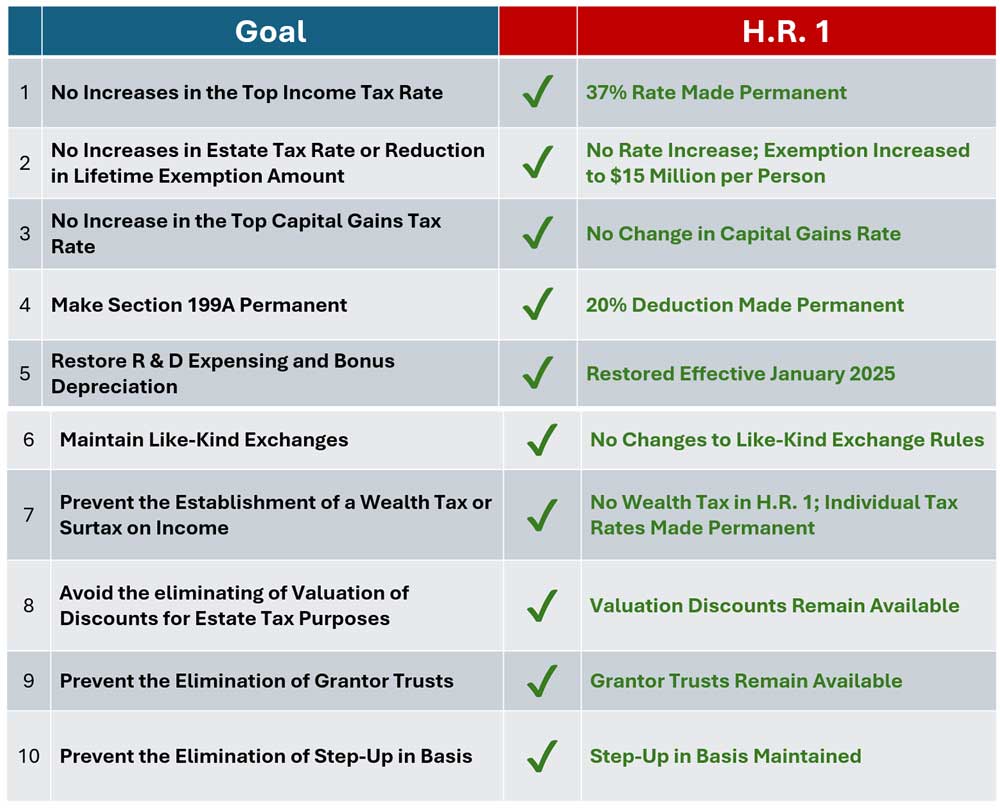

What Has Been Accomplished

Legislative Priorities for 2026

2025 Accomplishments for Policy and Taxation Group

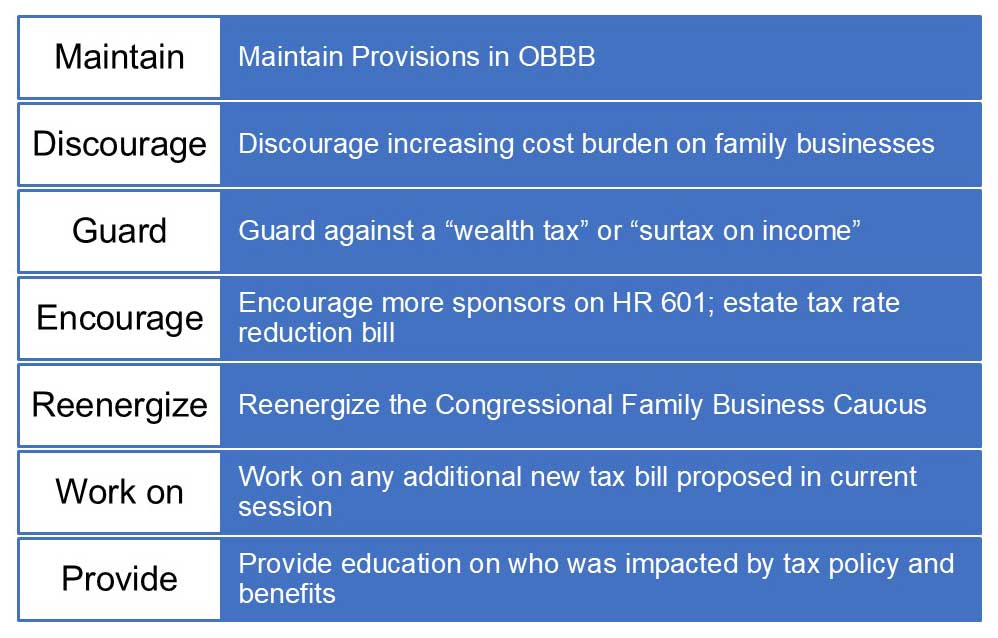

2025 Plan for Policy and Taxation Group

Continue as the Voice of Family Offices and Successful Individuals in Washington, DC, focused exclusively on the critical tax and economic issues that impact them.

