxationgroup.com/wp-content/uploads/2025/06/Instagram-Tamarind-webinar-400x250.jpg)