Latest Updates: News, Issues, Announcements, Webcasts, Whitepapers, and More

PATG Announces Q3 Family Office and Successful Family Events; Caucus Meeting Set for Sept. 17

Meeting with Members of Congressional Family Business Caucus Set for Sept. 17; Third Quarter Events Scheduled for Family Enterprise USA, Policy and Taxation Group Over a dozen regional and virtual family business and family office meetings, including the next...

Congress and Family Business: A Policy Win Checklist

The provided text from "Congress will Listen.pdf" discusses how consistent and constant communication with Congress led to the successful passage of the One Big Beautiful Bill Act (H.R. 1) on July 4th. This legislation is presented as a significant victory for...

24 Hours Left – Last Chance to Register: Rockefeller’s Formula for Legacy Success

Register Now July 25, 2025 | 10:00 AM – 11:00 AM PDT "Smart Strategies for Family Business Success" Join us on this webcast featuring Shirley Quackenbush, Robert Panetti, Ryan Coulson, and Michael Misciagna at Rockefeller Global Family Office. We will discuss...

Taxation & Representation: Passthrough Deduction May Rise – What It Means for Your Family Office and Successful Families

Passthrough Deduction Eyed for Bigger Boost in Future Bill: House Republicans are weighing the possibility of a second major tax package following the recent enactment of their One, Big, Beautiful Bill Act (OBBBA, Public Law 119-21), which extends key provisions of...

Estate Planning, Tax Policy for High-Net-Worth Families Featured in Webcast and Webinar

Estate Planning, Tax Policy for High-Net-Worth Families Featured in Webcasts with Brown & Streza, Dividend Assets Capital Family Enterprise USA hosts and Policy and Taxation Group Experts Provide Insights The fundamentals of estate planning for high-net-worth...

Webcast Happening Soon: Smart Tax & Legacy Tips for Family Business Owners

Register Now July 25, 2025 | 10:00 AM – 11:00 AM PDT "Smart Strategies for Family Business Success" Join us on this webcast featuring Shirley Quackenbush, Robert Panetti, Ryan Coulson, and Michael Misciagna at Rockefeller Global Family Office. We will discuss...

Plan Smarter: Strategies to Build Harmony and Preserve Wealth

Register Now July 25, 2025 | 10:00 AM – 11:00 AM PDT "Smart Strategies for Family Business Success" Join us on this webcast featuring Shirley Quackenbush, Robert Panetti, Ryan Coulson, and Michael Misciagna at Rockefeller Global Family Office. We will discuss...

Saying It Out Loud July 2025, By Pat Soldano

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupCongress Listens When Message is Constant and Consistent; ‘One Big Beautiful Bill’ Shows Congress Heard Us Educating Voters and Congress Pays Off for Family Offices and Successful Individuals ...

FEUSA Featured in New Videos by Tamarind Learning and YouTube’s ‘The Vault’

Family Enterprise USA Featured in New Videos by Tamarind Learning and YouTube’s ‘The Vault’ Topics Cover Family Business Priorities, New Tax Bill, and Next Generation Planning Family business priorities, the new tax bill, and succession are detailed in two new...

Don’t Miss This: Family Business Success Strategies Revealed Live

Register Now July 25, 2025 | 10:00 AM – 11:00 AM PDT "Smart Strategies for Family Business Success" Join us on this webcast featuring Shirley Quackenbush, Robert Panetti, Ryan Coulson, and Michael Misciagna at Rockefeller Global Family Office. We will discuss...

Constant, Consistent Education with Congress Pays Off in ‘OBBB’ for Family-owned Businesses, Family Offices

Constant, Consistent Education with Congress Pays Off in ‘One Big Beautiful Bill’ for Family-owned Businesses, Family Offices Working with Congress on the critical tax and economic policies affecting family-owned businesses, family offices, and successful...

The One, Big, Beautiful Bill Act – Summary and Analysis

On July 3, the House adopted the Senate substitute to H.R. 1, the One, Big, Beautiful Bill Act (OBBBA) by a vote of 218-214. The bill was signed into law on July 4, 2025. To read a breakdown of the full bill, please click here. About Brownstein Hyatt Farber...

Join Pat Soldano, Russ Sullivan & John Gugliada at FOX’s 2025 Family Office Forum

Join Pat Soldano, Russ Sullivan, and John Gugliada at the 2025 FOX Family Office & Wealth Advisor Forum, where leading family office executives and advisors come together to tackle the most pressing challenges in the UHNW space. This premier event offers...

Wealth, Complexity & The One Big Beautiful Bill: Time for a Family Office?

By Elizabeth M. Anderson, CEPAVice PresidentWhittier Trust | Wealth Management ServicesFamily-owned businesses are successful because the principals care deeply about their family name. Whittier Trust creates and executes plans to sustain the legacy of these...

Family Enterprise USA Creates Advisory Board to Educate Lawmakers on Critical Tax, Economic Policies

Family Enterprise USA Creates Advisory Board to Educate Lawmakers on Critical Tax, Economic Policies Affecting America’s Family-owned Businesses Four Member Group Offers Government Affairs, Community Relations, Entrepreneur, and Regulatory Insights Family...