- Increases in the Top Income Tax Rate

- Increases in Estate Tax Rate and Reduction in Lifetime Exemption

- Increase in the Top Capital Gains Tax Rate

- Elimination of 199A

- Restore R & D Expensing

- Elimination of like Kind Exchanges and Accelerated Depreciation

- Establishment of a Wealth Tax or Surtax on Income

- Eliminating of Valuation of Discounts for Estate Tax Purposes

- Elimination of Grantor Trusts

- Elimination of Step-Up in Basis

2024 Plan for Policy and Taxation Group

Legislative & Regulatory Issues

- Block harmful proposals under consideration by Congress, the Biden Administration, and/or regulatory agencies:

- Increase in Estate Tax Rate and/or Reduction in Lifetime Exemption

- Elimination of Step-Up in Basis

- Eliminating of Valuation Discounts or limitations on Valuation Rules for Estate Tax Purposes

- Curtailing Passthrough Business Profits (199A)

- Expansion of Self-Employment Taxes (SECA) to Active Income of Pass-Through Businesses

- Increase in the Top Income Tax Rate

- Reinstatement of the Individual Alternative Minimum Tax (AMT)

- Increase in the Top Capital Gains Tax Rate

- Implementation of a Surtax on Income, Mark-to-Market Regime, and/or Other Taxes on Successful Individuals

- Elimination of or Limitations on Grantor Trusts and/or GRATS

- Limitations on Retirement Accounts and/or Elimination of Holding Private Stock in IRA’s

- Elimination of Like Kind Exchanges

- Work with Congress to introduce and add co-sponsors for the Estate Tax Rate Reduction Act

- Support the work of the Family Business Estate Tax Coalition and the estate tax repeal bill

- Encourage Congress to extend and improve relevant TCJA tax provisions that expire in 2025

- Promote the Restoration of the R&D Expensing, Bonus Depreciation, and Other Pro-Business Tax Policies

Education

- Organize Regional Meetings; 25+; presentations around the country to present data, legislative/regulatory updates, background on the Congressional Family Business Caucus, voter attitudes, and secure additional Strategic Partners; see calendar of events for details and locations

- Host three Quarterly Update Calls with: Members of Congress, Congressional staff, Frank Luntz, and others

- Host Webcasts for Strategic Partners

- Host monthly Podcasts and post on Spotify

- Author and distribute “Saying It Out Loud” monthly Opinion piece

- Produce 20+ Family Business Videos on PATG YouTube channel and distribute via email, social media, and press release

- Utilize distribution database of 50,000+; send four to five emails and one Press Release per week

2023 Accomplishments

Legislative & Regulatory Issues

Blocked harmful provisions that were initially considered in the BBB and IRA, which continue to be considered in the current Congress and appeared again in the Green Book. Blocked these sweeping historic provisions:

- Increases in the Top Income Tax Rate

- Increases in Estate Tax Rate and Reduction in Lifetime Exemption

- Eliminating of Valuation of Discounts for Estate Tax Purposes

- Elimination of Grantor Trusts

- Elimination of Step-Up in Basis

- Limitations on Retirement Accounts and Elimination of Holding Private Stock in IRA’s

- Increase in the Top Capital Gains Tax Rate

- Curtailing Passthrough Business Profits (199A)

- Implementation of of a Surtax on income

- Elimination of like Kind Exchanges and Accelerated Depreciation

Education

- Host 11 Family Business Center Executive Directors in DC attend Caucus meeting; Hill meetings

- Host 25 attendees for Private Directors Governance Summit in DC; Legislative update and Hill meetings.

- Author Family Business Magazine regular column “On the Hill” in 6 issues.

- PATG/FEUSA Regional Meetings; 25+; presentation around the country to present data, legislative update, voter attitudes; see calendar of events for details and locations.

- Work with 40+ Family Business Centers attend 20+ Family Business Centers Events around the country.

- PATG/FEUSA 3 Quarterly Update Calls; with Congress members, staff, Frank Luntz, and others.

- PATG/FEUSA Host monthly Podcasts on Spotify

- Author and distribute “Saying It Out Loud” monthly Opinion piece.

- Produce 20+ Family Business Videos on YouTube FEUSA and PATG channels.

- FEUSA/PATG distribution database of 40,000+; 4 to 5 emails a week, one Press Release a week.

2022 Accomplishments

Over 2021- 2022, the Policy and Taxation Group won many significant legislative victories benefiting family offices and successful individuals. The recent Legislative Wins include Removing Damaging Tax Provisions from the Build Back Better Act.

- Increases in the Top Income Tax Rate

- Increases in Estate Tax Rate and Reduction in Lifetime Exemption

- Eliminating of Valuation of Discounts for Estate Tax Purposes

- Elimination of Grantor Trusts

- Elimination of Step-Up In Basis

- Limitations on Retirement Accounts and Elimination of Holding Private Stock in IRAs

- Increase in the Top Capital Gains Tax Rate

- Curtailing Passthrough Business Profits / 199A Reduction

Policy and Taxation Group was instrumental in educating legislators to Remove other tax provisions that were on the table:

- Surtax of 5 % on income of $10 million

- $200,000 for Trusts or Estates

- Additional 3 percent surtax on income above $25 million

- $500,000 for Trusts or Estates

- Net Investment Income Tax 3.8 % on non-passive income

- Change in tax on Carried Interest

- Elimination of Accelerated Depreciation

- Elimination of Like Kind Exchanges

Policy and Taxation Group fought to pull these harmful tax provisions from the Build Back Better Act and ensuing Inflation Reduction Act of 2022, a major tax and spending package, which spanned over 18-months and ultimately passed through the budget reconciliation process.

The Build Back Better bill was passed by the House of Representatives in 2021 but not by the United States Senate. Concerns of Senator Joe Manchin and negotiations with Senate majority Leader Chuck Schumer were influential. In 2022, the framework of the Build Back Better bill was taken up, resulting in the Inflation Reduction Act of 2022. After negotiations with Manchin, as well as Senator Krysten Sinema,the Inflation Reduction Act of 2022 passed by both chambers and became law in 2022 without the aforementioned tax provisions that would have been detrimental to family offices and successful individuals. We thank our Supporter for making these legislative wins possible.

2021 Accomplishments

Advocacy

- Facilitated the introduction of bipartisan, bicameral legislation to reduce the rate of the estate tax (Estate Tax Rate Reduction Act of 2021).

- Facilitated 61 meetings with members of Congress and/or their staff (see attached schedule of meetings) which consisted of members from 23 states. Of the offices met with, 21 were members of the House Ways and Means or Senate Finance committees and nine were members of House or Senate Small Business Committees. As part of these meetings, Brownstein lobbyist Russ Sullivan was sent to Phoenix to meet with Sen. Kyrsten Sinema (D-AZ). These meetings resulted in five substantive provisions that would have severely affected families and their businesses being removed from the Build Back Better Act.

- Hosted annual supporters meeting in Washington, DC, including remarks from Reps. Henry Cuellar (D-TX) and Jodey Arrington (R-TX). Members and supporters also had the opportunity to participate in 10 meetings on Capitol Hill with members of Congress and/or their staff.

- Hosted four legislative update calls for supporters and members, including participation by Sen. Jon Tester (D-MT), various Congressional staff, and Frank Luntz, among other presenters.

- Sent five call-to-action emails, which resulted in more than 300 communications to Members of Congress.

Research

- Organized a national poll by Frank Luntz on voter attitudes regarding taxes, successful individuals, and family businesses.

- Facilitated Annual Family Business Survey, resulting in 172 respondents, three pop-up survey questions, and one member survey. Used the survey results in meetings with members of Congress and/or their staff.

- Completed research on family businesses to determine their economic impact- used the research in meetings with members of Congress and/or their staff.

- Supported and participated in the Family Business Estate Tax Coalition, including the commissioning of an EY study that provided a macroeconomic analysis of the impact of eliminating step-up in basis.

Earlier Accomplishments

In 2020, PATG worked with Congressman Arrington to introduce HR5652, “The Estate Tax Rate Reduction Act’, which would reduce the rate of the estate tax from 40% to 20%.

In 2019, PATG assisted Senators Cotton and Bozeman in the introduction of S176 which reduced the rate of estate tax to that of capital gains; 20%.

In 2018, PATG worked with Senator Kyl to introduce S3638 which reduced the rate of estate tax from 40% to 20%.

In 2017, PATG was instrumental in securing a doubling of the lifetime exemption for gift tax, estate tax, and generation skipping tax to that of $11.2 million per person and $22.4 million per couple.

In 2016, PATG was the only organization to bring family businesses to a Hearing held at the Treasury on proposed 2704 regulations, which would have eliminated valuation discounts for family related companies. This resulted in the proposed regulations being “withdrawn” and secured valuation discounts for all families.

In 2015, PATG helped to secure the first stand-alone vote for repeal legislation in the House of

Representatives in a decade, in a bill that passed the House by a 240-179 bipartisan vote.

In 2012, PATG marshaled bipartisan support to defeat a confiscatory 55 percent rate, lowering the rate to 40% with NO expiration date, providing permanency of the estate tax law for the first time in decades.

In 2010, PATG led successful efforts to secure the lowest applicable rate of estate tax in more than 80 years.

Congressman Tony Gonzales of TX and Pat Soldano

Frank Luntz and Pat Soldano