Better Together: Strengthening Family Enterprise Teams with CFAR, Inc.

Pat Soldano, President of Family Enterprise USA and Policy and Taxation Group, hosted a webcast featuring Eliza Orleans, a Principle at CFAR. The webcast, titled "Better Together: Strengthening Family Enterprise Teams," aimed to teach family business leaders how to...

Quick Poll: Taxed More of Less Due to OBBB

We’d love to hear from you! Please take a moment to participate in our quick poll on The One Big Beautiful Bill .Your input helps us better understand and represent the interests of family owned businesses across the country.We hope...

Tax Update: House Approves Senate Reconciliation Package

Today, the House approved the Senate’s version of Republicans’ multi-trillion-dollar reconciliation package, known as the One Big Beautiful Bill Act (H.R. 1), by a vote of 218-214, with Reps. Brian Fitzpatrick (R-PA) and Thomas Massie (R-KY) joining all Democrats in...

PATG Creates Advisory Board to Guide Critical Tax, Economic Policies for Family Offices, Successful Family Businesses

Policy and Taxation Group Creates Advisory Board to Guide Critical Tax, Economic Policies for Family Offices, Successful Family Businesses Five Member Group Offers Private Equity, Entrepreneur, and Legal Insights Policy and Taxation Group, advocates on...

Senate Concludes OBBBA Vote-a-Rama

The Senate approved a revised version of the One Big Beautiful Bill Act (OBBBA) (H.R. 1) on July 1, concluding a vote-a-rama that began the morning of June 30 and lasted over 24 hours. Consideration was further delayed after Sen. Thom Tillis (R-NC) announced his...

Tax Update: Senate Passes Reconciliation Package

Moments ago, the Senate passed Republicans’ multi-trillion-dollar reconciliation package, known as the One Big Beautiful Bill Act (H.R. 1), by a vote of 51-50, with Vice President J.D. Vance casting a tie-breaking vote in favor of passage. Sens. Susan Collins...

Contact Congress. Ask your Representative to vote for the OBBB as it is passed by the Senate.

Senate’s ‘Vote-A-Rama’ Keeps Family Business-related Amendments on the Line Today, Senate voting continues on numerous filed amendments affecting family-owned businesses. Called the “vote-a-rama,” Republicans and Democrats are finalizing their votes on amendments to...

Saying It Out Loud June 2025, By Pat Soldano

By Patricia M. SoldanoFounder & PresidentPolicy and Taxation GroupNew Study Says College Students Ponder ‘Legacy,’ ‘Succession,’ and ‘Generating Revenue’ When Considering Joining the Family-owned Business But Family Communication Still Ranks High as Major...

2024-25 Family Business Rising Gen Survey: Communication is Still Key

The 2025 Rising Gen Survey probed current college students enrolled in family business or entrepreneurship courses about what was most important to them as it related to their family business. Not surprisingly, communication is king. Conducted in partnership...

Family Business Governance, Insights on Tax Bill Status Featured in Two New Podcasts

Family Business Governance, Insights on Tax Bill Status Featured in Two New Podcasts from Family Enterprise USA Family Business Magazine’s Bill Rock and Capitol Hill Experts, Russ Sullivan and Michael Hawthorne, Speak with Host Pat Soldano on ‘Voice of Capitol...

Contact your representatives in Congress and urge them to Oppose the Elimination of NOL Treatment in Section 461(l)

Your Voice Can Help Stop a $9 Billion Small Business Tax Hike Currently Secction 461(l) of the tax code currently says pass-through taxpayers cannot deduct “excess business losses” (i.e., losses above a cap of $250k for individuals and $500k for couples) in the...

Why Every Family Office Needs an ‘Expert Generalist’

By Linda C. MackFounder and PresidentMack InternationalWhy Every Family Office Needs an ‘Expert Generalist’ And How to Become the Ideal Family Office Leader of the Future Conventional wisdom suggests that success is associated with the ability to...

Tax Update: Congressional Republicans Racing to Complete Tax Package

House and Senate Republicans are charging toward their self-imposed July 4 deadline for passage of their multi-trillion-dollar reconciliation package, the One Big Beautiful Bill Act (H.R. 1), with Senate Majority Leader John Thune (R-SD) pledging to bring the Senate...

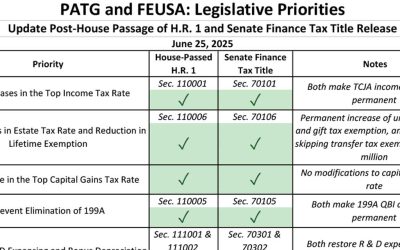

Senate Finance Committee Tax Title – Summary and Analysis

On June 16, Senate Finance Committee Chairman Mike Crapo (R-ID) released text of the committee’s tax title for the Senate’s fiscal year (FY) 2025 budget reconciliation bill. The Finance Committee’s tax title (Title VII) makes several modifications to the...

Reserve Your Spot – Build Teams That Drive Legacy and Results

Register Now June 27, 2025 | 10:00 AM – 11:00 AM PDT "Better Together: Strengthening Family Enterprise Teams" Join us for a webcast featuring Eliza Orleans, Principal at CFAR. How can family business leaders design and motivate teams across the...